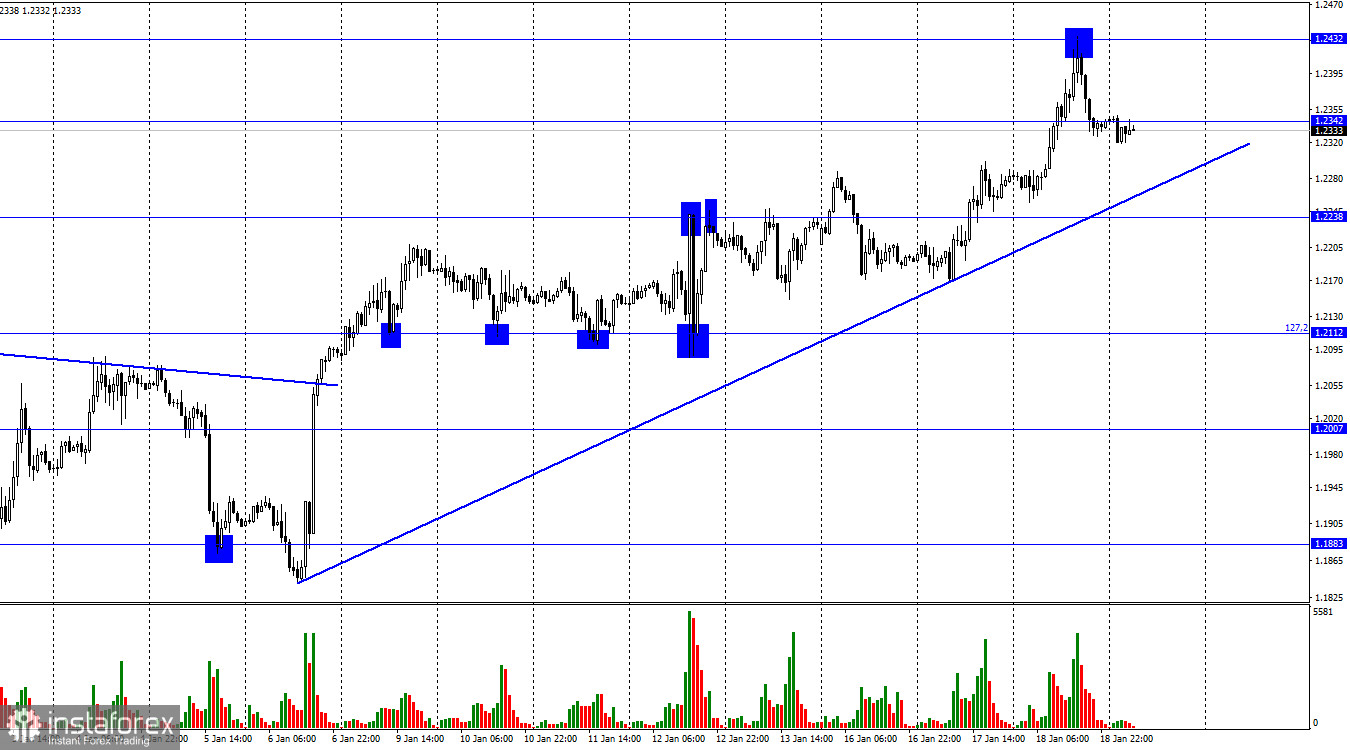

On Wednesday, GBP/USD reversed in favor of the pound on the H1 chart and hit 1.2432. A rebound from this level supported the US dollar, and the pair dropped below 1.2342. The quotes are now located close to the ascending trendline. If the price settles below this line, the pound is very likely to fall toward 1.2238 and 1.2112.

Yesterday, the inflation data was issued both in the EU and the UK. On the one hand, the report disappointed traders as it showed only a slight decline to 10.5%. Yet, bulls were encouraged by this data because they view higher inflation as a good reason to buy the pound ahead of new rate hikes by the Bank of England. At the end of the trading session, the US dollar won back some losses but overall, it is still depreciating against the pound.

The American currency was mainly supported by the FOMC members who unanimously expressed the need to further tighten monetary policy. In the medium term, however, this factor is unlikely to boost the demand for the US dollar. Today, another FOMC member Lael Brainard will make a statement. If she supports the hawkish stance of her colleagues, the greenback may rise slightly. However, moving above the trendline might be a challenging task for bears.

The end of the week might be non-eventful for the pound/dollar pair. Today, there are no important reports either in the UK or in the US. On Friday, three other FOMC members will speak. In the UK, the data on retail sales will be published. The problem is that Fed officials don't make any serious statements that could possibly drive the US dollar up. Therefore, I don't expect the sellers to seize the initiative in the next two days. Still, we need to keep in mind the trendline.

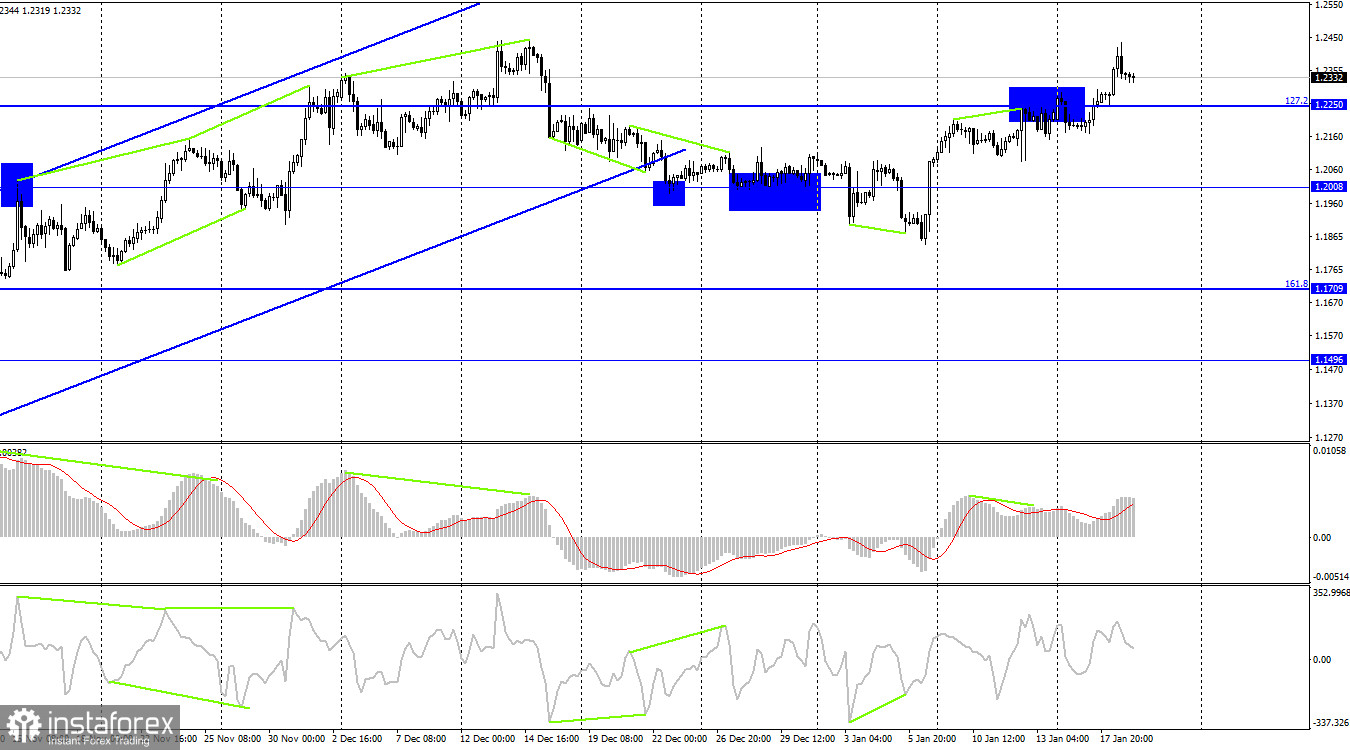

On the 4-hour chart, the pair settled above the Fibonacci retracement level of 127.2% at 1.2250. This allows the pair to extend its growth toward the next Fibo level of 100.0% at 1.2674. The bearish divergence has been canceled, and there are currently no new divergences forming. Consolidation below 1.2250 may bring more bearish pressure to the market, thus letting the US dollar rise to 1.2008.

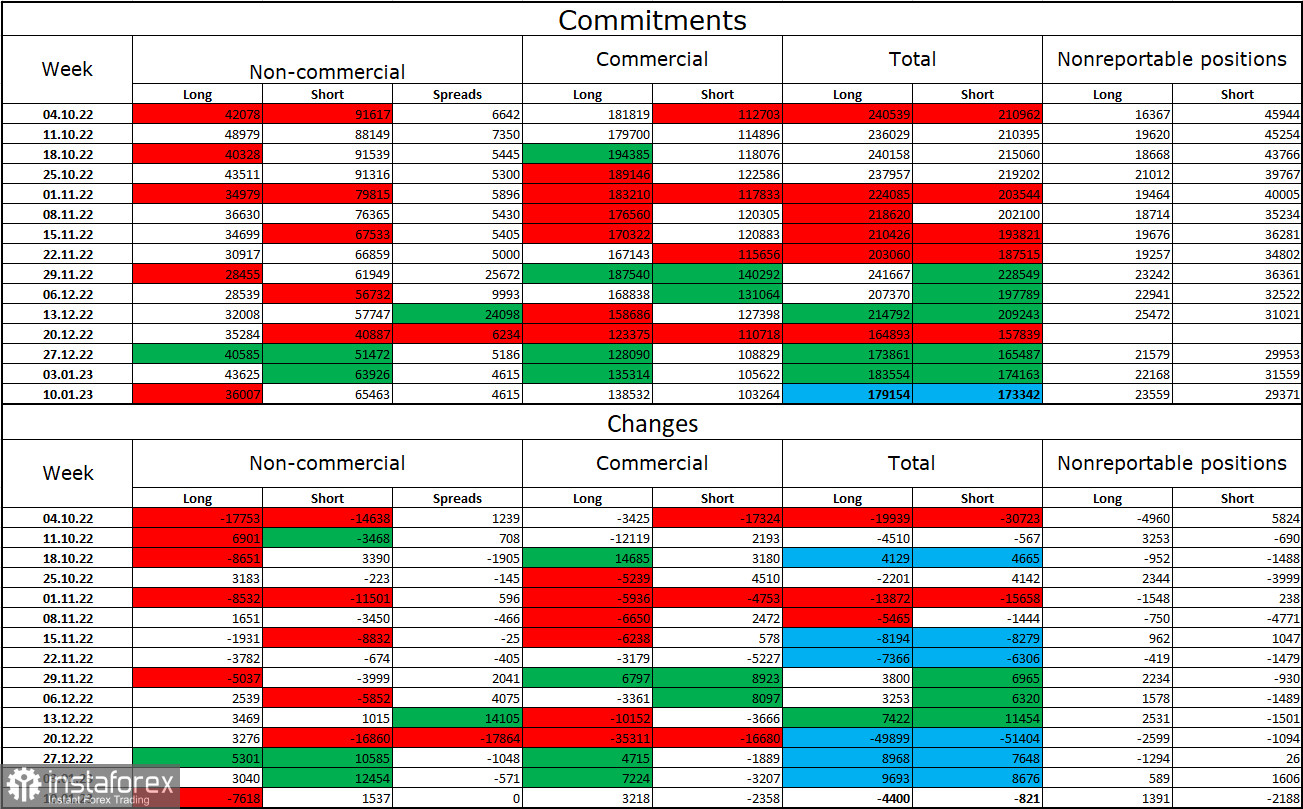

Commitments of Traders (COT) report

Last week, the non-commercial group of traders became more bearish on the pair than a week ago. The number of opened long contracts decreased by 7,618 while the number of short contracts went up by 1,537. The overall sentiment of large market players remained bearish as the number of short positions still outweighs the number of long ones. In recent months, the British pound has been gaining ground. However, today, there are twice as many short contracts as long ones. Therefore, the outlook for the pound has again worsened over the past few weeks. On the 4-hour chart, the price left the ascending channel that has been there for three months. This can serve as a factor limiting the pound's upside potential.

Economic calendar for US and UK:

US – Building Permits (13-30 UTC).

US – Philly Fed Manufacturing Index (13-30 UTC).

US – Initial Jobless Claims (13-30 UTC).

On Thursday, the US economic calendar has some events of medium importance, while the UK has nothing to pay attention to. So, the influence of the information background on the market sentiment will be weak today.

GBP/USD forecast and trading tips:

I would recommend selling the pound if the quote settles below the trendline on H1 with the targets at 1.2238 and 1.2112. I recommended buying the pound if the price closed above 1.2342 on H1 with the target at 1.2432. This level has been tested. You can open new long positions when the pair closes above 1.2342 with the target at 1.2432.