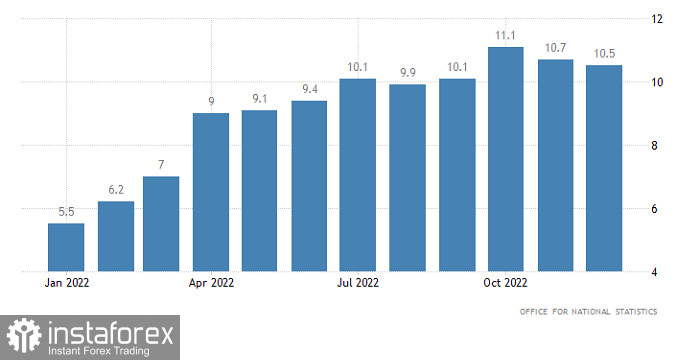

Pound continued to rise even though inflation in the UK slowed down from 10.7% to 10.5%. This indicates that market players are more concerned about the actions of the Fed, which recently led to a rather impressive weakening of the dollar. Also, during the last Bank of England meeting, two of its members called for a lowering of the refinancing rate, which means that the Bank of England could also end the cycle of its interest rate hike soon.

Inflation (UK):

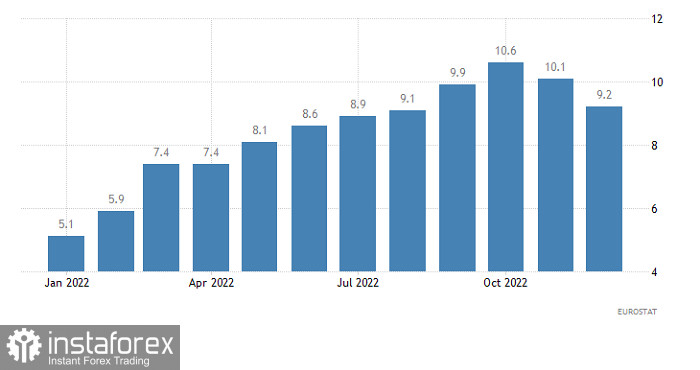

The situation is similar in the Euro area, where inflation slowed from 10.1% to 9.2%. Euro also rose in price; however, it was more modest as the market already took into account the initial estimates.

Inflation (Europe):

But the main reason for the dollar's decline during the European session was the US statistics as the growth rate of retail sales slowed down from 6.5% to 5.0%, while industrial output fell from 2.5% to 1.8%. Previous data had also been revised downwards, with retail sales dipping to 6.0% and industrial output to 2.2%.

Fortunately, after the release of the reports, dollar demand returned, thanks to retail sales remaining the same. It was the best reflection of consumer activity in the region, which is the engine of economic growth. Since the data turned out to be significantly better than expected, market players have become confident that the US can avoid a recession.

Retail sales (United States):

Investors should gradually start reconsidering their positions in favor of the dollar as the developing dynamics is likely to limit the upward potential in euro and pound. Of course, today is still partial to risky assets since the US may report an 8,000 increase in the number of jobless claims. This growth is insignificant, but the forecasts are still negative, so there is no reason for dollar to rise at the moment. Consequently, the market is likely to consolidate around the current values.

Jobless claims (United States):

EUR/USD is likely to remain fluctuating in an amplitude of about 100 pips, but a full-blown correction could lead to an exit from the established price range.

In GBP/USD, the quote came close to the local high, so a rebound followed. It is almost back to 1.2300, which is a key support level. In order for this pullback to turn into a correction, traders need to keep the pair below the support level, otherwise, there could be another price increase.