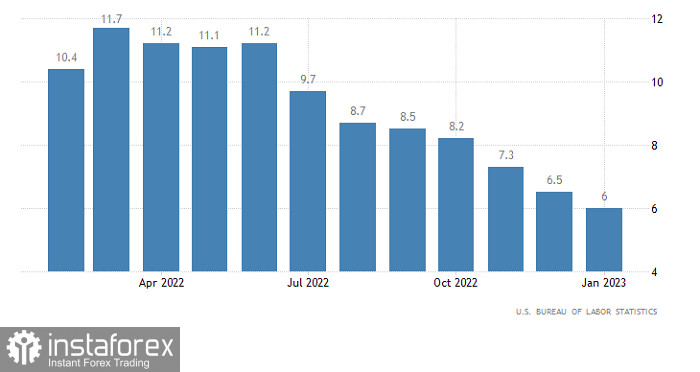

The euro has been falling since early February, and the market needs at least a local correction. However, macroeconomic data is pushing the euro down. This time, the producer price index data was the key reason for the decline. The indicator's growth slackened to 6.0% from 6.5%, whereas economists had expected a drop to 5.6% from 6.2%. In other words, inflation will slow down slower than expected. It means that the Fed may decide to raise the key rate more than two times. There is no wonder that the greenback continues gaining in value. Since the macroeconomic calendar is empty, the market situation will remain intact until the end of the week.

US Producer Price Index

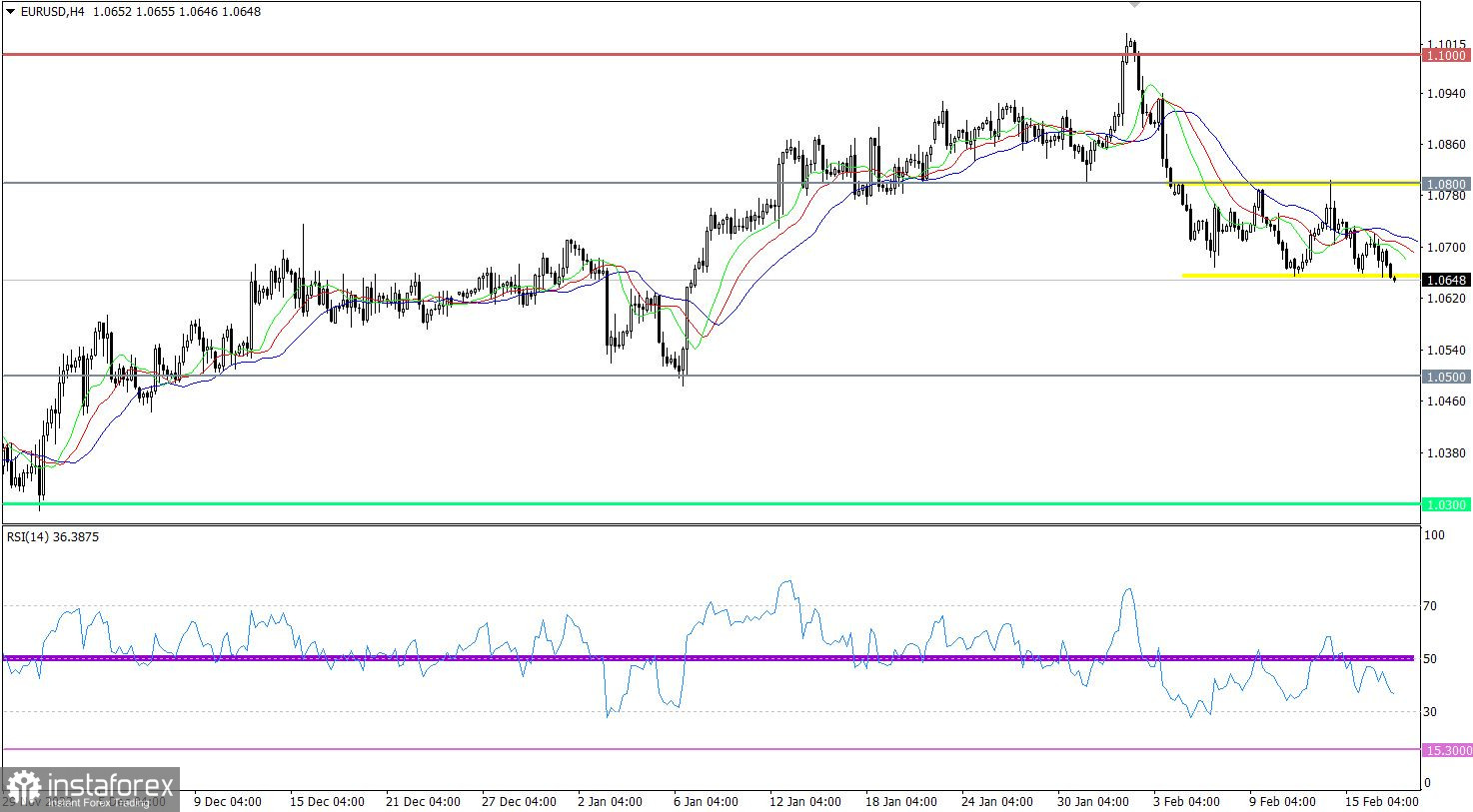

Sellers are exerting significant pressure on the euro. This is proved by the price settlement at 1.0650. Notably, the quote has been trading sideways for the eighth day in a row. The limits of the range are located at 1.0650/1.0800.

On the four-hour and daily charts, the RSI indicator is hovering in the lower area of 30/50, which corresponds to the bearish sentiment among traders.

In the same time frames, the Alligator's MAs are headed downwards but the technical signal is still unstable.

Outlook

If the price settles below 1.0650 on the four-hour chart, the volume of short positions may increase. This may lead to the prolongation of the correctional movement.

Traders will consider the alternative scenario if the price rebounds from the level of 1.0650. In this case, the sideways channel will continue its formation.

In terms of the complex indicator analysis, we see that in the short-term and intraday periods, indicators are pointing to the bearish sentiment since the correctional movement continues.