The market runs ahead of itself. This happened from time to time in the second half of 2022, when stock indices soared sharply on expectations of a dovish reversal of the Fed, and the central bank punished them more often than turned a blind eye to inappropriate antics. This time, the EURUSD pair went up sharply, although TD Research warns that the U.S. dollar is currently trading at a discount of 2%. It will weaken in the third or fourth quarter, but so far, the rally of the main currency pair looks too sharp.

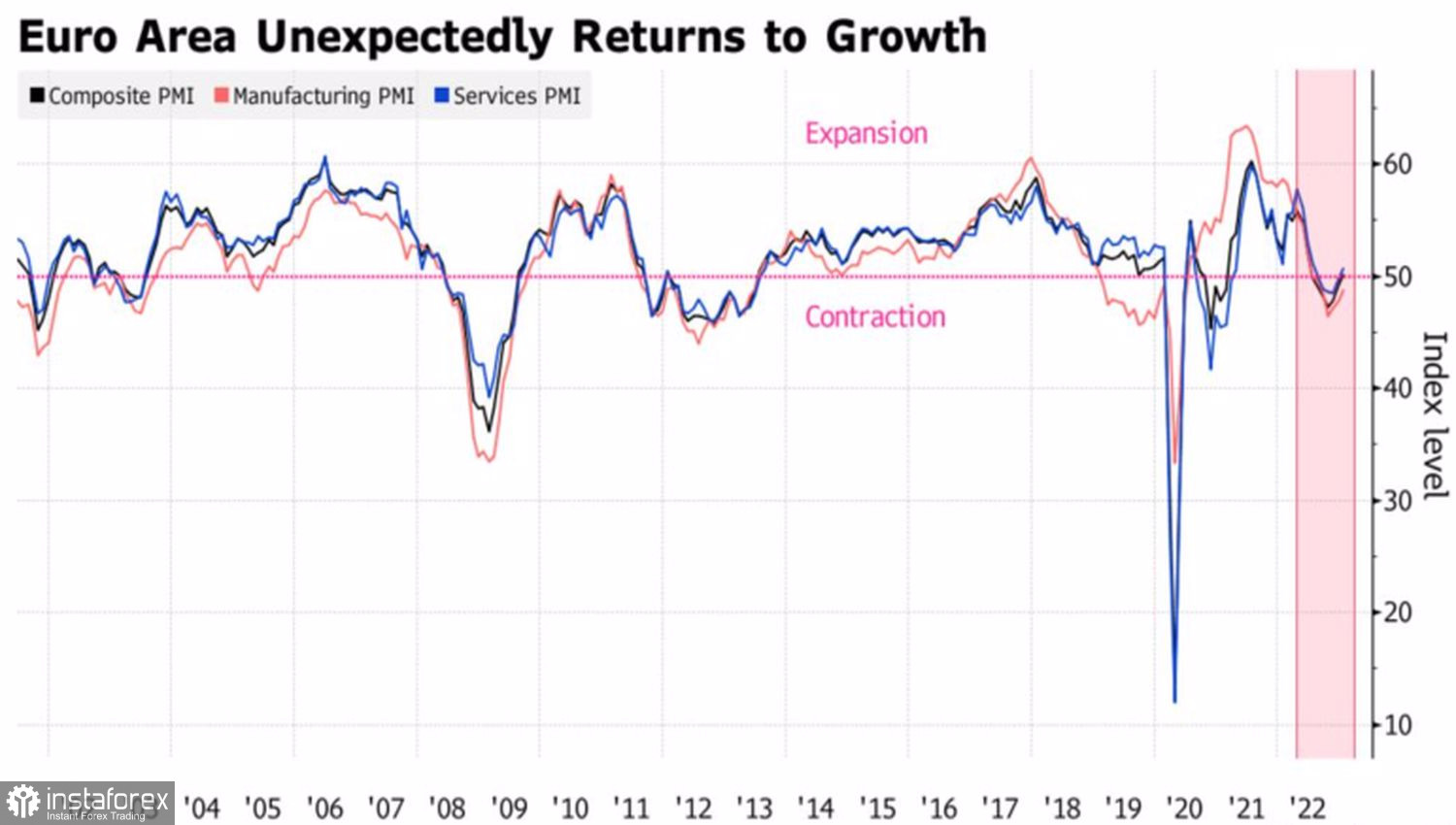

What impresses euro fans is that the European economy has been surprising pleasantly rather than disappointing lately. However, you need to understand that it is not out of the woods yet. Yes, the eurozone composite PMI in January passed the important 50 mark for the first time since June, indicating that GDP returned to growth in early 2023 and the currency bloc will avoid recession. However, the German manufacturing sector is still shrinking, and the delayed effect of the ECB's monetary tightening is not yet fully felt by the economy.

Dynamics of European business activity

And while the latest PMI statistics will be enough for the European Central Bank to raise its deposit rate by 50 bps in February, investors need to hold their horses a bit. Optimism is certainly a good thing, but it takes time for ambitious plans to materialize.

The same goes for China. It could account for half of all global GDP growth in 2023, but consider that COVID-19 outbreak is not yet over, and the Lunar New Year celebrations are delaying a stormy start. We have to be patient so that everything goes exactly as planned. Global GDP is expanding rapidly, the global risk appetite is rising like wildfire, and EURUSD is hitting 1.15.

Despite the increasing probability of a pullback in the main currency pair, the chances of continuing the upward trend in the medium term are still high. Both stock indices of the euro area and inflow of capital from abroad to the stock market will contribute to this. Yes, EuroStoxx 600 for the last three months rose by 15%, almost twice as much as S&P 500, but its fundamental evaluation is still underestimated. According to Bernstein, the European index trades at a 25% discount to its U.S. counterpart at a historical average of 15%.

Dynamics of U.S. and European stock indices

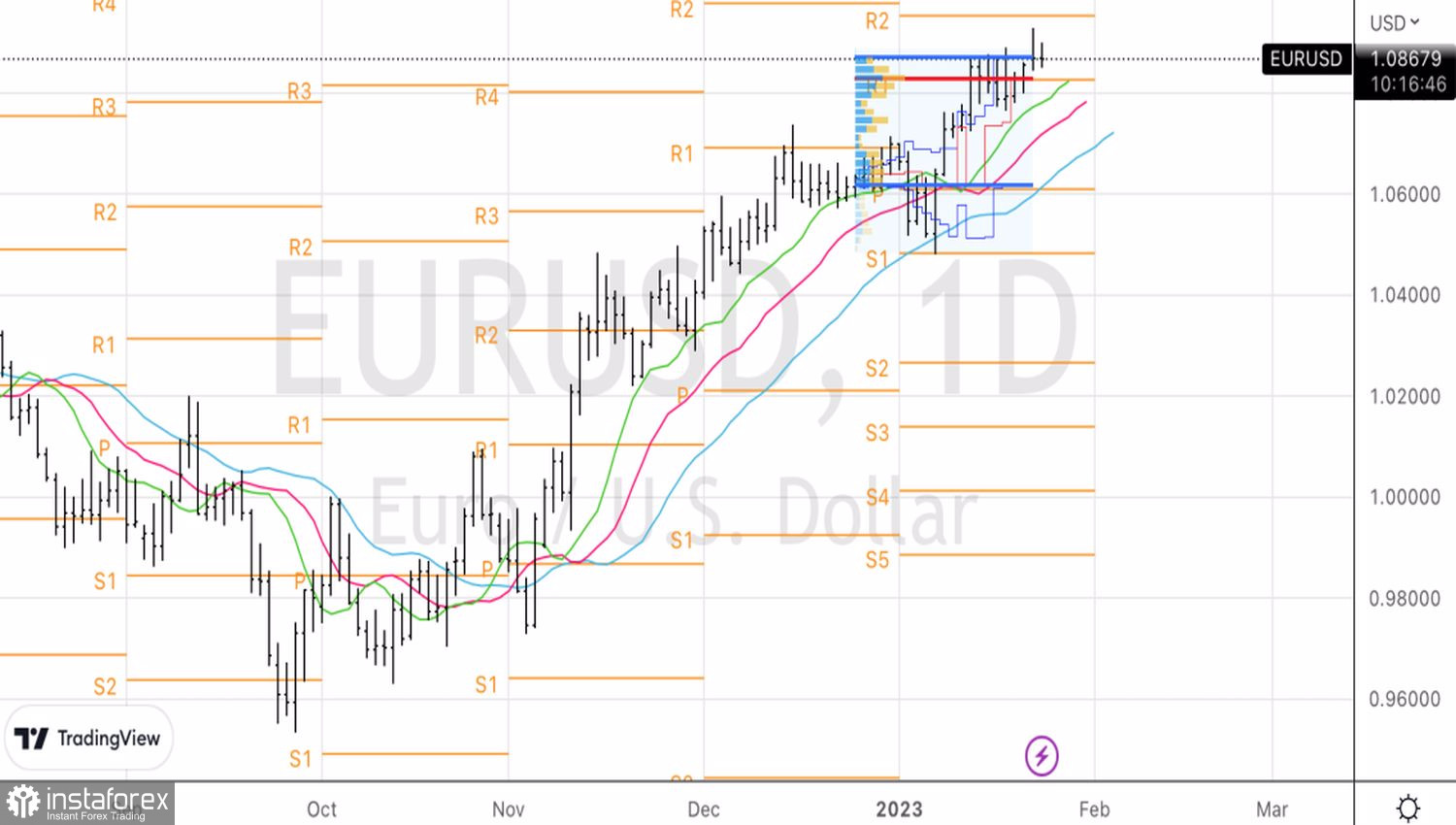

Thus, the euro retains all its major trump cards: a stronger economy than expected, a hawkish ECB and the attractiveness of European assets. Nevertheless, the regional currency can benefit from a short-term correction.

Technically, on the EURUSD daily chart, the formation of a doji bar with a long upper shadow signals that the bulls may have problems in the short term. A fall below its low at 1.085, followed by a successful assault on support at 1.083, would make sense to sell.