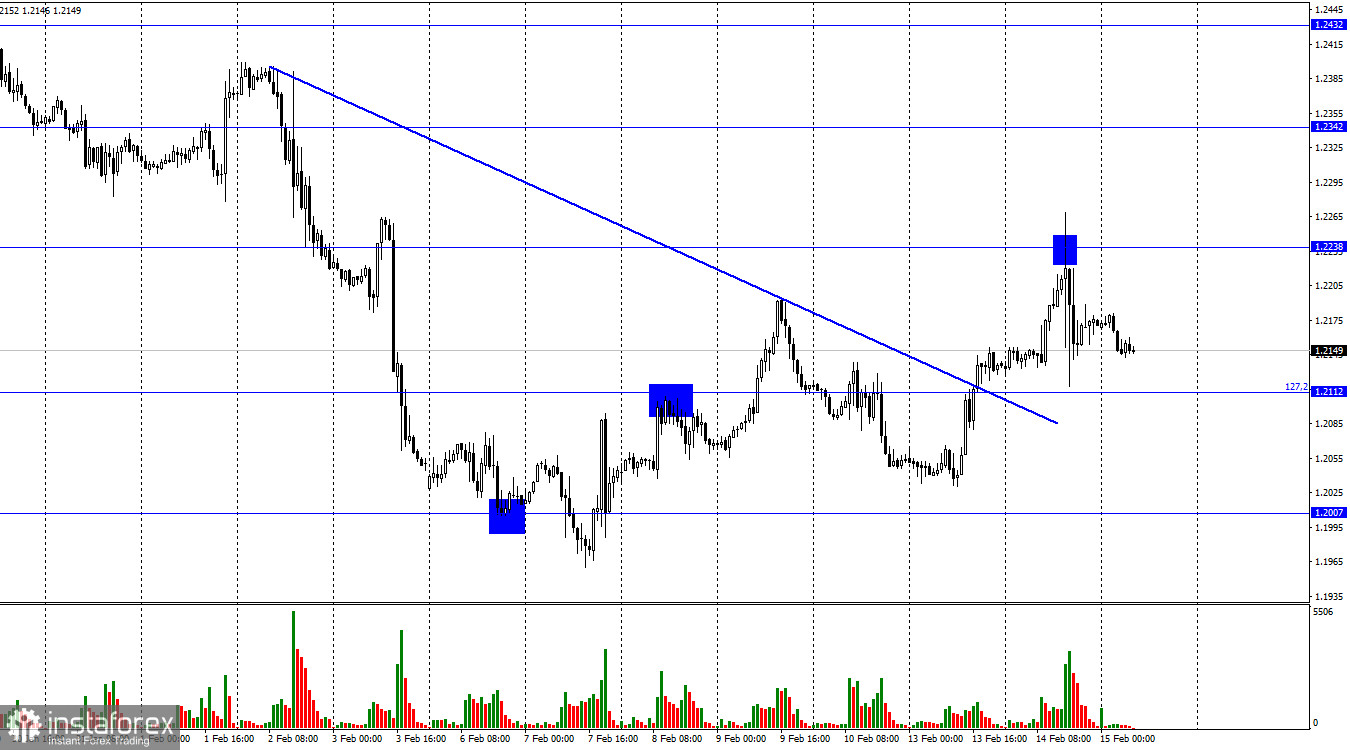

The GBP/USD pair on Tuesday increased to a level of 1.2238, rebounded from it, turned in favor of the US dollar, and then declined to the corrective level of 127.2% (1.2112), as seen on the hourly chart. The pair is still falling this morning, and if it consolidates at 1.2112, traders will be able to predict that the decline will continue to the next level of 1.2007.

One specific event, the US inflation report, was the cause of the pair's decline yesterday. The consumer price index decreased by 6.4%, which traders said was too little. The likelihood of a stronger PEPP tightening in the current year increased right away, and the US dollar went up with it. Today, it was already known that the UK's January inflation rate dropped from 10.5% to 10.1%. I find it difficult to categorize this change as "strong" or "weak," but traders found the slowdown to be fairly satisfying, and they kept selling British currency as the likelihood of a significant rate hike by the Bank of England declined. It turns out that the US currency was supported by both inflation reports. This, in my opinion, is reasonable given that the pound has recently been actively increasing, which hasn't always been consistent with the information background. I think a technical correction, which has already started and should continue, is overdue. The reports on inflation, however, merely help the pair in carrying out a graphical scenario.

There won't be any significant news today, but positive US figures could cause a small increase in the value of the dollar. I anticipate a consistent drop in quotes to 1.1950–1.2007. Since there won't be any central bank meetings for some time, traders' moods may be influenced by what the FOMC and the Bank of England say when they speak next. And after the inflation reports, their rhetoric might change a little.

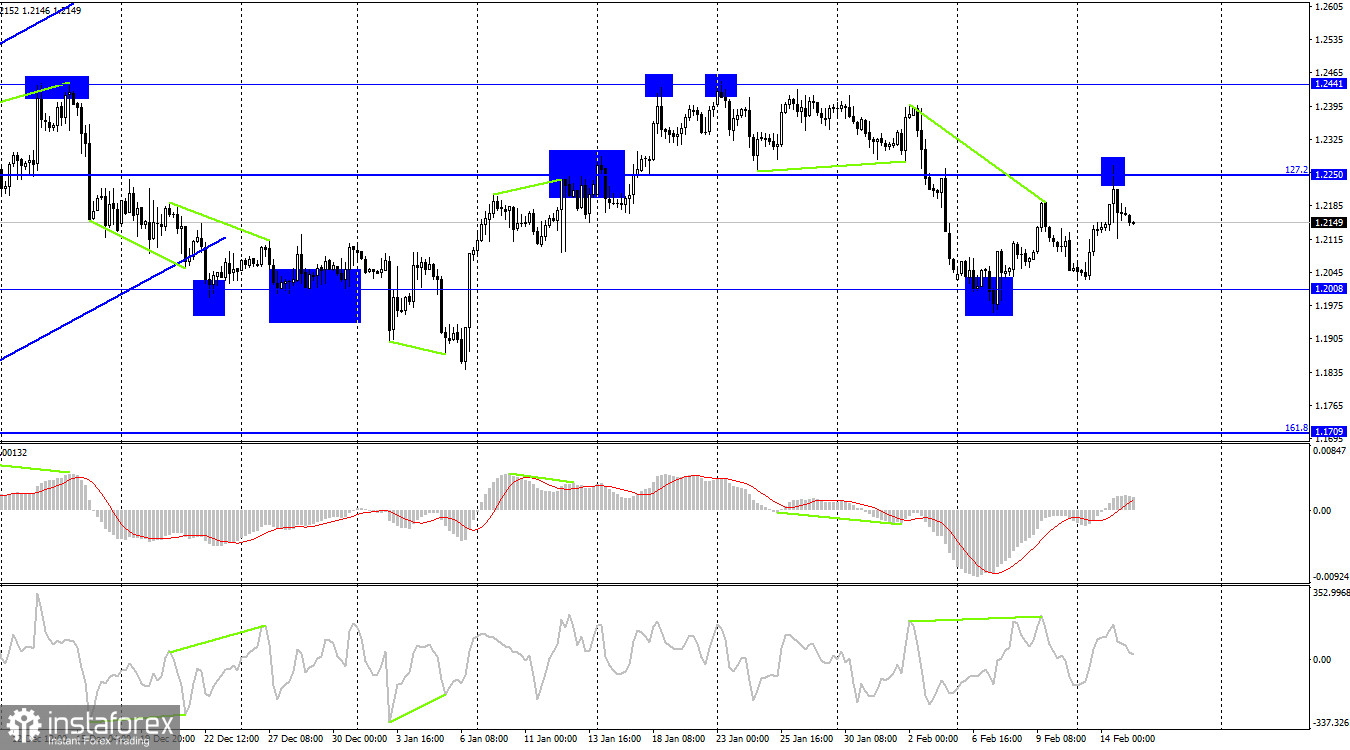

On the 4-hour chart, the pair reversed in favor of the US dollar, rebounded from the Fibo level of 127.2% (1.2250), and began to fall toward the 1.2008 level. The British pound will benefit from rising quotes from this level and the beginning of a new upward trend toward 1.2250. The likelihood of the price falling further in the direction of the corrective level of 161.8% (1.1709) will rise if the price is fixed at 1.2008.

Report on Commitments of Traders (COT):

In comparison to the previous reporting week, the sentiment among traders in the "Non-commercial" category has grown less "bearish." The number of long contracts held by investors dropped by 6,713 units, while the number of short contracts dropped by 7,476. The major players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. The situation has shifted in favor of the British pound over the last few months, but today the number of long and short positions in the hands of speculators has nearly doubled once more. As a result, the outlook for the pound has once again declined, but it is not eager to decline and is instead concentrating on the euro. An exit from the three-month upward channel was visible on the 4-hour chart, and this development may have stopped the pound's growth.

News calendar for the USA and the UK:

UK – consumer price index (07:00 UTC).

US – retail sales volume (13:30 UTC).

US – volume of industrial production (14:15 UTC).

The UK inflation figure was previously made public on Wednesday, and there will only be reports of average relevance in the US. The information background may not have much of an impact on traders' attitudes for the remainder of the day.

Forecast for GBP/USD and trading advice:

When the British pound recovers from levels of 1.2238 or 1.2250, new sales could be initiated with targets of 1.2112 and 1.2007. The initial target has been completed. When the pair recovers from the 1.2008 level, purchases can be initiated with targets of 1.2112 and 1.2238.