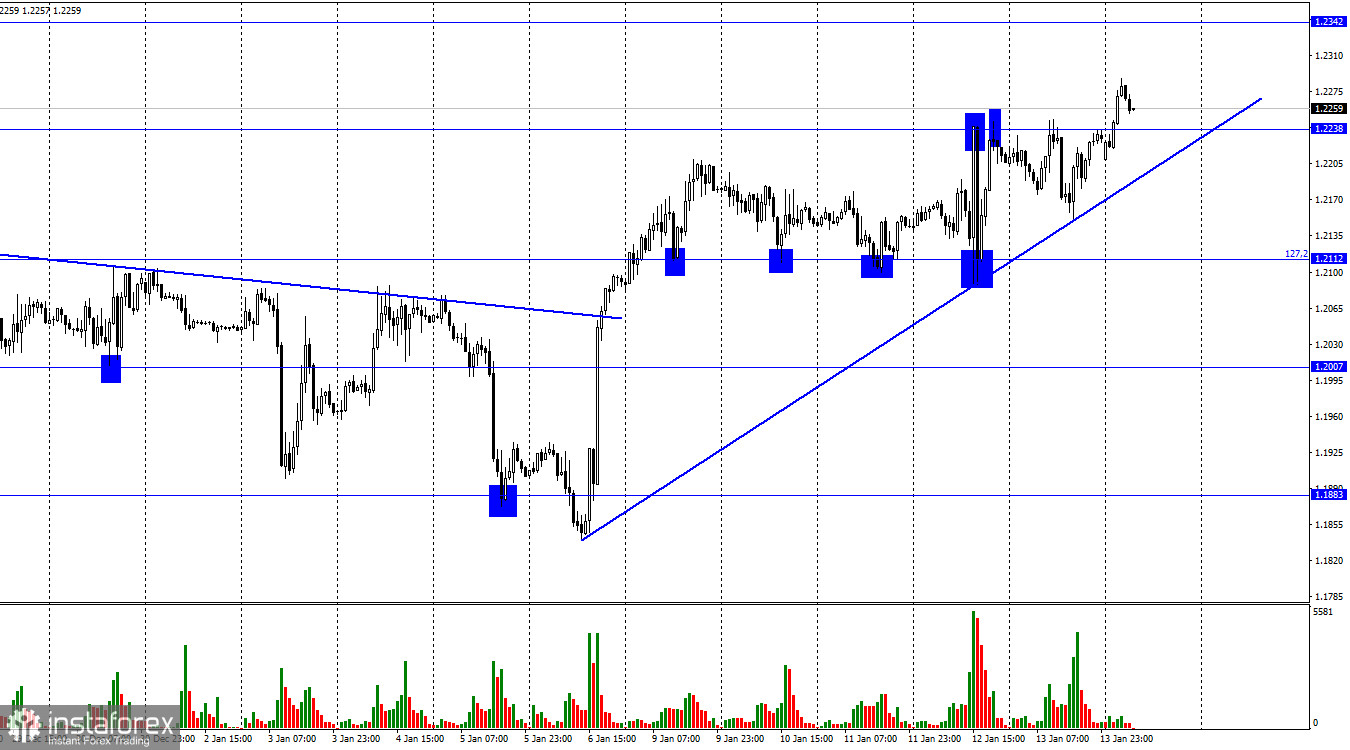

On Friday, GBP/USD rebounded from the H1 trendline, reversed upwards, and closed above 1.2238. On Monday morning, the pair returned to the level of 1.2238. A bounce off this level will send the pair higher toward the next target at 1.2342. Consolidation below the trendline will favor the US dollar and initiate a slight decline toward the retracement level of 1.2112.

The pound bulls were supported by the UK economic data issued on Friday. UK GDP came out stronger than expected and showed an expansion of 0.1% on a monthly basis. Industrial production fell by 0.2% month-on-month and by 5.1% year-on-year. The second report could have hardly supported the pound. Yet, the first one is considered to be more important. The longer the UK economy is holding above the zero GDP growth, the better it is for the pound. The British currency has a much more serious problem to deal with. We are talking about inflation which remains stubbornly high. There was only a slight decline of 0.4% (YoY) in consumer prices in November. But this is a very weak result given that the BoE has hiked interest rates 8 times already.

Apparently, such an outcome of the BoE's monetary policy is rather disappointing. Although traders are currently focused on the Fed, they still need to monitor inflation and interest rates in the UK. The incoming data is mixed. Yet, at the start of the year, the British pound got support from the CPI data in the US. According to it, consumer prices have slowed considerably. This week, investors will be waiting for another report on UK inflation which is not expected to show any significant decline. This means that the Bank of England will most likely lift the rate by 0.50% in early February. In case traders haven't priced in this factor yet, the pound may extend its gains in the weekly session. This week, no more important reports are expected either in the US or the UK.

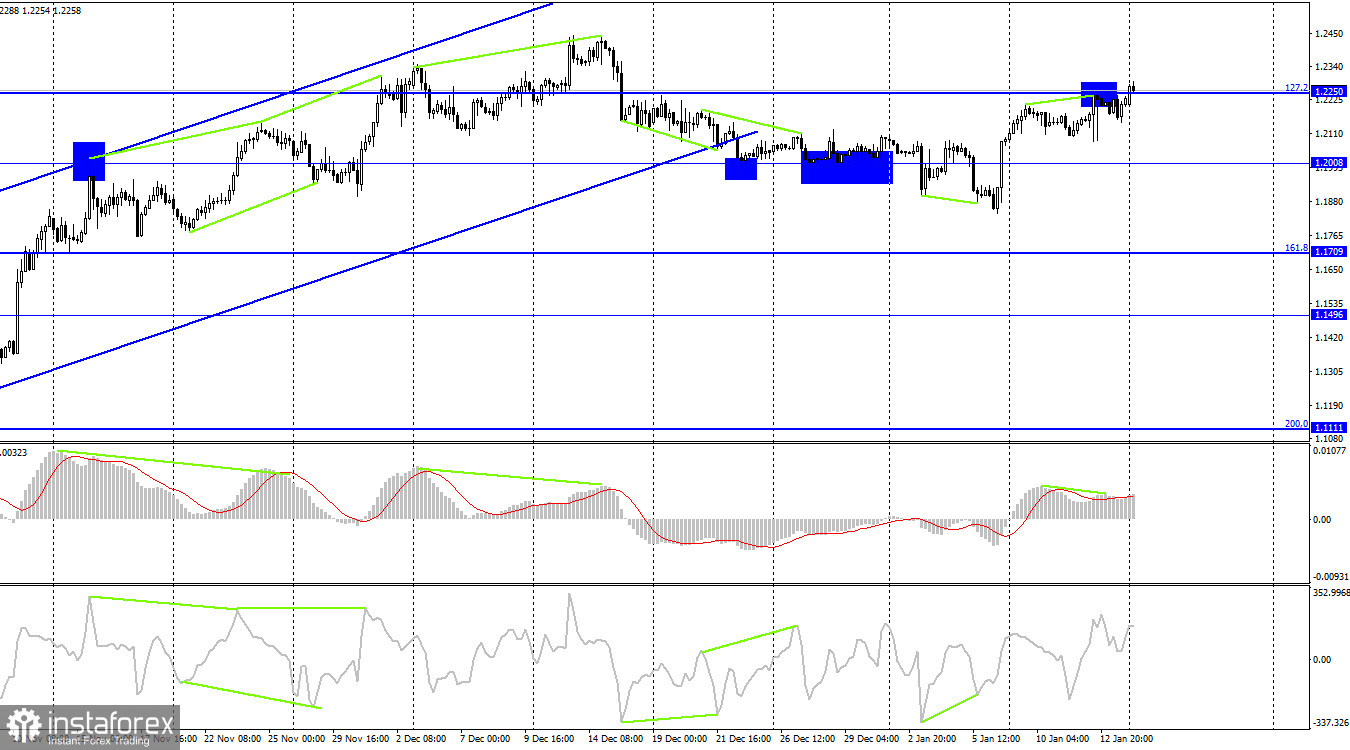

The pair advanced to the Fibonacci retracement level of 127.2% at 1.2250 on the 4-hour chart. The MACD indicator has formed a bearish divergence right there. So, the pair may soon reverse in favor of the US dollar and start falling toward 1.2008. If the price closes above 1.2250, the divergence will be canceled and the pair may move higher to the next Fibonacci level of 100.0% at 1.2674.

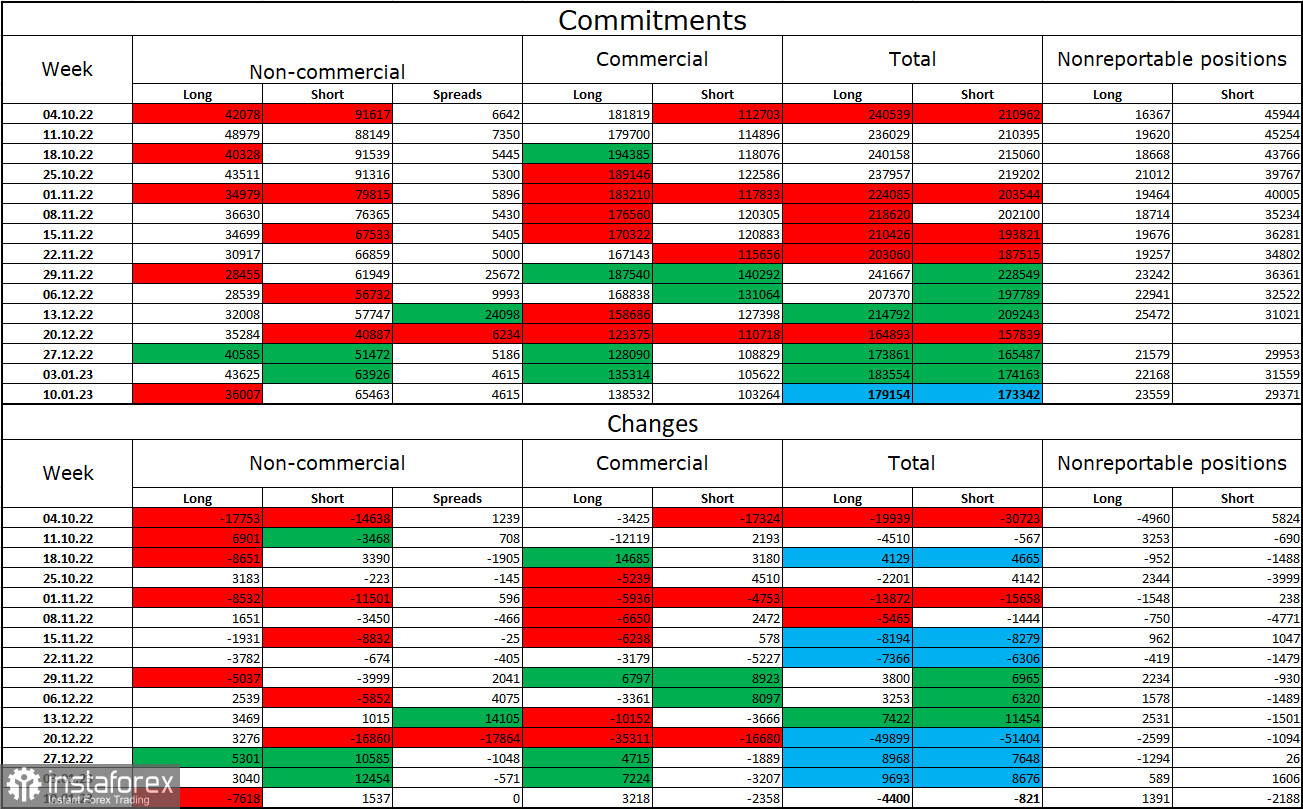

Commitments of Traders (COT) report

Last week, the non-commercial group of traders became more bearish on the pair than a week ago. The number of opened long contracts decreased by 7,618 while the number of short contracts went up by 1,537. The overall sentiment of larger market players remained bearish as the number of short positions still outweighs the number of long ones. In recent months, the British pound has been gaining ground. However, today, there are twice as many short contracts as long ones. Therefore, the outlook for the pound has again worsened over the past few weeks. On the 4-hour chart, the price left the ascending channel that has been there for three months. This can serve as a factor limiting the pound's upside potential.

Economic calendar for US and UK

There are no important economic events in either the UK or the US on Monday. Therefore, the influence of the information background on the market sentiment will be zero in the afternoon.

GBP/USD forecast and trading tips

I would recommend selling the pound if the quote settles below the trendline on H1 with the target at 1.2112. You can open new long positions on the pound when the price closes above the level of 1.2238 with the target at 1.2342. These trades can be kept open for now.