After a powerful previous week, Bitcoin is taking a pause in its bullish rally. The cryptocurrency successfully reached and consolidated above the $21k level. At the same time, during the current week, the asset is constantly facing sellers' pressure, which is one of the reasons for the pause in the upward movement.

Apart from that, the need for consolidation is due to the continuous upward movement of the asset's price for two weeks. Bitcoin is consolidating above $21k to avoid overheating, as well as a sure absorption of bearish volumes.

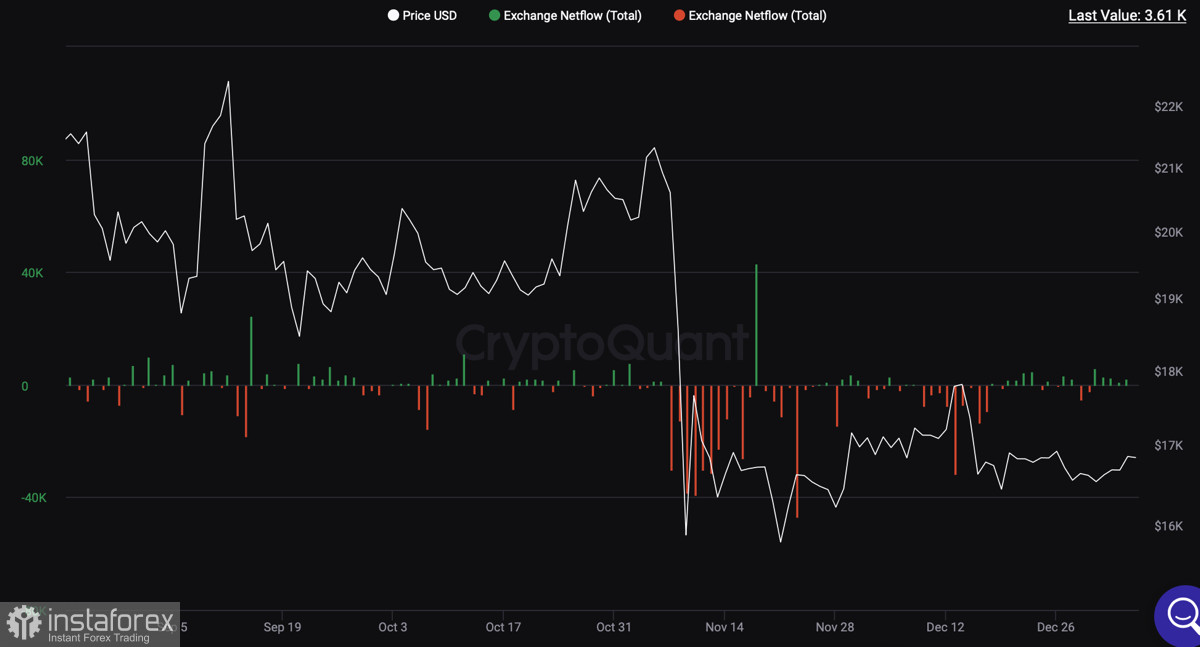

Rising bearish volumes are also an important reason for the pause in Bitcoin's bullish trend. The $21k level is the starting point for the cryptocurrency market to fall to the local bottom after the FTX crash. Also, this milestone serves as a psychological mark for investors who have not seen a powerful cryptocurrency bullish trend for about nine months.

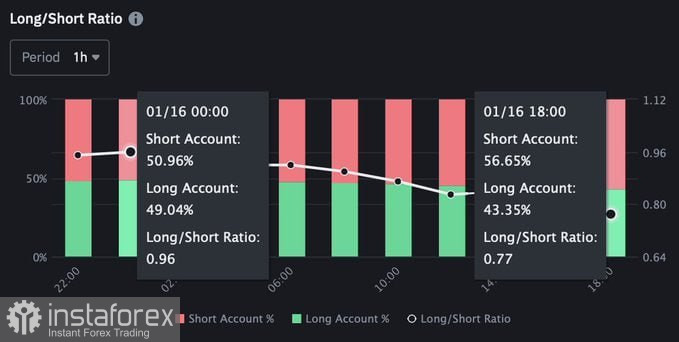

This is confirmed by data from IntoTheBlock, which notes that about 57% of traders on the largest crypto exchange have opened short positions in relation to Bitcoin. The process of changing the paradigm of thinking has begun due to the intensification of the bullish movement, but it will take time. So BTC will face the market indecision more than once.

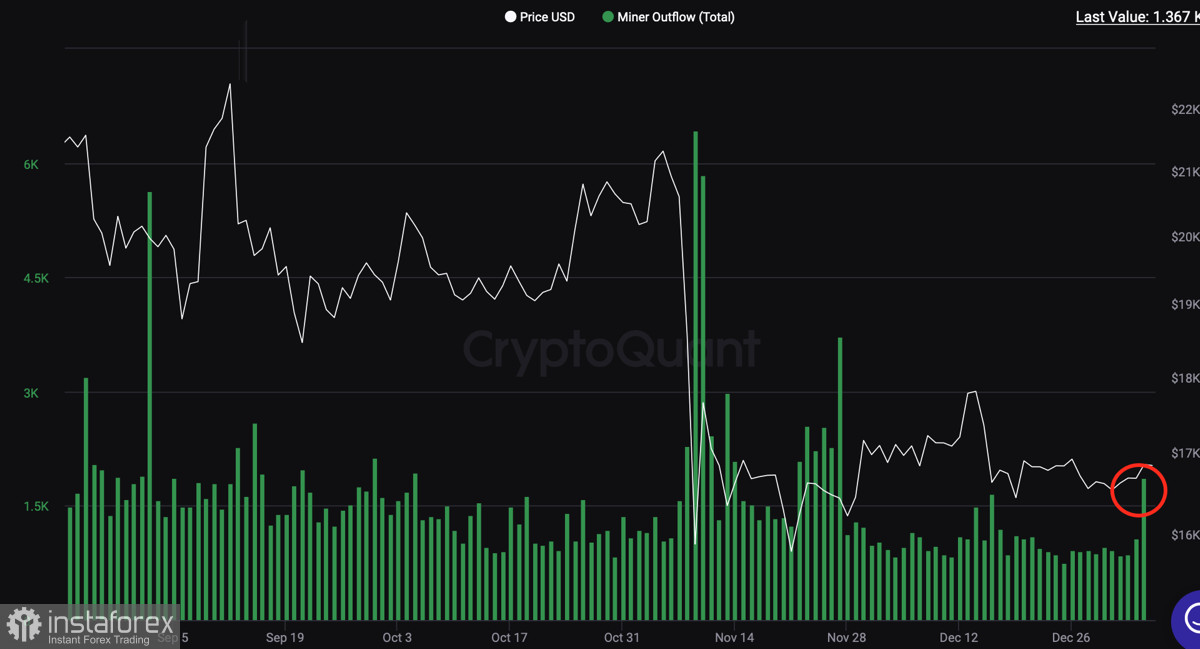

Another reason for the price consolidation above $21k was the cryptocurrency's network performance and the improvement in the state of affairs of the miners. According to Glassnode, the price of BTC has once again risen above the average aggregate breakeven for miners. At the same time, Kaiko reports a significant increase in the daily trading volume of BTC.

Santiment experts note that take-profit sentiment has increased significantly among Bitcoin investors. Given the information above, mining companies may be the main pool of those who sell BTC to get quick liquidity and pay off debts.

Bitcoin and SPX

The upward movement of SPX and the local bullish trend of the stock market have become one of the key reasons for the growth of the cryptocurrency market. However, they can also cause a downward movement in the form of a local correction. As of January 18, the S&P 500 index is near the $3,900 key resistance zone.

The asset is unsuccessfully trying to break through this boundary, which may eventually serve as the starting point for a price correction and entail Bitcoin. However, technical metrics point to another attempt to retest $4,000. The MACD is moving in the green zone, and the stochastic is forming a bullish crossover.

In the near future, it is worth keeping a close eye on SPX, as this particular asset may become a key factor in the further movement of the BTC price.

BTC/USD Analysis

Bitcoin has formed two uncertain candles over the past three days, and the current trading session may become the next stage of the struggle between bulls and bears for the $21k level. As of writing, buyers emerges as clear winners from this struggle, which leaves the bullish idea relevant.

At the same time, the technical metrics remain in the overbought zone, but are moving flat. The MACD indicator became the third key indicator, which left the green zone and rose in the overbought zone. As a result, we are seeing a consolidation movement, which may lead to a local correction.

Bitcoin has approached a key resistance zone, both technically and psychologically. We must not forget about the growing volumes of profit taking in the BTC market, and even given the start of consolidation, the market will need time to absorb new volumes.

The significance of the current sale can be judged by the conclusions of Glassnode analysts, who reported that the number of BTC whales has decreased to a three-year high. According to this statement, we can conclude the volume of BTC sales by large investors, including miners.

Results

Most likely, we are waiting for a local correction of Bitcoin, which will happen for one of many reasons or for all at once. Given the changing market sentiment, the correction will be shallow, specially if the market defends key support zones.

The initial target for the downside movement of BTC should be the $20k level. This is a key trading and psychological level of the cryptocurrency. If it is maintained, Bitcoin will quickly resume growth. However, with a deeper correction, the price could head for a retest of $19.4k level, and lower to the $18k–$18.5k area.