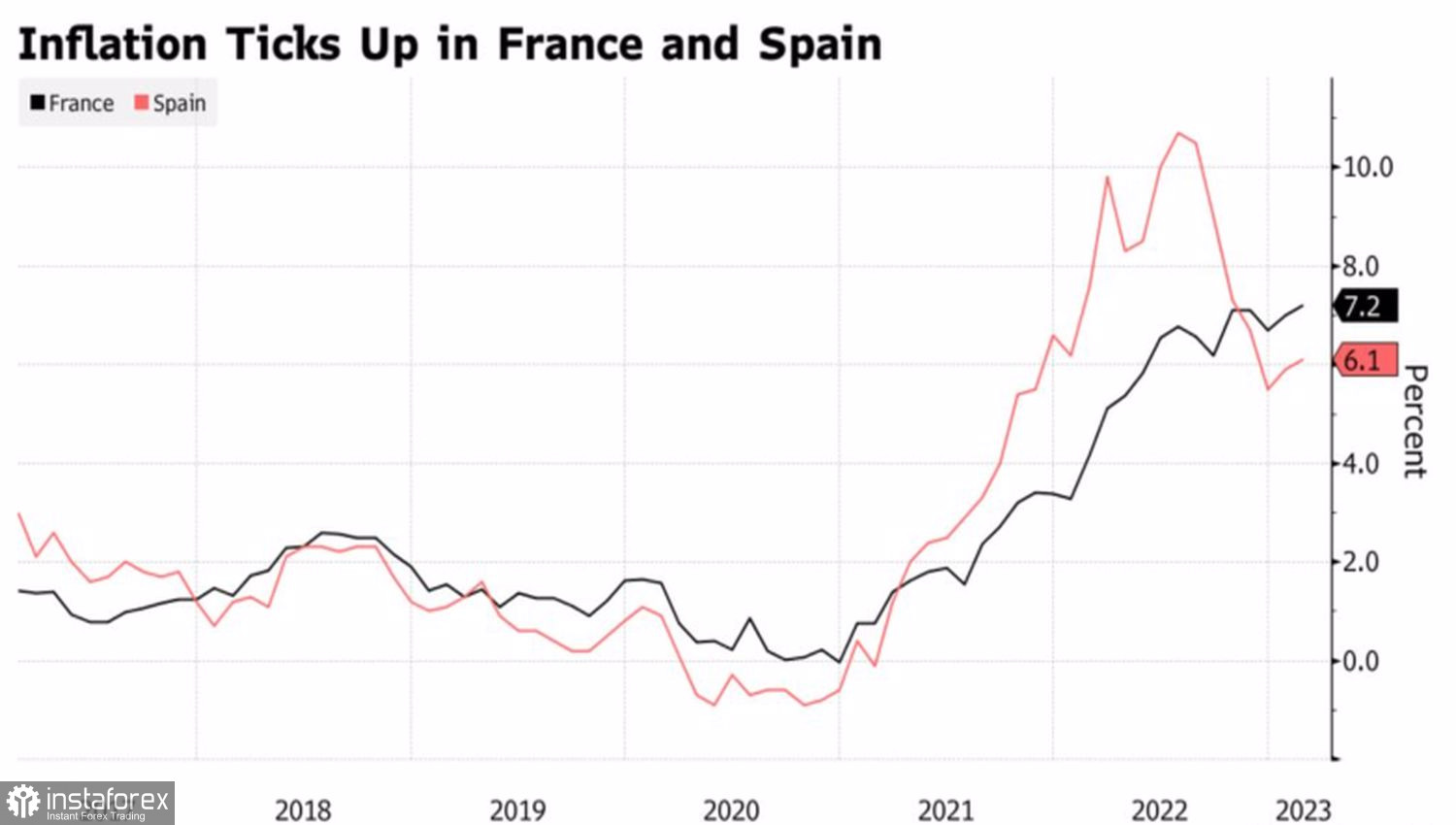

If the economy brings pleasant surprises, we should be prepared for inflation to rise faster than expected. French consumer prices soaring to a new all-time high of 7.2% and stronger Spanish CPI than Bloomberg had expected helped boost European bond yields and EURUSD back above 1.06.

Dynamics of inflation in France and Spain

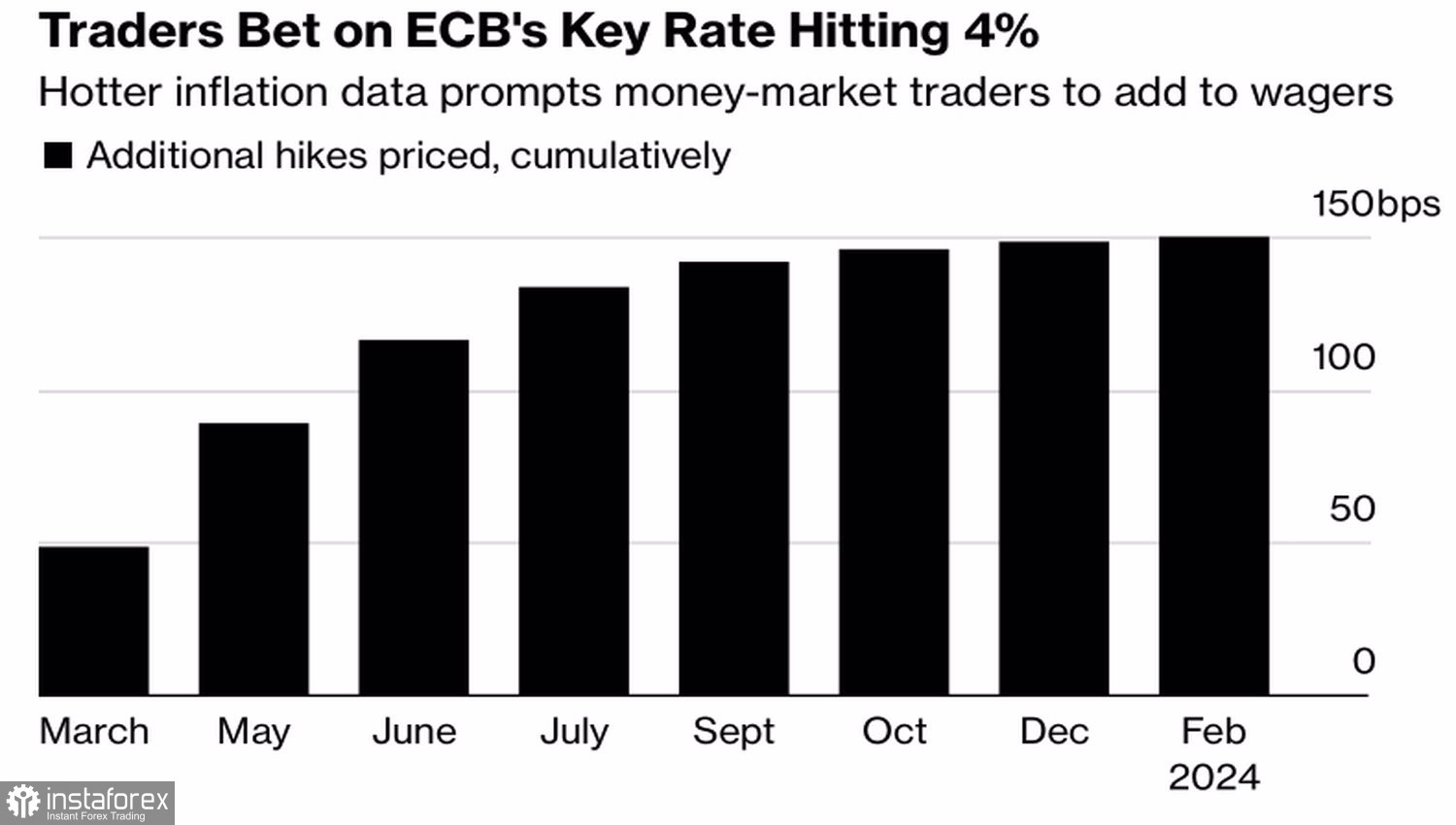

If the second and fourth eurozone economies face increased inflation pressures, there is a high risk of acceleration in European consumer prices as a whole. The ECB's work is far from done, and the deposit rate could rise to 4%. These are the expectations of the futures market, and they are higher than the 3.5% that took place in early February. Not surprisingly, even a centrist such as Chief Economist Philip Lane argues that borrowing costs will remain elevated for a long time.

The ECB's deposit rate has never reached a 4% high in its history. The current cycle of monetary policy tightening is the most aggressive since the introduction of the euro, but it does not do EURUSD much good.

Dynamics of expectations for the ECB deposit rate

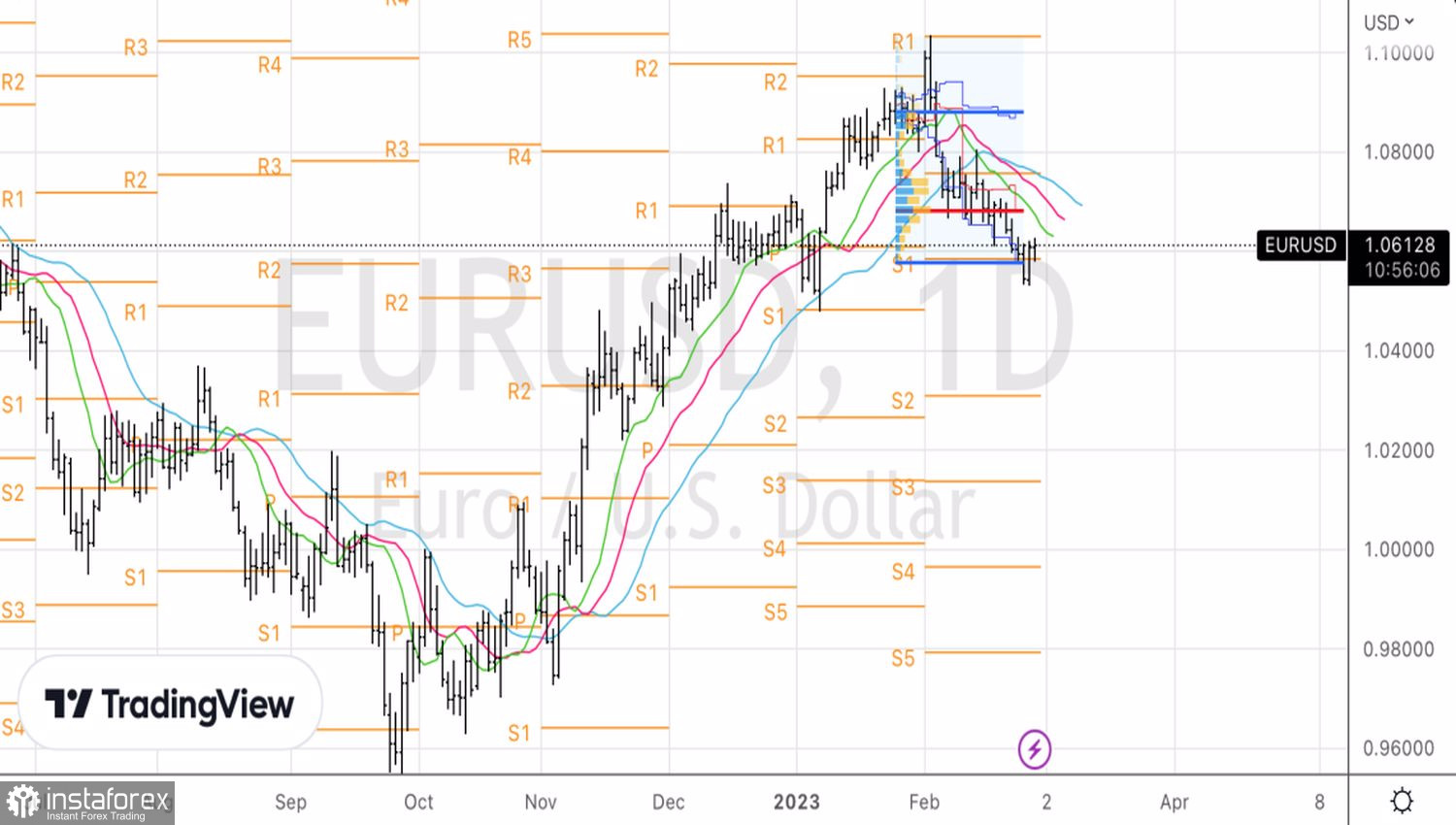

Investors are fixated on the return of U.S. dollar's trump cards to the game, including falling stock indices and rising U.S. bond yields. The Germans do not lose to them, with 2-year rates rising to the highest level since 2008, but this seems to be too little for EURUSD to be able to restore the upward trend. At best, the pair will enter a state of consolidation before the release of data on the U.S. labor market and inflation.

At worst, its decline will resume as ISM manufacturing PMI and services PMI statistics will be released soon. Another batch of pleasant surprises – and stock indices will resume falling. At the same time, the deterioration of global risk appetite will lead to the strengthening of the dollar as a safe-haven currency.

The fact is that the stock market perceives good news from the economy as bad for itself. Investors look at events through the prism of the Fed's monetary policy. Strong statistics increase the chances of raising the federal funds rate to 5.5% and possibly up to 6%. On the contrary, weak data reduces this probability. For the S&P 500, rising rates, including bond yields, are an extremely unfavorable event. Rising borrowing costs increase costs and prevent stocks from rising.

Thus, the euro is fighting not only with the Fed, which is set to continue the cycle of monetary policy tightening, but also with U.S. stock indices. And with such a balance of power, EURUSD has more chances to lose than to win. Although in the medium term, everything may change.

Technically, the return of the euro to the limits of the fair value range of $1.0575–$1.0885 is a good sign for the bulls. However, the rebound from resistance at 1.0675 and 1.069 should be used to sell EURUSD.