The pound against the dollar is losing ground. Just yesterday, the GBP/USD pair was approaching the boundaries of the 23rd figure, while today, the price has already tested the 20th price level. The downward dynamics is due not only to the strengthening of the U.S. currency, but also to the weakening of the sterling. The U.K. labor market has provided only temporary support to the pound: inflation data released today disappointed buyers of GBP/USD. Almost all components of the release came out in the "red zone," reflecting the slowdown in inflation growth.

The language of dry numbers

In the language of dry numbers, the situation is as follows. The consumer price index in monthly terms came out at -0.6% (against the forecast of a decline to -0.4%). For the first time since January 2022, this component of the report was in the negative area. In annual terms, the CPI came out at around 10.1%, while the forecast was 10.3%. A smooth (but consistent) downward trend is recorded here for the third month in a row.

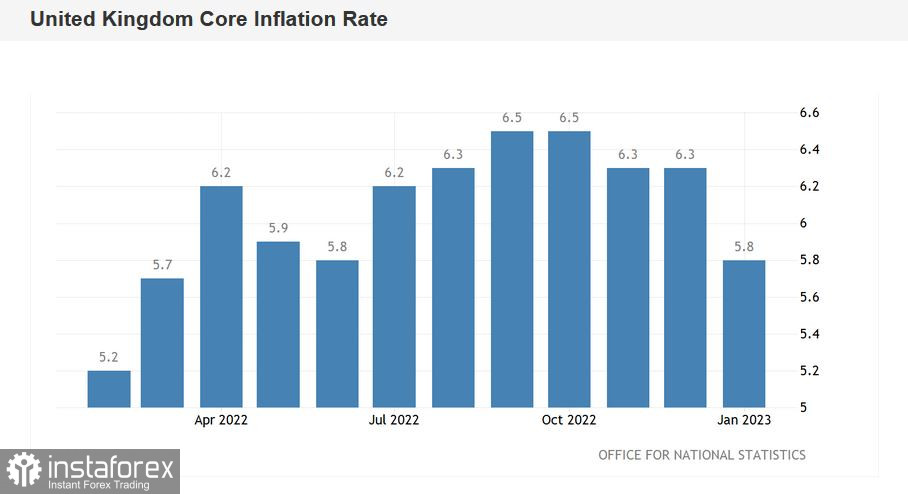

The main consumer price index sank more significantly: with the forecasted decline of 6.2%, the indicator turned out to be at 5.8%. This is the weakest growth rate since June 2022. The purchasing price index and the producer price index—all these inflation indicators were also in the red, showing a slowdown in growth. The only exception was the retail price index, but there is no reason to talk about any breakthrough here: in annual terms the index remained at the level of December, and in monthly terms it came out at zero (with a forecast decline to -0.2%).

The structure of the release suggests that the slowdown in inflation was facilitated by lower prices for transport, restaurants and hotel services. At the same time, the growth in prices for tobacco and alcohol products has become a deterrent to slowing down inflation.

Recall that, according to data published yesterday, unemployment in the UK in January remained at 3.7% (the third month in a row), and jobless claims decreased by almost 13,000 for the same month, while most experts expected the opposite dynamics (growth by 18,000). At the same time, wages in Britain decreased in real terms from October to December 2022 by 2.5%.

What the reports say

In summary, we can conclude that the U.K. labor market is in pretty good shape amid slowing inflation. This combination increases the likelihood that the Bank of England will soften its rhetoric in the near future and, perhaps, even allow a pause in rate hikes. According to a number of currency strategists, the British regulator can put a period to the current cycle in March by raising the rate by 25 points and thus stopping at 4.25%. According to other analysts, the central bank will add another 25 basis points in May, bringing the rate to the final level of 4.5%.

By the way, do not forget that at the February meeting, two members of the Bank of England's Monetary Policy Committee, Silvana Tenreyro and Swati Dhingra, again voted against raising the interest rate. In their opinion, the central bank "has already done enough" to stop inflation growth. They voiced a similar position at the previous December meeting. It is likely that the macroeconomic reports published this week will tip the scales in favor of a conditionally "dovish" scenario, according to which the March 25-point increase will be the last in the current cycle.

It is clear that the downward momentum of GBP/USD is due not only to the weakening of the British pound, but also to the strengthening of the U.S. currency. The US dollar index shows an upward trend, playing out yesterday's report on the growth of the consumer price index. The published figures indicate that the rate of decline in inflation in the U.S. has slowed down, and this fact cannot but worry the members of the Fed.

Yesterday, Dallas Fed President Laurie Logan stated that it is necessary to continue raising the rate "for a longer period than previously assumed." Amid such fundamental signals, the market's hawkish expectations regarding the Fed's next steps have significantly increased. In particular, the probability of a 25-point rate hike in March is close to 100%. The probability of similar decisions by the central bank in May and June has also increased.

Conclusions

The established fundamental background favors the development of the downward impulse of GBP/USD. On the D1 timeframe the pair is between the upper and middle lines of the BB indicator, but above the Kumo cloud. If the sellers overcome the upper boundary of this cloud (1.2080 support level), the next ambitious target of the downward movement will be 1.1990, which is the bottom line of the Bollinger Bands on the same timeframe.