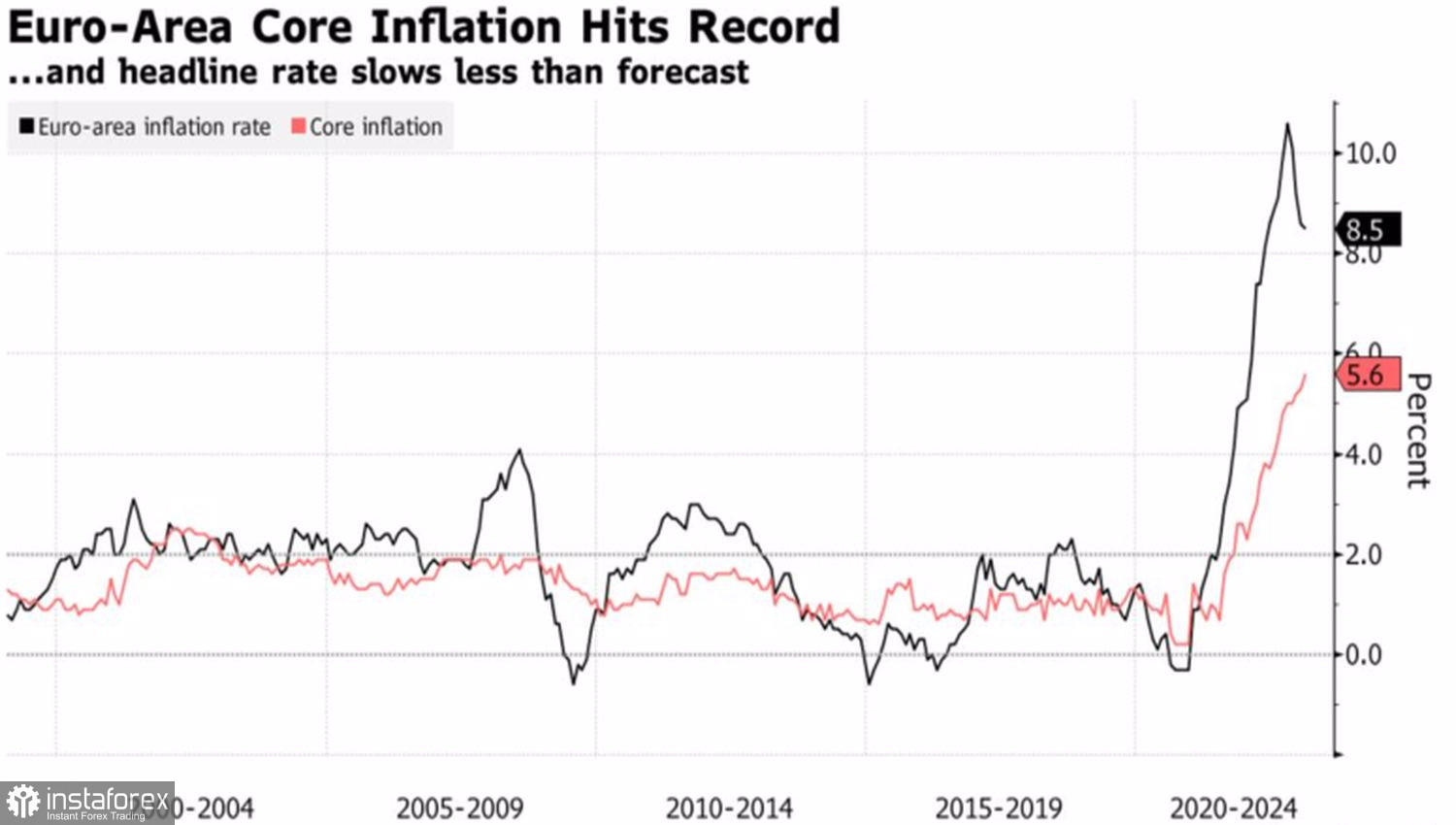

Was it a surprise that inflation in the eurozone rose faster in February? I don't think so. After consumer prices in France, Spain, and Germany rose more than Bloomberg experts expected, it was easy to guess that the currency bloc, as a whole, would also face a high CPI. And so it did: the figure rose 8.5%, exceeding the consensus estimate of 8.3%. Moreover, core inflation set a new record of 5.6%, which removes questions about the ECB's March deposit rate hike of 50 bps to 3%. Nevertheless EURUSD took a lukewarm attitude to the important release.

Dynamics of European inflation

Obviously, investors have been waiting for this. In addition, the euro has already had a sad experience when its rally in the European session, thanks to strong statistics on Spanish and French inflation at auction on February 28 and the German CPI at auction on March 1, was interrupted and reversed at the American session due to the fall of U.S. stock indices. For the third time, the bulls had no desire to step on the same rake on EURUSD, so they decided not to get into trouble.

Euro fans were not hooked by the "hawkish" speeches of the members of the Governing Council. Bundesbank President Joachim Nagel said it would be a terrible mistake to stop or slow down the cycle of tightening monetary policy, and after raising the rate by 50 bps in March, the same decisive steps will be required. ECB President Christine Lagarde considers an increase in the cost of borrowing from 2.5% to 3% at the next meeting of the Governing Council a necessary and very likely decision and argues that the European Central Bank will continue to follow this path. Bank of France Governor Francois Villeroy de Galhau predicts that rates will peak in the summer.

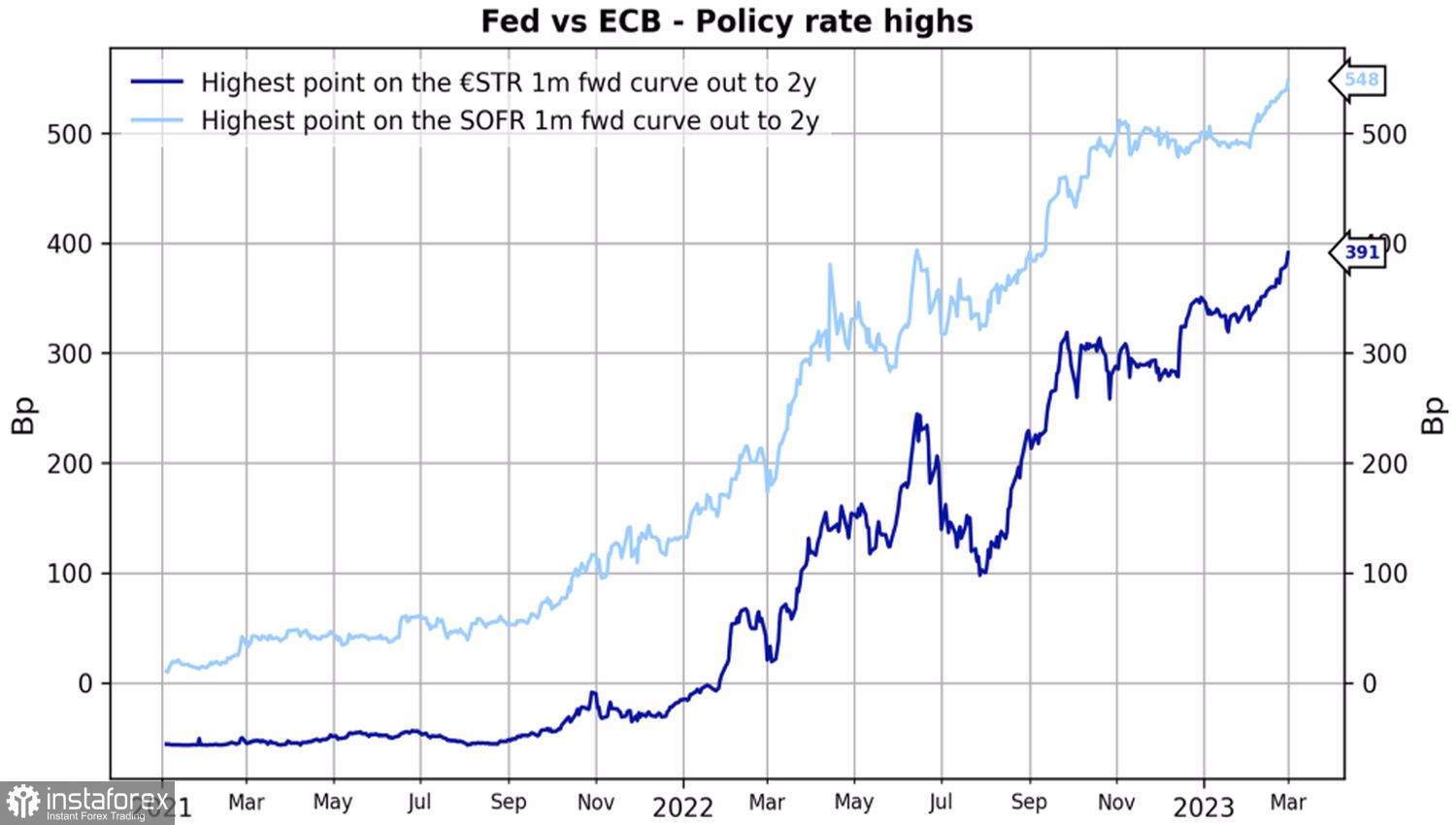

It is not surprising that against this background, the futures market raised the expected ceiling to 4%. It is still 150 bps away, which is 75 bps more than before the peak of the federal funds rate.

Dynamics of the expected peaks of the Fed and ECB rates

Thus, the resilience of the eurozone economy in the face of the armed conflict in Ukraine and the energy crisis has turned to sticky inflation at elevated levels. This requires the ECB to be decisive. And its hawkish fervor is likely to persist throughout the year, which will serve the euro well.

Another thing is that consumer prices in the U.S. do not want to slow down, and the Fed is forced to act aggressively. This circumstance pushes up the Treasury yields and strengthens the demand for the dollar. How will it all end? I think sooner or later the labor markets on both sides of the Atlantic will start to cool down. And the U.S. will be the first to do this, which will bring EURUSD to 1.12 by the end of 2023.

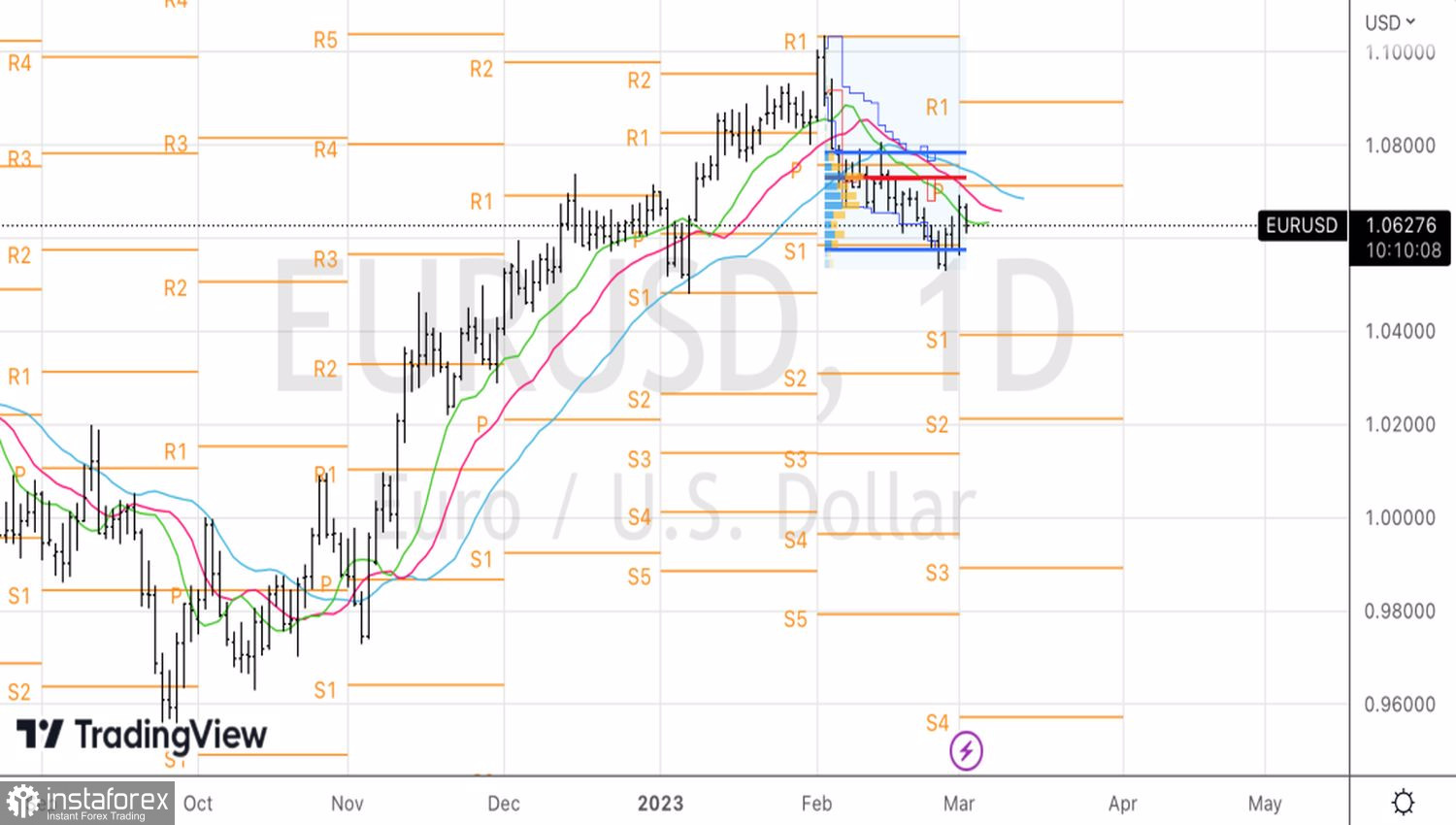

Technically, the strategy of selling the euro on growth works out well. If the major currency pair closes the day below dynamic resistance in the form of a green moving average, then short positions can be built up from its low. The targets for selling EURUSD are 1.0575 and 1.0510.