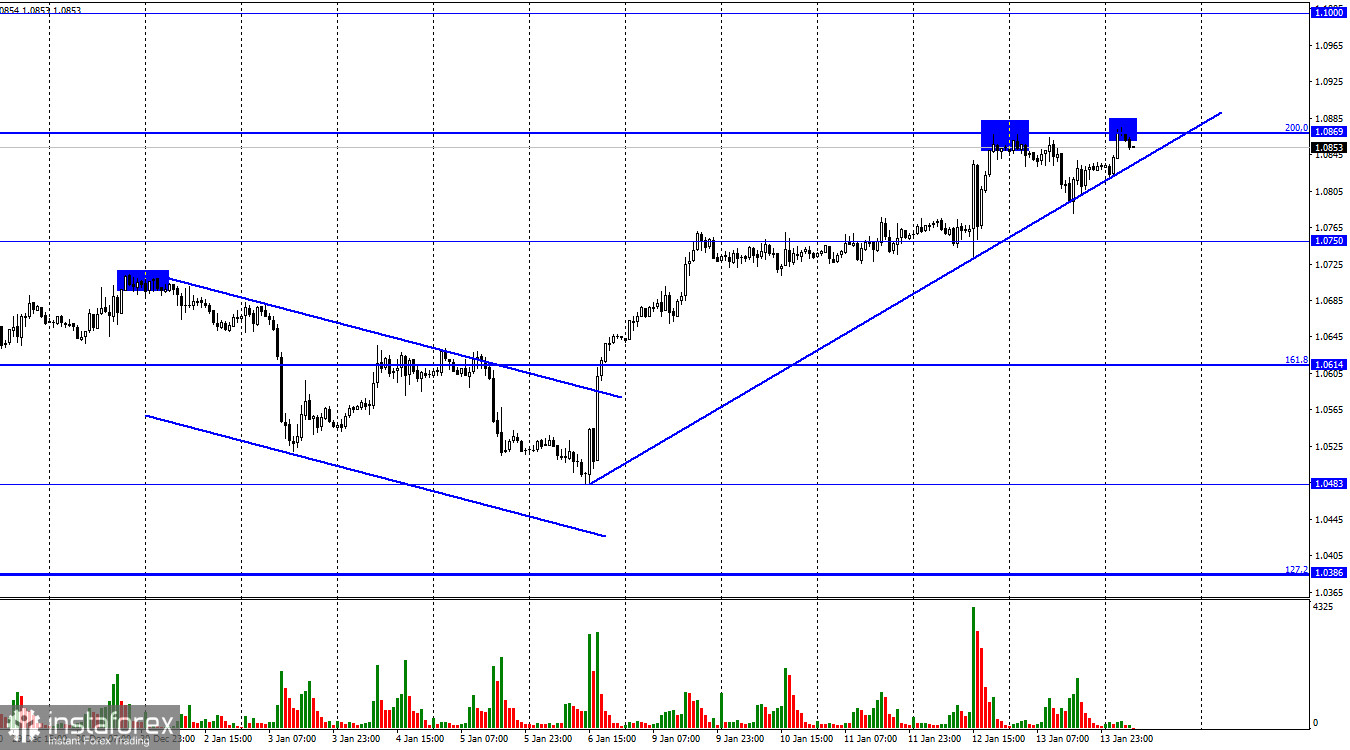

Hi, dear traders! EUR/USD dropped off 1.0869 which corresponds to the 200.0% Fibonacci level on the 1-hour chart and reversed in the favor of the US dollar. The price fell to the trend line which now defined market sentiment as bullish. The currency pair rebounded to the 200.0% Fibonacci level overnight. A new drop will again prop up the US dollar. This time, the instrument may close below the trend line, thus changing market sentiment to bearish. Alternatively, if the price settles above 1.0869, this will increase the odds of a further growth towards 1.1000.

Despite the fact that the bulls are still ruling the market, the Federal Reserve sends signals about further monetary tightening. Last week, FOMC policymaker Michelle Bowman praised the central bank for its success in taming inflation. According to her words, low unemployment rates give hope that a serious economic downturn could be avoided. At the same time, Michelle Bowman underscored the Fed's commitment to its hawkish monetary policy. Indeed, the Federal Reserve will not cancel aggressive monetary tightening until the consumer price index approaches the target level of 2%.

Interestingly, investors consider the red-hot inflation report to be a sign that the Federal Reserve is likely to moderate the pace of rate hikes at future policy meetings. Inflation in the US has been waning for six months straight at a steady pace. At present, traders bet on a 0.25% rate hike at the Fed's meeting in February. Some economists reckon that the Fed might raise interest rates by 0.50% as a precautionary measure. The thing is that no one dares predict how inflation will slow down in the future. If CPI rates fall, the Federal Reserve will have to accelerate the pace of rate hikes. This will not be the best solution which could send shock waves across the domestic economy. From my viewpoint, now there is a fifty-fifty chance of a rate hike by 0.25-0.50%.

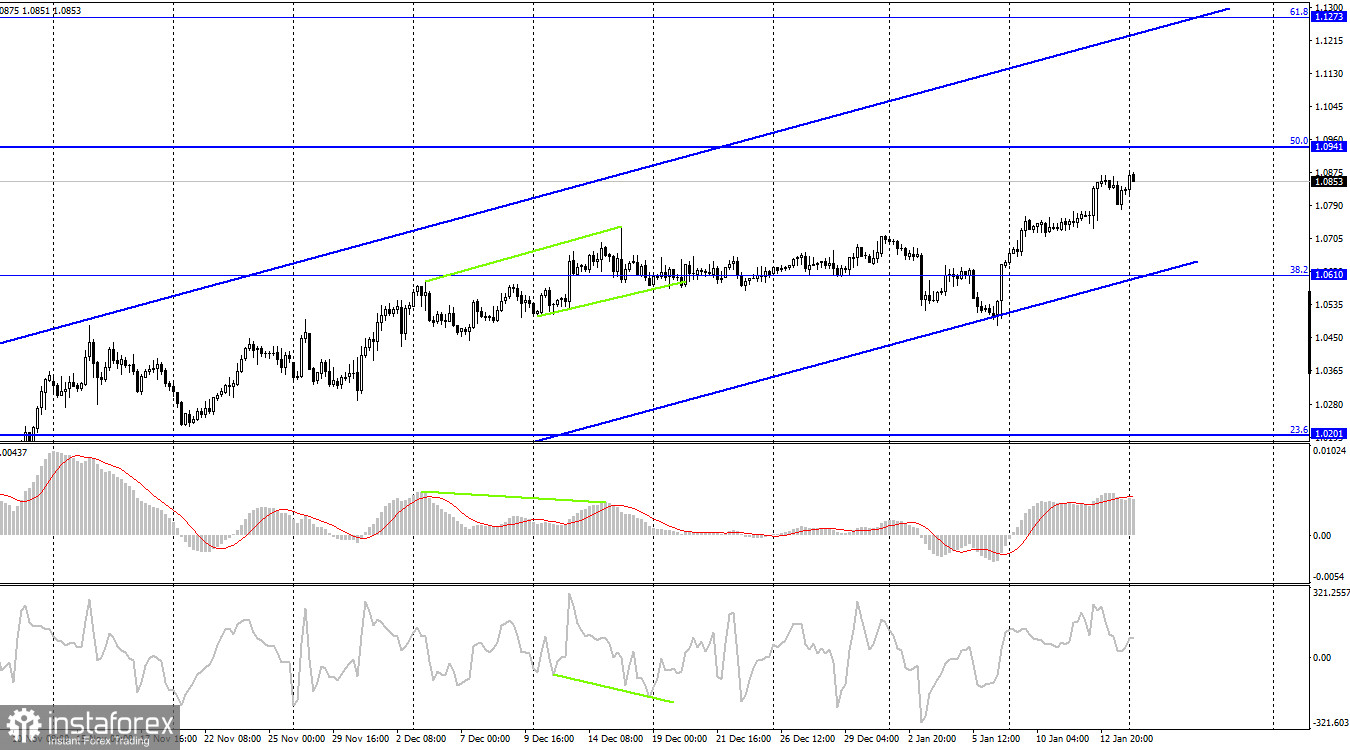

On the 4-hour chart, EUR/USD reversed in favor of the euro and is still extending its growth toward 1.0951, the 50.0% Fibonacci correction. If the price drops off this level, it will encourage the US dollar and will enable the price to fall to 1.0610, the 38.2% Fibonacci level. The upward trend corridor again defined trading sentiment as bullish. I don't expect a sharp fall in the single European currency until its closes below the corridor.

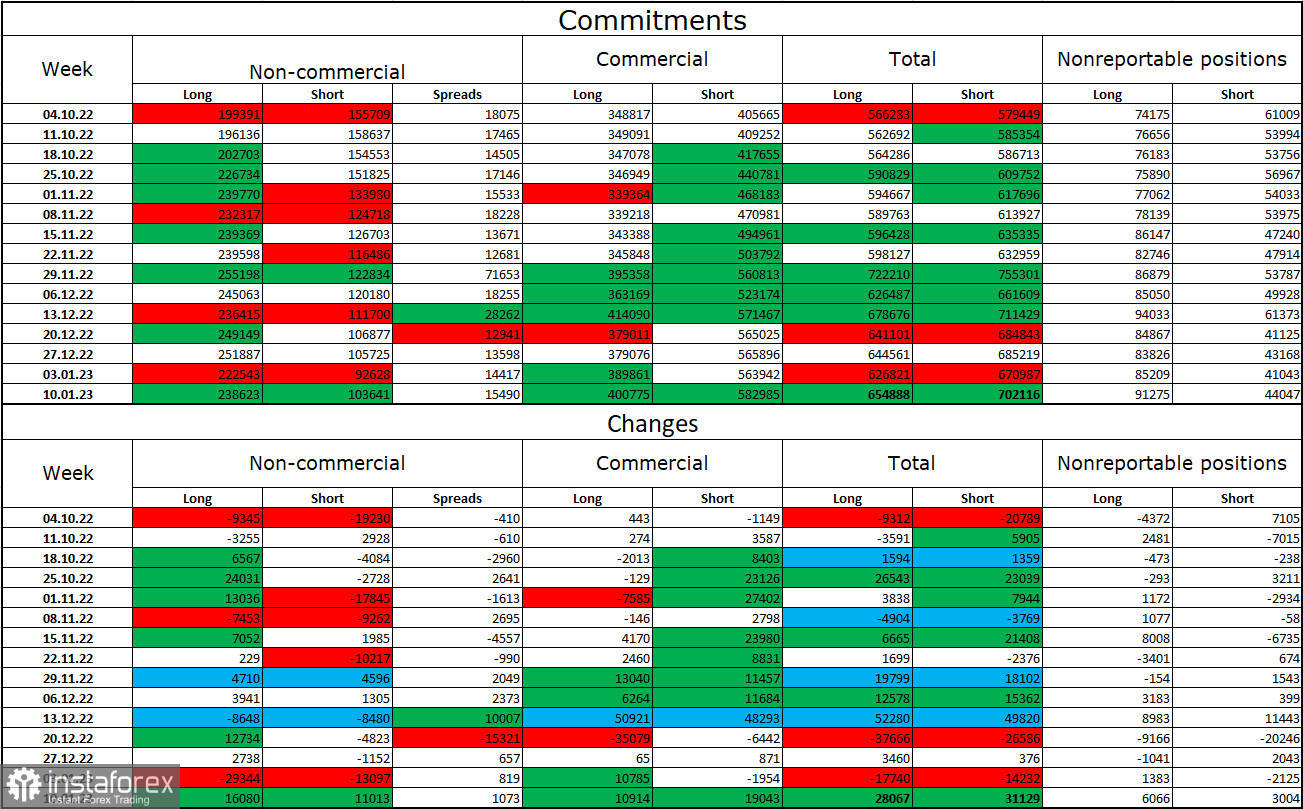

Commitments of Traders (COT):

Last reporting week, speculators opened 16,080 long contracts and 11,013 short contracts. The sentiment of market makers remains bullish and is getting stronger again. The total number of long contracts, amassed by speculators, is now 239Ks and short contracts 104K. The single European currency continues to grow at the moment, which corresponds to the data of COT reports. At the same time, I want you to pay attention to the fact that the number of longs is two and a half times higher than the number of short ones. Over the past few weeks, there has been a higher chance for the euro's growth. This is what actually happened in EUR/USD. Oddly, the information background does not always support the bullish scenario. The situation remains favorable for the euro after a protracted "black period", so the outlook for EUR/USD remains bullish. However, going beyond the ascending corridor on the 4-hour chart may indicate that the bearish sentiment might revive in the near future.

Economic calendar for US and EU

On January 16, the economic calendar both for the US and the EU does not contain a single meaningful report. So, the information background makes no impact on market sentiment today.

Outlook for EUR/USD and trading tips

Short positions on EUR/USD make sense if the price closes below the trend line on the 1-hour chart with targets at 1.0750 and 1.0614. Traders could also plan long positions if the instrument closes above 1.0869 on the 1-hour chart with targets at 1.0941 and 1.1000.