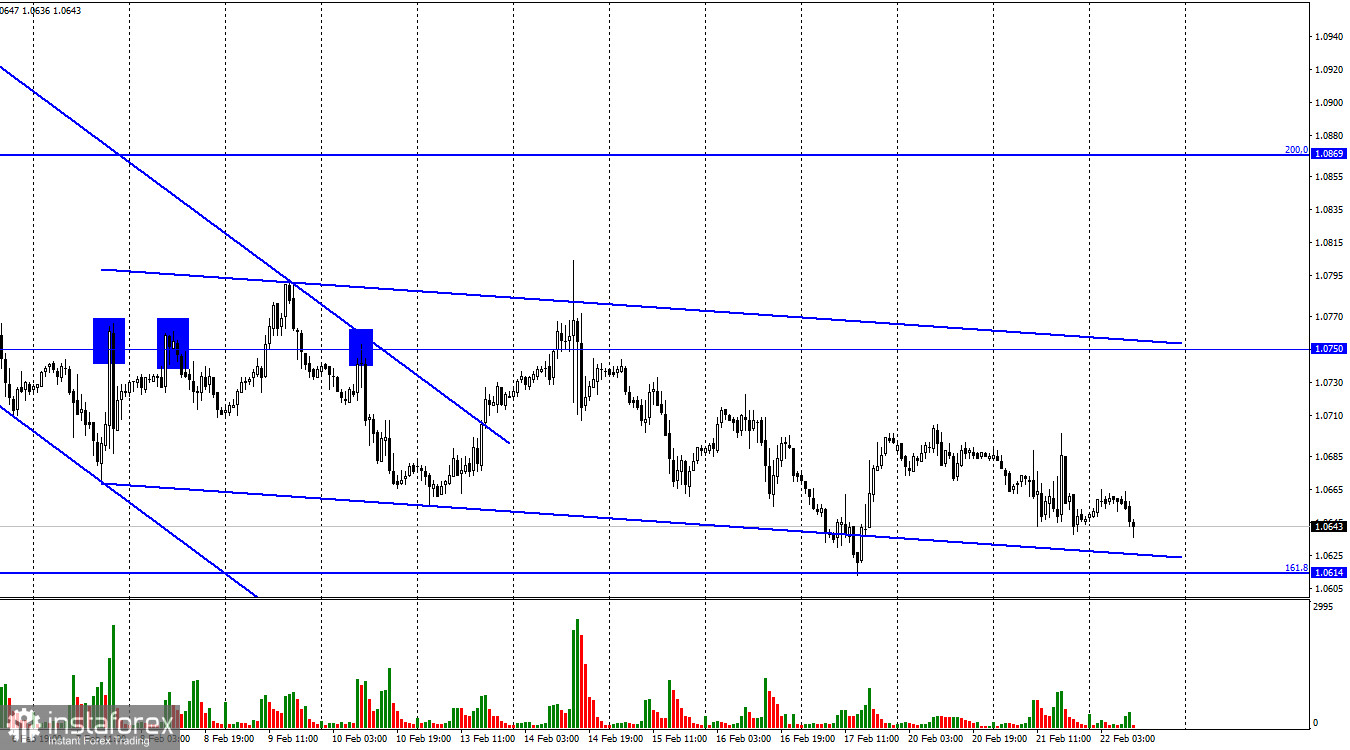

Hello, dear traders! Yesterday, EUR/USD was moving down to the 161.8% retracement level of 1.0614. In fact, the pair rebounded from the same level a few days ago. Anyway, it was a brief increase. I do still believe that the pair has limited growth potential. The downtrend will extend once the price returns to the 161.8% retracement level of 1.0614 and consolidates below it, with the target at 1.0483. The current descending trend corridor reflects the bearish market sentiment.

The bears encountered support from yesterday's business activity data. EUR/USD briefly went up in price. It fell right after the publication of the upbeat PMI statistics in the US. Today, the Fed will deliver its FOMC Minutes. Such reports rarely provide traders with fresh information because of Jerome Powell's press conference right after the meeting where he gives answers to all the important questions. This time, however, inflation showed only a slight decrease, so the possibility of further tightening increased. Moreover, the inflation report came already after the FOMC meeting. Therefore, if the Minutes are more hawkish, that could provide support for the bears. In my view, the greenback is likely to extend yesterday's growth, especially given the absence of the bulls in the market who even did not want to bring the pair back to 1.0750.

In the 4-hour time frame, the pair settled above the ascending trend corridor. That is a crucial moment because the pair left the corridor it has been moving within since October. With the bearish sentiment in the market, downward targets stand at 1.0610 and 1.0201. Nevertheless, the bullish MACD divergence indicates the possibility of growth in the price. Likewise, a rebound from 1.0610 could mark the end of the downtrend.

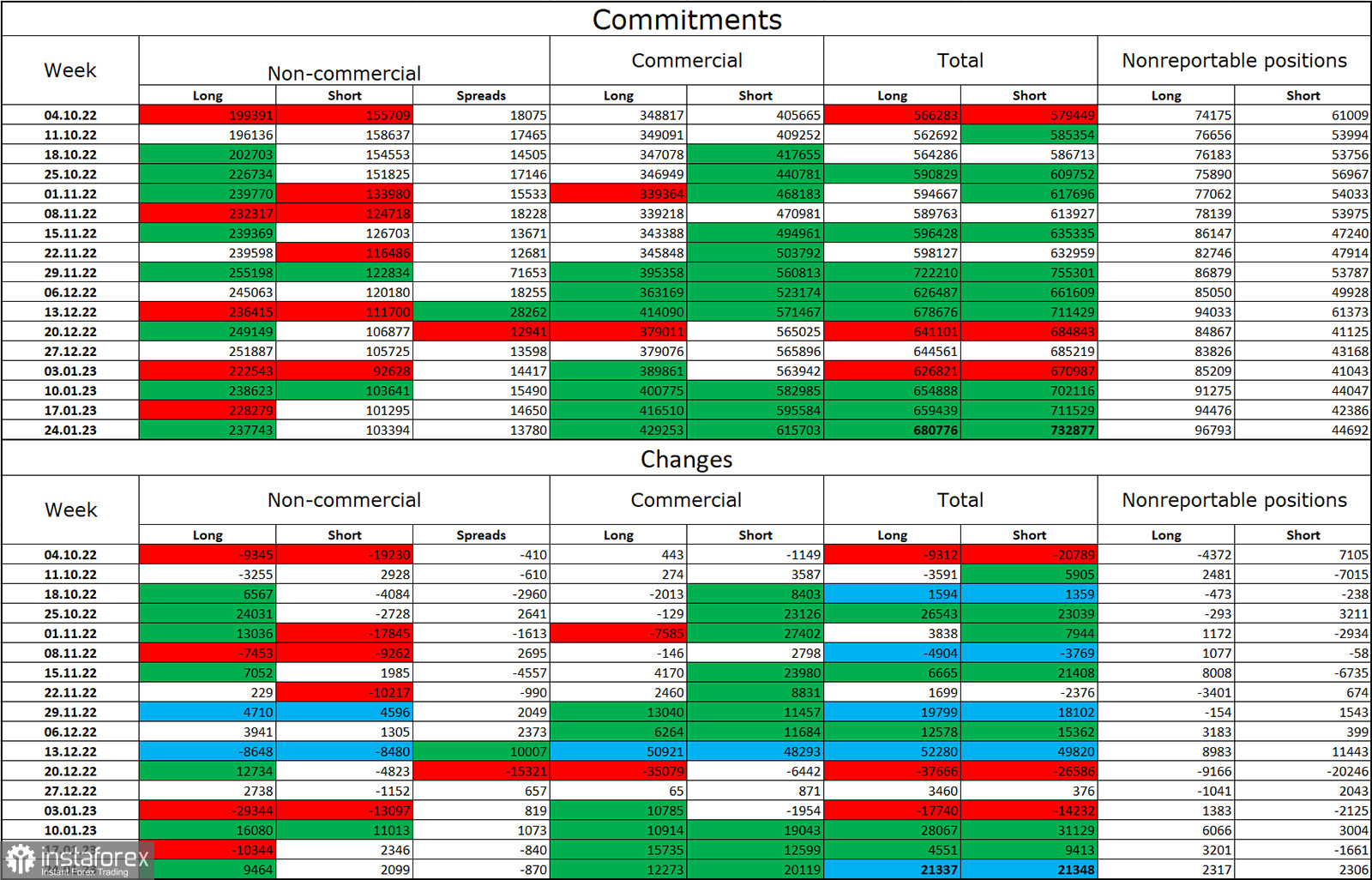

Commitments of Traders:

Over the reporting week, speculators opened 9,464 long positions and 2,099 short ones. The bullish sentiment has increased somewhat. Speculators currently hold 238,000 long positions and 103,000 short ones. The pair is on the rise in line with the latest COT report. At the same time, the number of longs exceeds that of shorts almost 2.5 times. Over the past several weeks, the pair has been on the rise despite having little support from fundamental factors. Anyway, the outlook for EUR/USD is going to be positive for as long as the ECB raises rates by 0.50%.

Macroeconomic calendar:

United States: FOMC Minutes (19-00 UTC)

On February 22, the macroeconomic calendar does not contain any important releases in the eurozone. In the United States, the FOMC Minutes will be delivered. Therefore, fundamental factors are likely to affect trader sentiment by the end of the day.

Outlook for EUR/USD:

Consider selling after the close below 1.0610 with the target at 1.0483 and buying after a rebound from 1.0610, targetting 1.0750 in the 4-hour time frame.