The euro-dollar pair updated the 7-week price low on Friday, having consolidated within the 5th figure. In the wake of the dollar rally, EUR/USD bears tested an important support level of 1.0550 (the lower line of the Bollinger Bands indicator on the daily chart). Such price dynamics is quite justified: the next inflation report reflected a slowdown in the rate of decline in inflation in the United States. The basic PCE index, which is the most important inflation indicator for the Federal Reserve, turned out to be in the green zone. This was the last puzzle that formed the general picture. US inflation began to rise again, forcing the Fed to take retaliatory measures.

Powell's worries were justified

Back in early February, Fed Chairman Jerome Powell was concerned about the rate of decline in inflation. Although at that time only indirect inflation indicators signaled this. The "backbone" indices (CPI, PPI, PCE) reflected a downtrend.

Nevertheless, speaking at a conference at the Economic Club of Washington, Powell made it clear that the Fed will continue to raise the rate, "which has not yet reached an acceptable level to combat inflation" (while he did not specify what level of the rate is "acceptable"), and secondly, it will keep the policy at a restrictive level "for as long as it takes." At the same time, he then admitted that a disinflationary process had begun in some sectors of the US economy. But the market ignored this remark, focusing its attention on the hawkish stance. For example, Powell said that the rate of inflation may slow down to the target level only in 2024.

Already in mid-February, it became clear that Powell had not expressed his concern in vain. The published inflation reports reflected a slowdown in the rate of decline in inflation. The Consumer Price Index and the Producer Price Index were in the green zone, surprising many experts and market participants. To complete the picture, another report was needed, which would confirm (or vice versa – cast doubt on) the current trend. We are talking about the main index of Personal Consumption Expenditures (PCE). This is the most important inflation indicator, which is monitored by members of the Fed.

The puzzle has developed

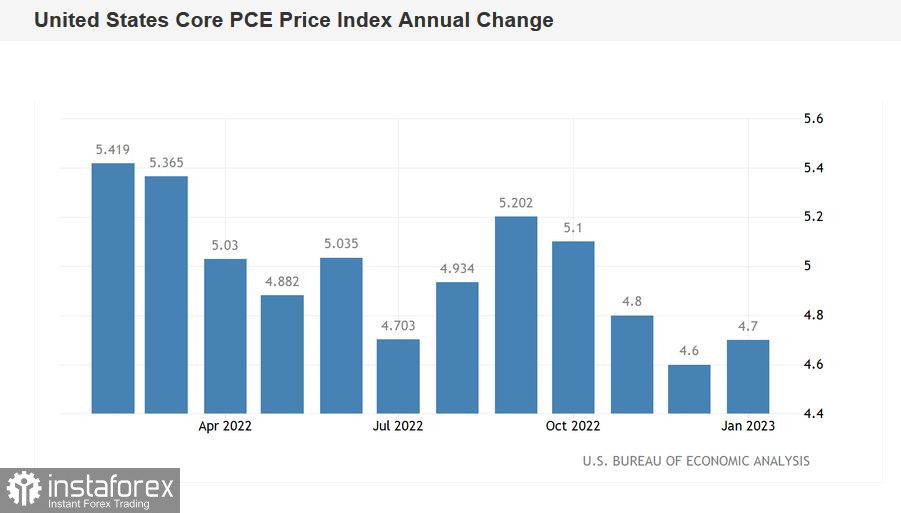

The report turned out to be on the side of dollar bulls. The PCE index not only found itself in the green zone, but also resumed its growth after a three-month consecutive decline (year-on-year). So, in September 2022, the indicator peaked at 5.2%. Then, amid the aggressive actions of the Fed, the index began to slide down, reaching 4.6% in December. And according to the forecasts of most experts, in January this was supposed to drop by 4.2%. But contrary to expectations, the PCE index rose to 4.7% (YoY). On a monthly basis, the indicator also came out in the green zone, rising to 0.6% (the highest growth rate since June last year).

The annual core PCE price index is the Fed's preferred measure of inflation. Even an "isolated" growth of this indicator can provide support to the U.S. currency. Whereas at the moment we can already talk about an established trend, given that other inflation indicators are in the green zone as well.

Market reaction

The US dollar strengthened its positions all over the market, though at the moment we cannot speak about a "refined" market reaction: the notorious Friday factor blurs the entire picture. Obviously, many traders do not risk holding short positions in the pair near 7-week lows ahead of the weekend. The bears are taking profits and that is why the pair cannot consolidate at the base of the 5th figure. Therefore, the consequences of the report will be revealed starting on Monday.

In general, take note that the bears received another advantage. The hawkish expectations regarding the Fed's future actions will increase again, and this factor will provide the greenback with background support. For instance, according to the CME FedWatch Tool, the probability of a 50-point rate hike at the March meeting is now 30%. A few weeks ago, such a scenario was not considered by the market at all in a serious way. Accordingly, hawkish expectations about further actions of the Fed are increasing. In particular, the probability of raising the rate to 5.75% by the results of the June meeting is now 25%.

Thus, the established fundamentals promote the development of the downtrend. The first target is 1.0500 (lower limit of the Kumo cloud on the daily chart). The main target is in the area of the 4th figure at 1.0450 (middle line of the Bollinger Bands indicator on the weekly chart).