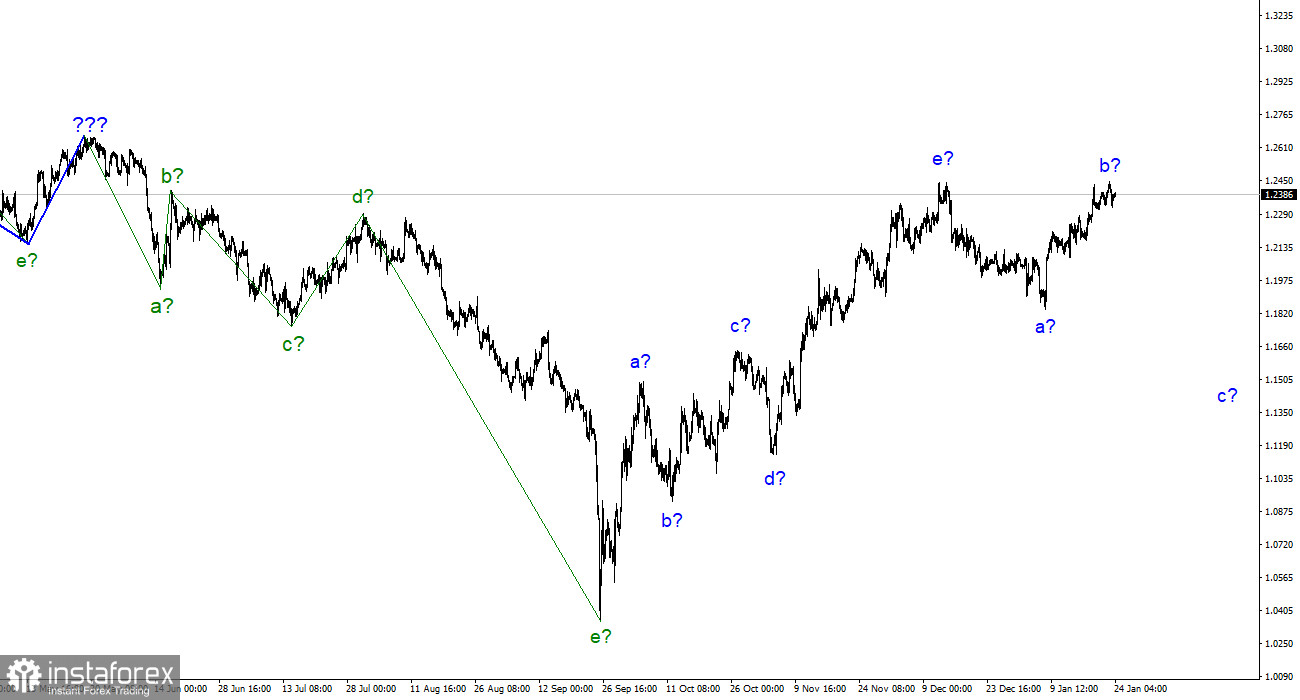

The wave markup for the pound/dollar instrument currently appears rather complex, but it also doesn't call for any explanations and starts to diverge dramatically from the markup of the euro/dollar instrument. Our five-wave rising trend segment has the form a-b-c-d-e and is most likely already finished. I anticipate that the construction of the downward phase of the trend has already started. This section will at least have three waves, but wave b ended up being too long because of the recent spike in the instrument's quotes. The present upward wave will no longer be regarded as wave b if the price increase persists, and the markup for the entire wave will need to be adjusted. The instrument can decline by 500–600 basis points if the current wave markup is still accurate, but I still plan to generate a falling wave using it. Wave e's peak does not surpass that of the anticipated wave b.

The market's response to business activity was significant.

On Tuesday, the pound/dollar exchange rate decreased by 90 basis points. The most intriguing part of the story then starts. Reports on business activity in the UK were released in the morning, at the same time as the decline in demand for the pound started. It increased to 46.7 points in the manufacturing sector, decreased to 48 points in the services sector, and decreased to 47.8 points for the composite indicator. The third index is a derivative of the previous two, and it turns out that one index declined and the second grew, both of which remained below the critical level of 50. All three indices increased in the European Union, but there was no increase in demand for the euro; instead, the market chose to ignore these findings. The UK's numbers were impartial and contradictory, yet the country's economy shrank by roughly 100 basis points.

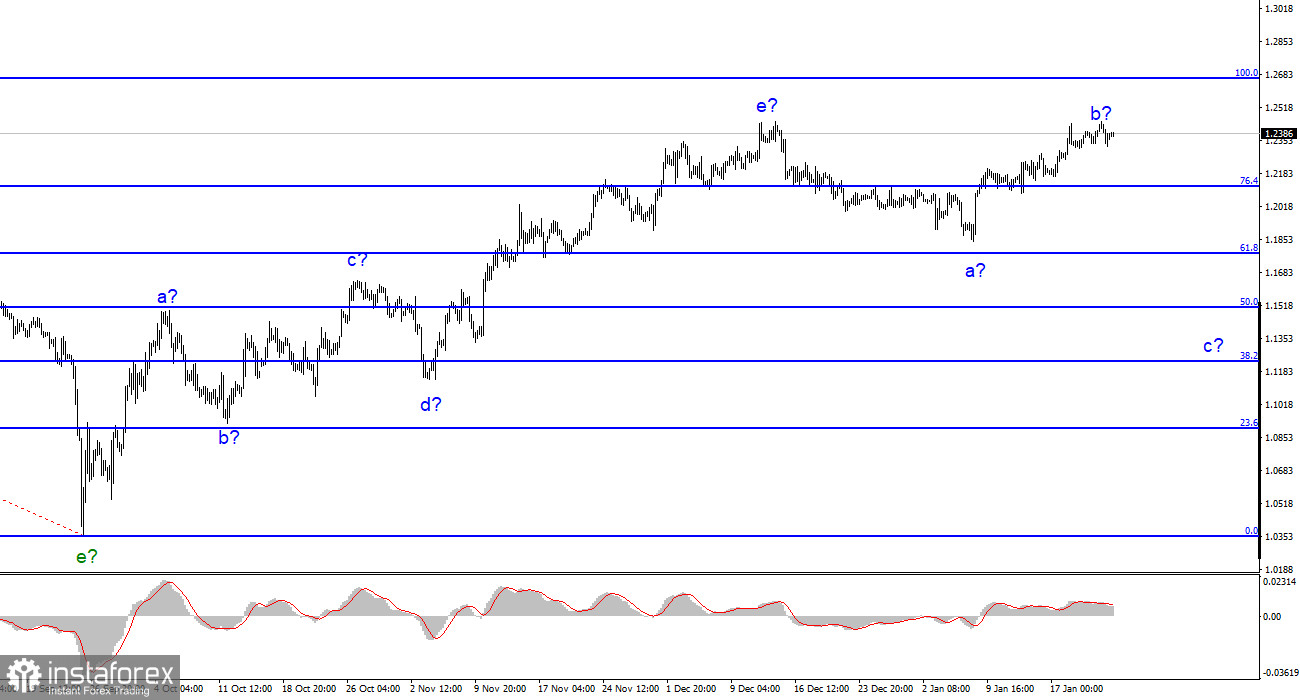

The pound is now moving more logically, as I already stated, and its wave marks also appear more convincing. Although the third wave of the corrective part of the trend has not yet materialized and the entire segment may change into a more complicated wave structure, we can still expect a slide from the British pound with a higher chance right now. The business activity indices could now be nothing more than a pretext for the formation of downward wave C. But it is still unclear why the euro would choose to ignore the wave markings while the pound would continue to walk in that direction. Based on everything mentioned above, I would use the pound or dollar as my trading instrument of choice at any given time. The value of the euro is still rising, but I find it hard to understand why there is still such a strong desire for it in the market. Analysts have examined the rates and predicted what they will be in the near future numerous times, but all of their conclusions have been overly detailed and incorrect. Inflation is too important a factor to predict for 2023.

Conclusions in general

The building of a downward trend section is still assumed by the wave pattern of the pound/dollar instrument. According to the "down" reversals of the MACD indicator, it is possible to take into account sales with objectives around the level of 1.1508, which corresponds to 50.0% by Fibonacci. The upward portion of the trend is probably over; however, it might yet take a longer form than it does right now. However, you must exercise caution while making sales because the pound has a significant tendency to rise.

The image is comparable to the euro/dollar instrument at the higher wave scale, but distinctions still start to show. Currently, the upward correction portion of the trend is almost finished (or has already been completed). If this presumption is true, then we must wait for the development of a downward section to continue for at least three waves with the possibility of a decrease in the region of figure 15.