Why is gold rising? Is inflation too high? But in 2022, it was even higher. Is the global economy on the verge of a recession? But at the end of last year, the chances of a recession were high. Now, the opening of China and the sharp drop in gas prices in Europe allow us to look to the future with optimism. Are geopolitical risks going wild? But has anything changed in the last few months? So why has XAUUSD managed to add 15% since the beginning of November?

In fact, the guiding star of the precious metal is the proximity of the peak of the federal funds rate. Since the period when it was allowed to trade freely, there have been 10 cases where U.S. borrowing costs have reached their ceiling. Five months before this event and six months after, the price of gold increased by an average of 18%. During that time, it outperformed the S&P 500 by 9.7%. Moreover, in 60% of cases, the peak rates within 18 months were followed by recessions. And then, the precious metal outperformed the broad stock index by 26%.

Gold dynamics and federal funds rates

From a theoretical point of view, everything looks right: gold does not earn interest, so it underperforms bonds when their yields rise. At the same time, the proximity of the federal funds rate ceiling means that yields are already falling, as they are now, or will soon fall. The flow of capital to the precious metal market begins, which leads to an increase in prices. Not surprisingly, Bank of America believes that futures quotes will exceed $2,000 an ounce in the coming months, while WisdomTree calls the figure $2,100 due to gold purchases as insurance against high inflation and various kinds of shocks.

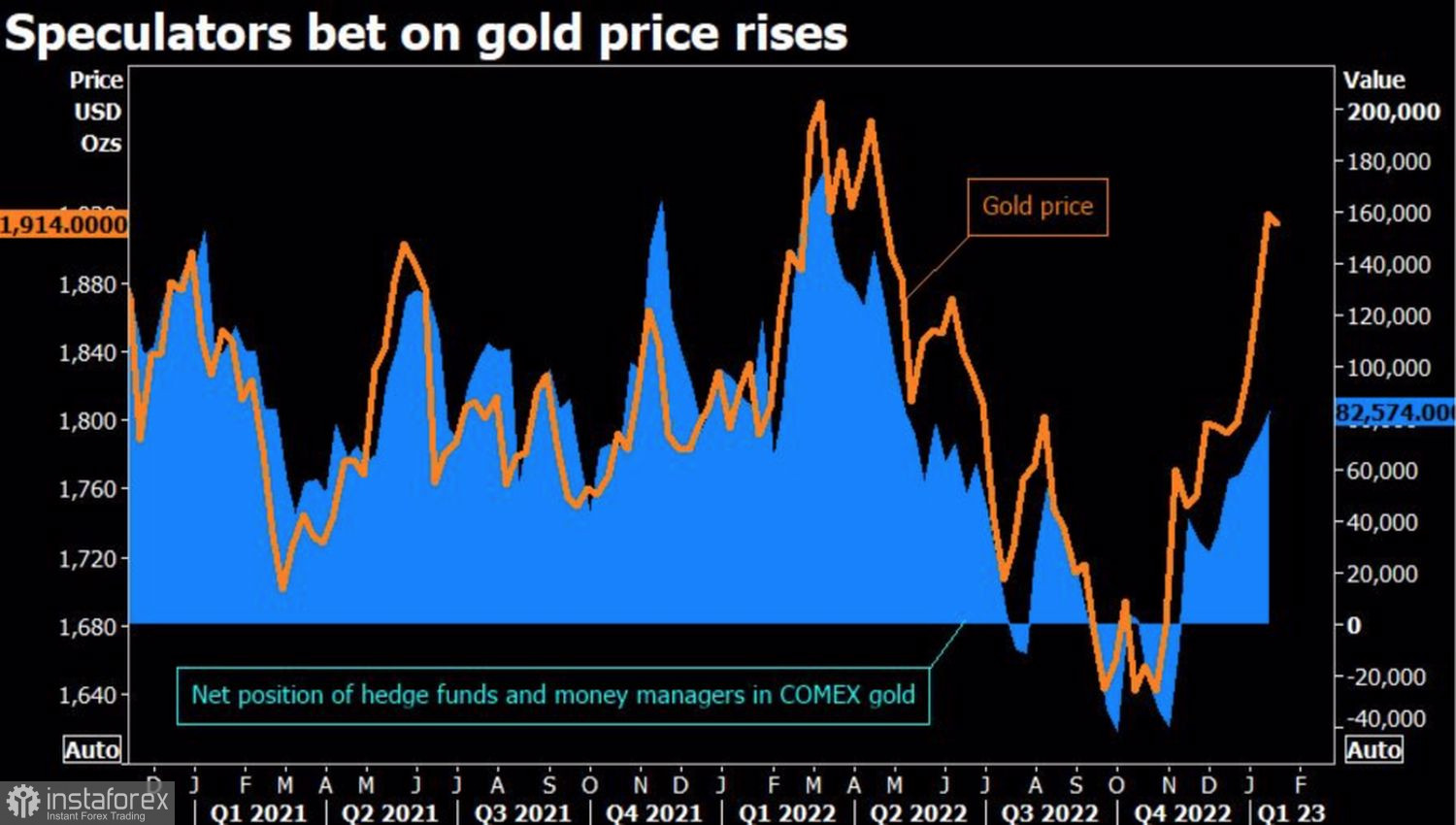

Speculators are sensitive to the changing conjuncture of the financial markets and do not get tired of increasing longs, which in their pure form have reached their maximum levels since the spring of 2022.

Dynamics of gold and speculative positions

The proximity of the peak of the federal funds rate and the associated desire of the Fed to slow down the pace of monetary tightening weaken the U.S. dollar. It is being sold, among other things, due to the loss of American exceptionalism. The economies of other countries are beginning to outpace the United States in terms of growth, and investors are increasingly looking to other markets in order to park their money. At the same time, hopes for a strong recovery in China's GDP increase risk appetite and keep safe-haven assets in the black.

Of course, everything can change. China will not be able to give the result that is expected of it. The arrival of frosts in Europe will revive the topic of the energy crisis, and the U.S. economy will still fall into recession. However, until all this happens, the precious metal will continue to shine.

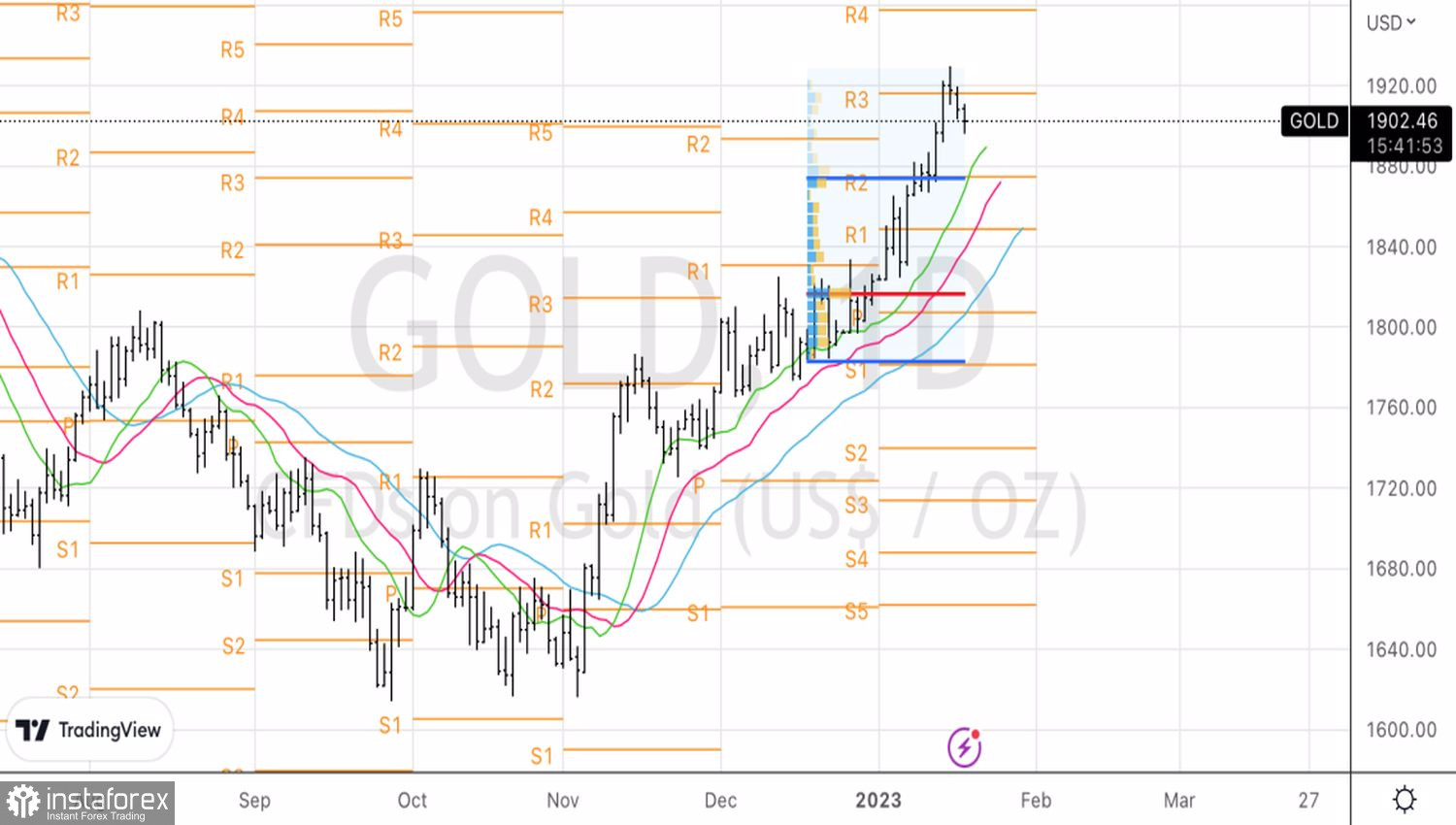

Technically, there is a pullback to an upward trend on the daily chart of gold. The first of the two previously set targets for longs has been fulfilled. Now we focus on buying on the exhaustion of the correction, followed by a rebound from supports in the form of pivot points and moving averages at $1,893 and $1,873 per ounce.