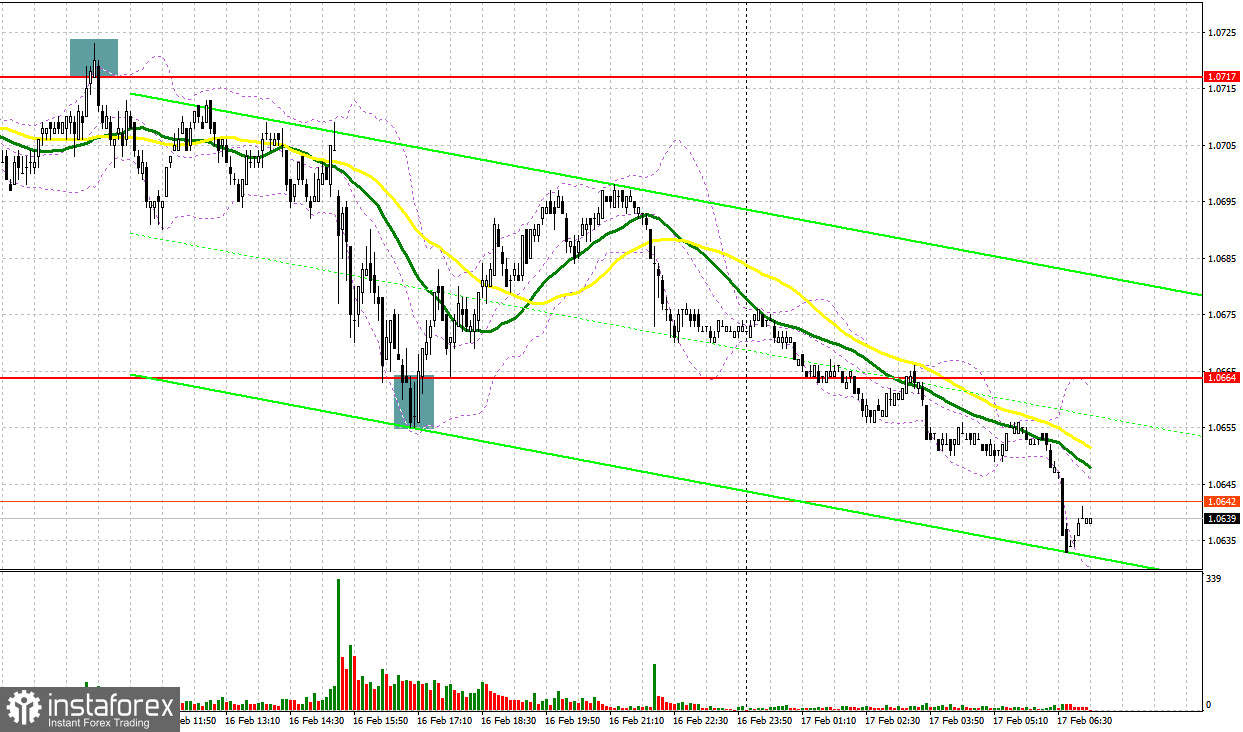

Yesterday, traders received several perfect signals to enter the market. Let us take a look at the 5-minute chart to find out what happened. Earlier, I asked you to pay attention to the level of 1.0717 to decide when to enter the market. A rise and false breakout of this level led to a perfect sell signal. As a result, the price dropped by more than 50 pips. In the second part of the day, bulls protected 1.0664 by forming a false breakout, which gave a buy signal. As a result, the pair climbed by more than 30 pips.

Conditions for opening long positions on EUR/USD:

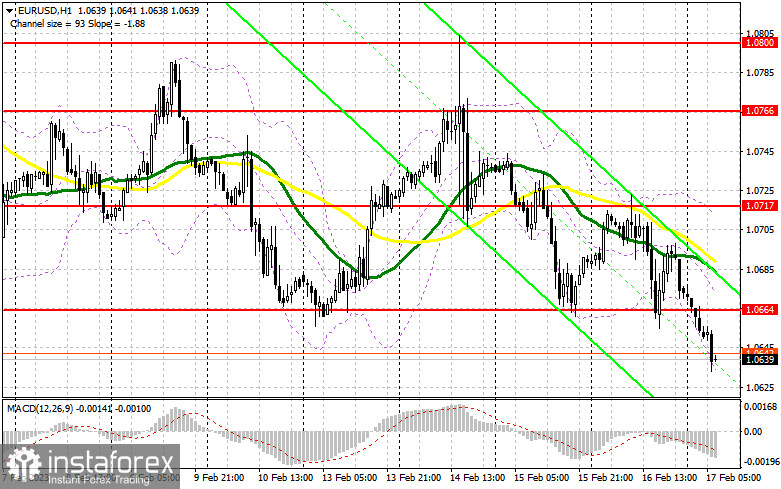

This week, the US has published a lot of important macroeconomic reports, which intensified pressure on the risk assets. The fact is that the US economy has a significant influence on the Fed. A further rise in the key rate will inevitably lead to economic difficulties. In the event of this, a soft landing will hardly become possible. Today, traders should pay attention to the German produce price index and France's consumer price index. A rise in the indicators will confirm that the ECB has chosen the right strategy concerning the key rate hike. The eurozone current account will hardly affect the market sentiment. If the pressure on the pair remains intact, it will be wise to go long only after the price hits the nearest support level of 1.0602. Only a false breakout of this level will give a sell signal with the target at the resistance level of 1.0664. Bulls failed to protect this level during the Asian trade. As a result, the pair left the sideways channel. A breakout and an upward test of 1.0664 amid strong data from the eurozone will give an additional long signal with the target at 1.0717. However, the price is unlikely to go above this level. If the pair breaks 1.0717, this will affect bears' stop orders and give one more long signal with the target at 1.0766, where it is better to lock in profits. If the euro/dollar pair declines and buyers fail to protect 1.0602 in the first part of the day, pressure on the pair will remain the same. A breakout of this level will intensify the bearish trend. In this case, traders should focus on the next support level of 1.0565. Only a false breakout of this level will lead to a buy signal. Traders may also go long just after a bounce off the low of 1.0525 or even lower – at 1.0484, expecting a rise of 30-35 pips.

Conditions for opening short positions on EUR/USD:

Traders may go short from 1.0664. It is very important that bears act aggressively at that level in the first part of the day. Strong inflation in Germany and France may boost the pair. Only a false breakout of 1.0664 will confirm that big traders are in the market. In the event of this, the pair may continue falling to 1.0602. A breakout and a reverse test of this level amid the Fed's hawkish rhetoric may form a new sell signal with the target at 1.0565. This will intensify the bearish sentiment. If the price settles below this area, it may slide to 1.0484, where it is better to lock in profits. If the euro/dollar pair increases during the European session and bears fail to protect 1.0664, bulls may try to return to the market. In this case, it will be wise to avoid selling until the price touches 1.0717. Slightly below this level, there are sellers' MAs. It is possible to sell at this level after an unsuccessful settlement. Traders may also go short just after a rebound from the high of 1.0766, expecting a decline of 30-35 pips.

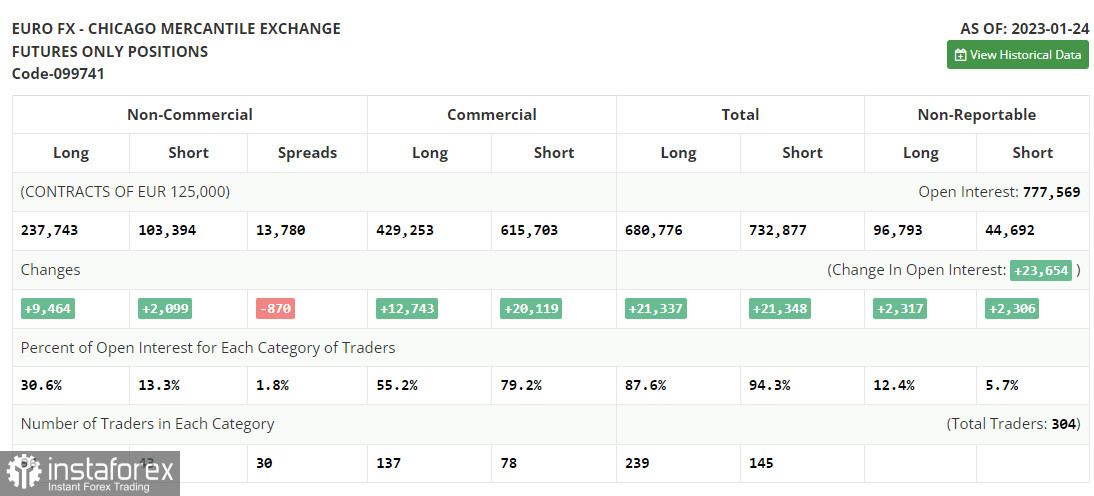

COT report

Since a technical problem in the CFTC has been settled yet. The latest COT report was published on January 24. Thus, the COT report for January 24 logged a rise in both short and long positions. Traders have significantly increased long positions following hawkish speeches of ECB policymakers. They are betting on further monetary tightening by the ECB and the Fed's dovish stance. The US regulator may reduce the pace of tightening for the second time in a row. Weak macro stats on the US economy, namely a drop in retail sales and a slowdown in inflation may force the central bank to take a pause in rate hikes to avoid any damage. This week, several central banks will hold their meetings. Their results will eventually determine the trajectory of the euro/dollar pair. According to the COT report, the number of long positions of the non-commercial group of traders increased by 9,464 to 237,743 while short positions advanced by 2,099 to 103,394. At the end of the week, the total non-commercial net position rose to 134,349 from 126,984. It appears investors believe in the upside potential of the euro. Nevertheless, they are waiting for more clues from central banks regarding interest rates. The weekly closing price grew to 1.0919 from 1.0833.

Signals of indicators:

Moving Averages

Trading is performed below 30- and 50-day moving averages, which points to a bearish market.

Note: The author considers the period and prices of moving averages on the one-hour chart which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair increases, the resistance level will be formed by the upper limit of the indicator located at 1.0717. In case of a decline, the lower limit of the indicator located at 1.0635 will act as support.

Description of indicators

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial

- traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.