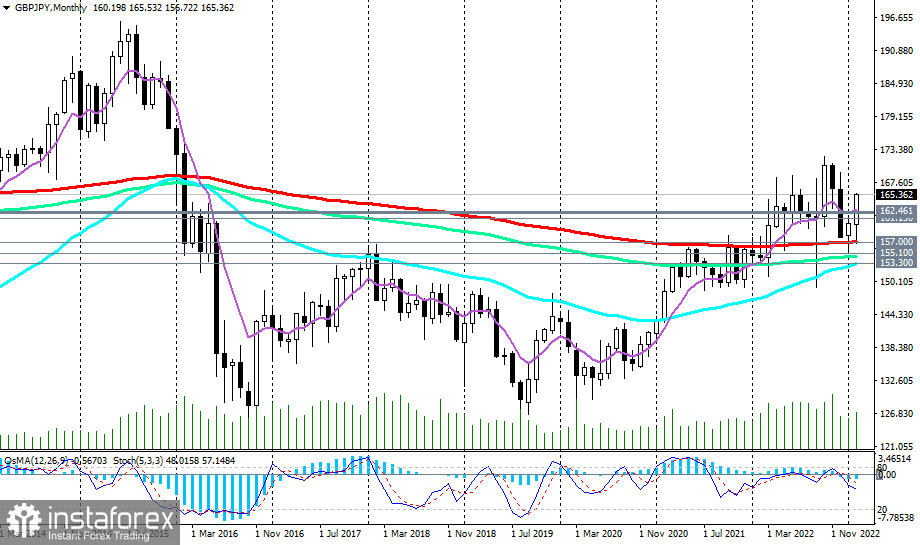

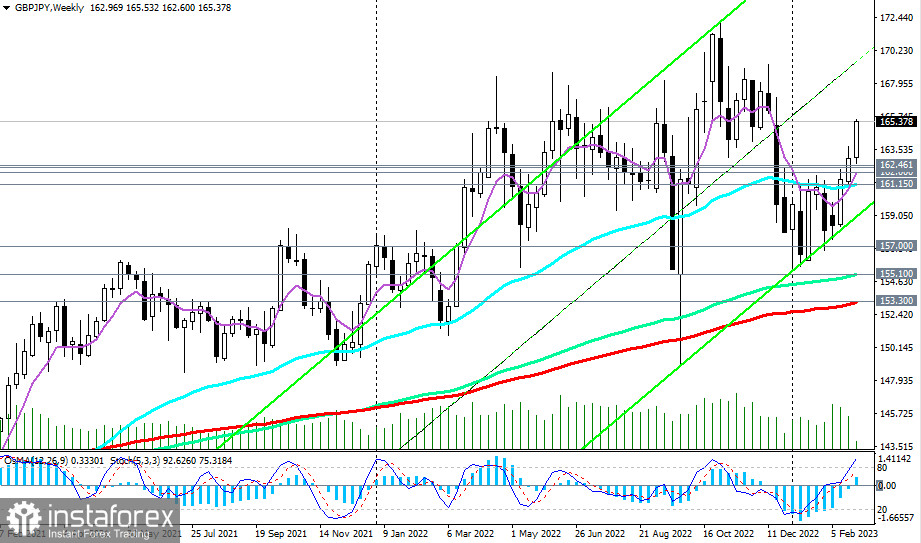

The yen is weakening amid comments of incoming Bank of Japan Governor Kazuo Ueda, while the pound is strengthening in the major cross pairs. That is accordingly true for the GBP/JPY, which as of writing, was trading above 165.30, having strengthened by 1.5% just in the last two incomplete trading days and has been in the bull market zone for two years since the breakdown of 142.00.

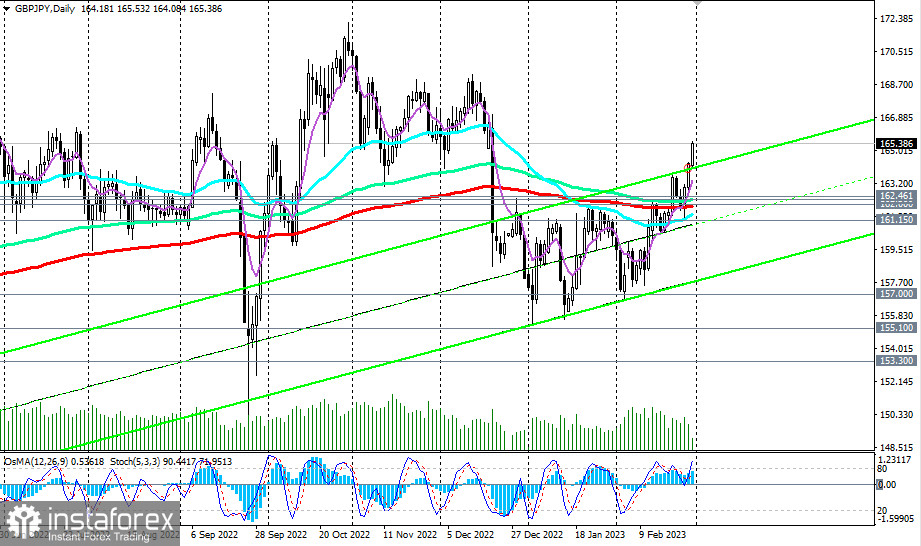

Today, GBP/JPY continued to rise, trading above the key support levels 162.00 (200 EMA on the daily chart), 157.00 (200 EMA on the monthly chart), 153.30 (200 EMA on the weekly chart).

Technical indicators OsMA and Stochastic on the daily and weekly charts are also on the buyers' side, while a strong bullish momentum pushes the pair towards last year's highs above 172.00.

In an alternative scenario, the first signal to sell may be a breakdown of the local low 165.05, and today's local low at 164.08. In the meantime, long positions remain preferable, short positions are considered only as a short-term alternative.

Support levels: 164.00, 163.00, 162.46, 162.30, 162.00, 161.15, 157.00

Resistance levels: 166.00, 167.00, 168.00, 169.00, 170.00, 171.00

Trading scenarios

Sell Stop 164.90. Stop-Loss 165.60. Take-Profit 164.00, 163.00, 162.46, 162.30, 162.00, 161.15, 157.00

Buy on the market, Buy Stop 165.60. Stop-Loss 164.90. Take-Profit166.00, 167.00, 168.00, 169.00, 170.00, 171.00