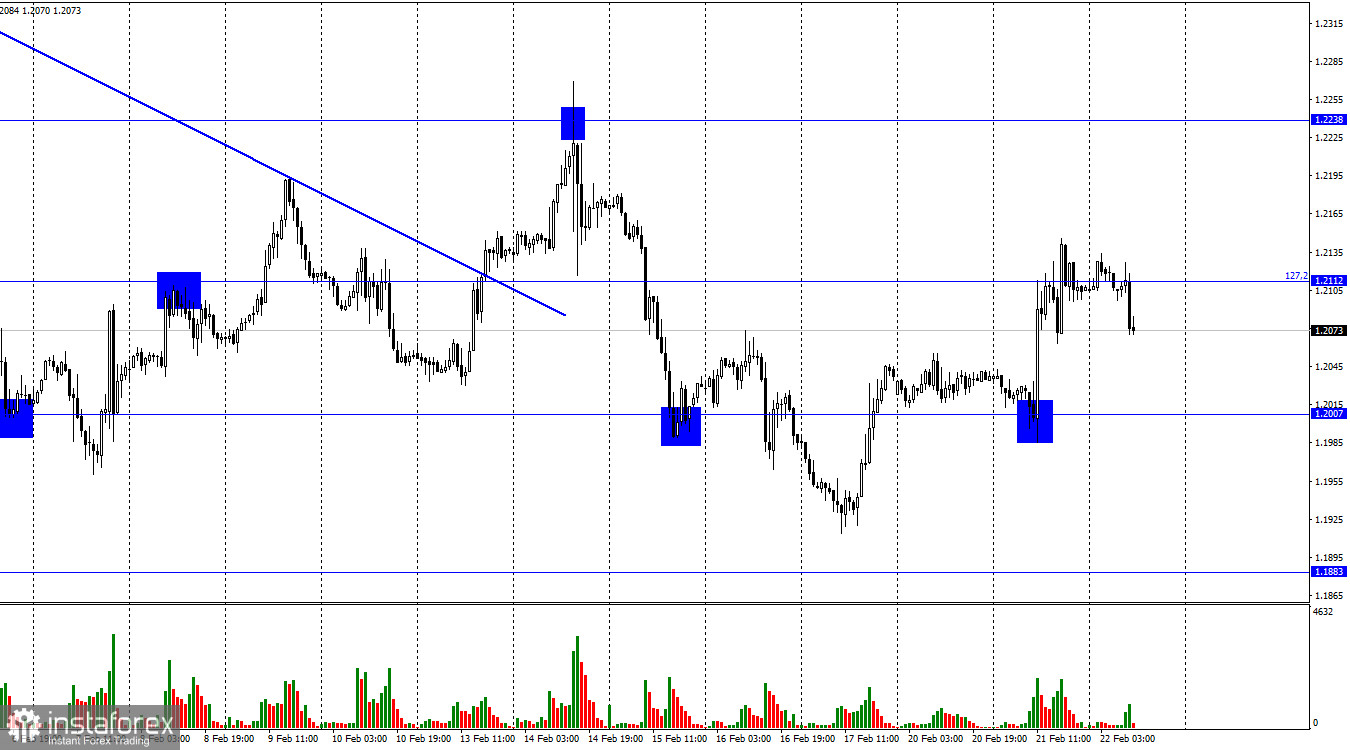

On the 1-hour chart on Monday, GBP/USD advanced to the Fibonacci level of 127.2% at 1.2112. Today, however, the pair reversed in favor of the US dollar and began to slide back toward the level of 1.2007. Yesterday, bulls were driven by better-than-expected data on business activity in the UK. On Wednesday, there will be no important economic publications for the whole day. That is why the pound is losing ground and sliding to the downside. What happened yesterday could be just a coincidence. If not for the strong data reported yesterday, the pound might have declined just like the euro did.

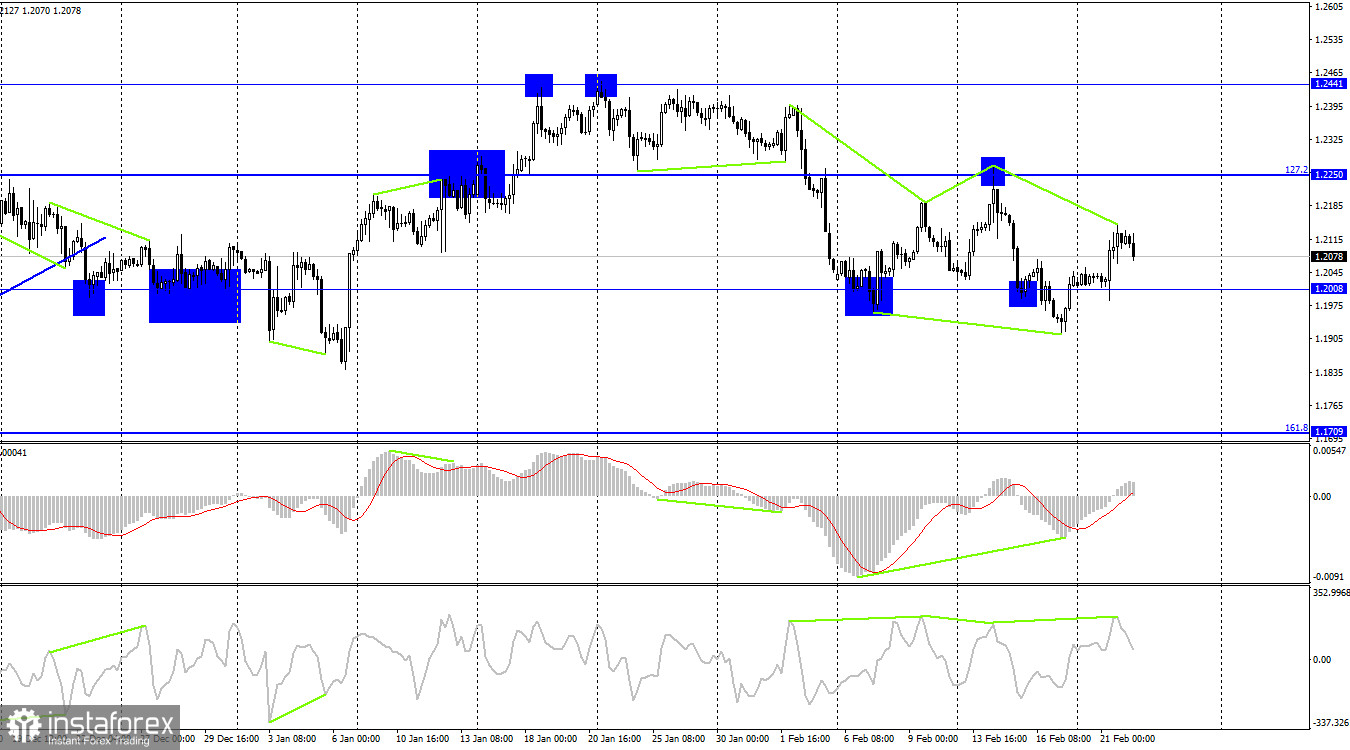

I have already mentioned the FOMC minutes in my other article, and this is the only driver that can potentially move the market today. Therefore, all focus will be on the FOMC meeting, the Fed and its monetary policy. Today, we can talk about the outlook for the pound in the long run, for example, in a few weeks. If we take a look at the 24-hour interval, we will see that the pair has been trading in the range between 1.1909 and 1.2462 since November 22. This means that we are dealing with a horizontal channel. A close below 1.1909 will allow bears to resume selling. Yet, they still need to overcome this level first and this could be possible only amid a certain news background.

This week seems rather uneventful in terms of economic reports. On Thursday and Friday, the US will publish the data on GDP and personal income and expenditures. Neither of the two reports is able to support the US dollar. The second Q4 GDP estimate of 2.9% is likely to come in line with the first estimate. As for the UK, it has already revealed the business activity data which provided strong support for the pound. However, it is not enough to keep the pound afloat for long. A lot will depend on the Bank of England which keeps silent for now.

The pair reversed to the upside on the H4 chart following a bullish divergence formed by the MACD indicator. The fact that the quote has settled above the level of 1.2008 suggests a further rise. However, the emergence of the bearish divergence formed by the CCI indicator may bring the pair back to the level of 1.2008. A firm hold below this line will mean a further decline toward the retracement level of 161.8% at 1.1709.

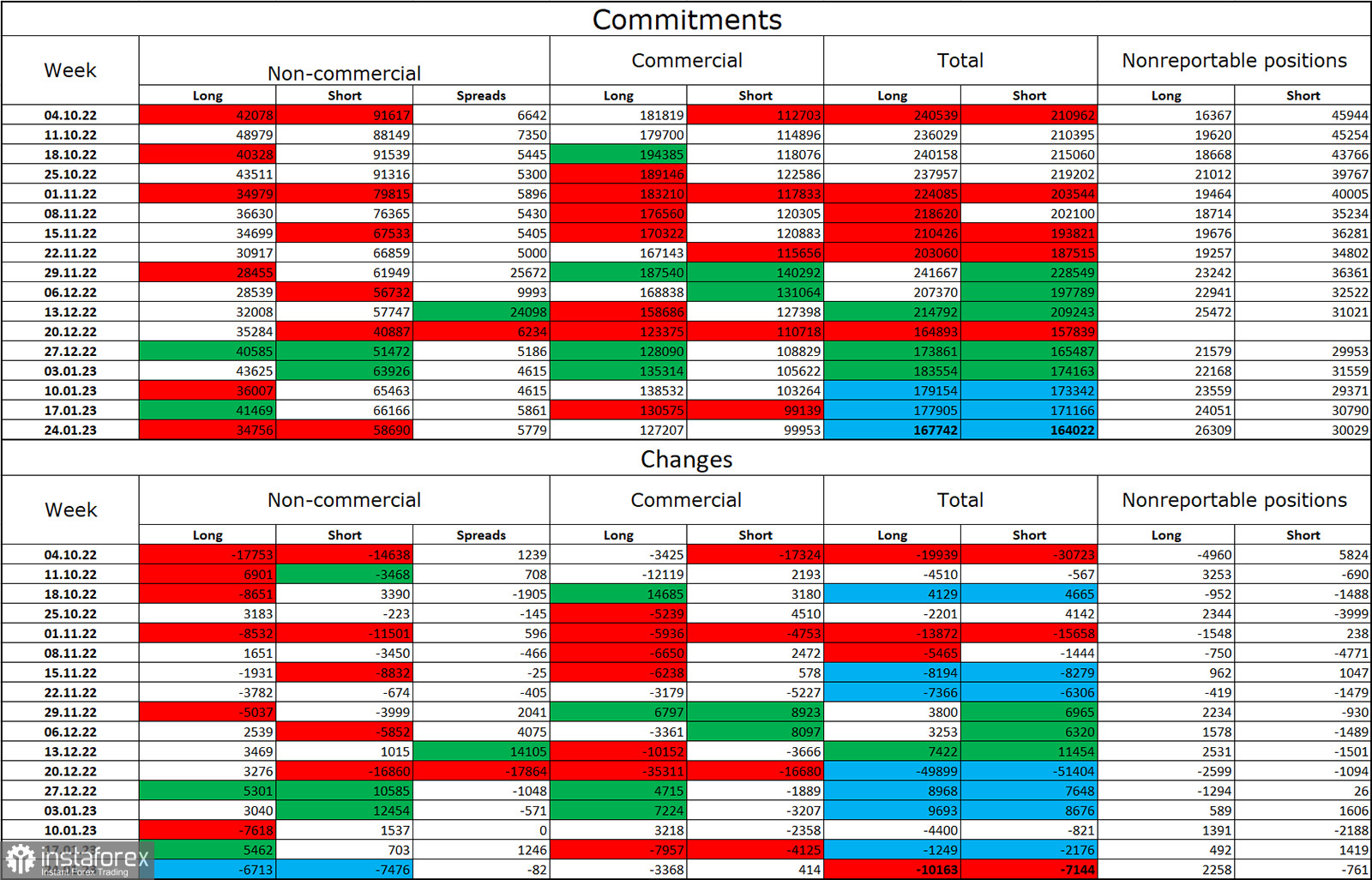

Commitments of Traders (COT) report:

The sentiment of the non-commercial group of traders has become less bearish over the past week. The number of Long contracts opened by traders decreased by 6,713 while the number of Short contracts fell by 7,476. The overall sentiment of large market players remained bearish as the number of short positions still exceeds the number of long ones. In recent months, the pound has been gaining ground. In recent months, the British pound has been gaining ground. However, today, there are twice as many short contracts as the long ones. Therefore, the outlook for the pound has again worsened over the past few weeks. The pound, however, is holding steady, following the trajectory of the euro. On the 4-hour chart, the price left the ascending channel that has been there for three months. This can serve as a factor limiting the pound's upside potential.

Economic calendar for UK and US:

US – FOMC Meeting Minutes (19-00 UTC).

On Wednesday, the economic calendars for the UK and the US have almost no events. Therefore, the influence of the information background on the market can be strong only when the FOMC minutes are out.

GBP/USD forecast and trading tips:

Selling the pound was possible after a rebound from 1.2112 on the H1 chart with the targets at 1.2007 and 1.1883. These positions can be kept open for now. You can open log positions on the pair if the price rebounds from 1.2007 with the target at 1.2112.