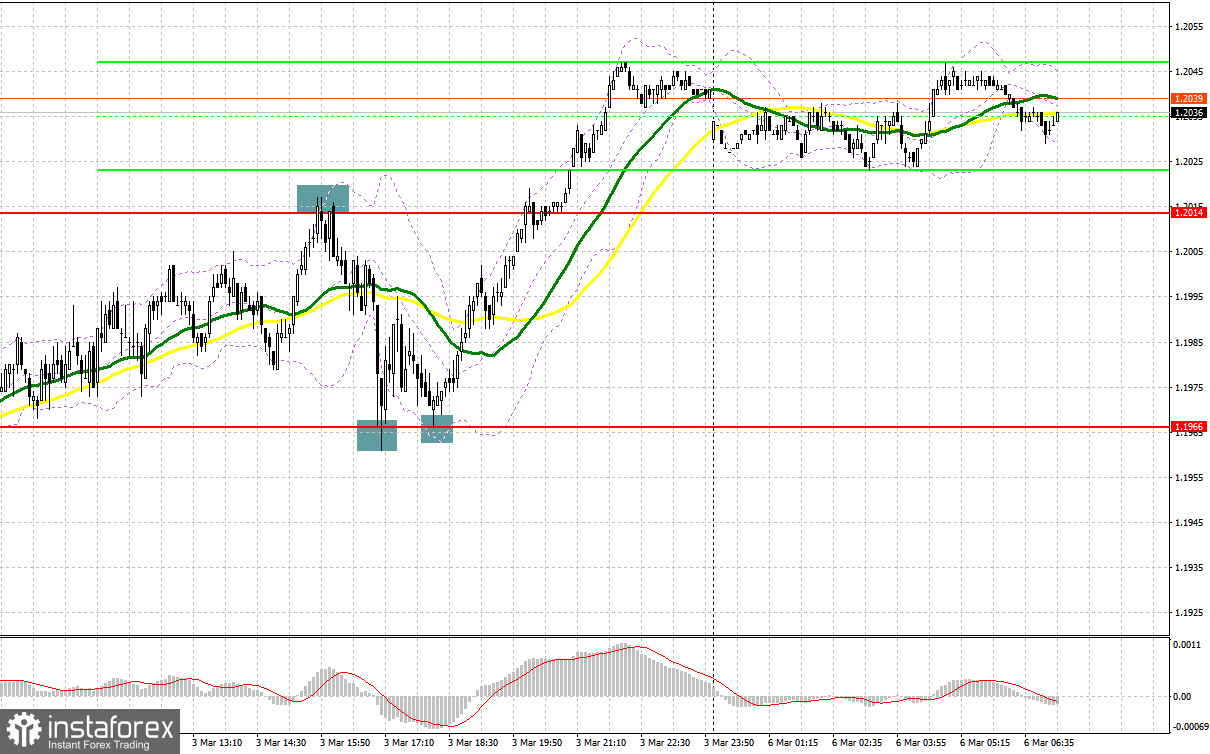

Last Friday, there were several entry points. Now, let's look at the 5-minute chart and figure out what actually happened. In my morning article, I turned your attention to 1.1994 and recommended making decisions with this level in focus. A rise and a false breakout of this level amid positive PMI data led to a sell signal for the pound sterling, which resulted in a downward movement of more than 45 pips. The test of the support level of 1.1966 in the afternoon and a false breakout of this level allowed the bulls to regain the upper hand. Hence, a buy signal appeared. The pair climbed by about 40 pips to 1.2014.

When to open long positions on GBP/USD:

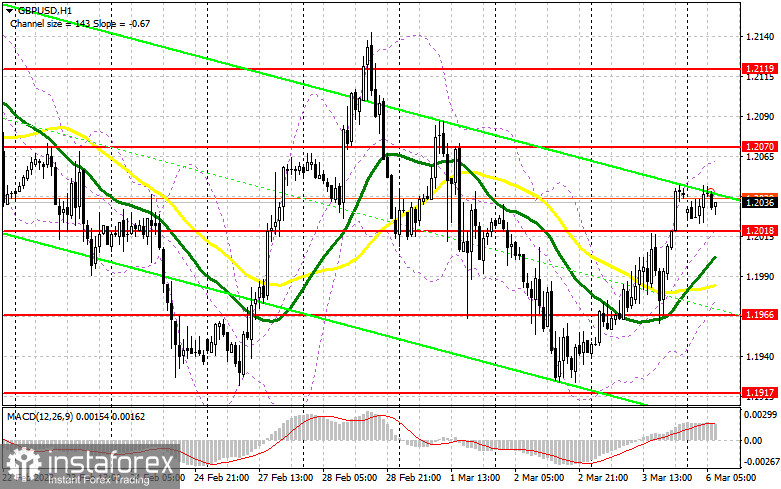

Today, bulls need to defend the support level of 1.2018, formed last Friday. If the IHS Markit/CIPS UK Manufacturing PMI turns out to be positive, they will be able to do so. A false breakout of 1.2018 could give a new buy signal within an upward correction. The pair is likely to approach 1.2070. Only after consolidation and a downward test of this level, GBP/USD is likely to jump to a high of 1.2119. A rise above this level could push the pair to 1.2177 where I recommend locking in profits. If the bulls fail to protect 1.2018, the pressure on the pound sterling that persisted over the past week will only increase. Below this level, the moving averages are benefiting the bulls. In this case, I advise you not to rush into purchases and open long positions near the support level of 1.1966 only after a false breakout. You could buy GBP/USD at a bounce from 1.1917, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

To dominate the market and trigger a sharper downward movement, bears need to defend the resistance level of 1.2070. They also should push the pair back to 1.2018. A jump and a false breakout of 1.2070 amid strong PMI data will generate an excellent sell signal. GBP/USD may approach 1.2018. A breakout and an upward test of this level will undermine further upward correction and bolster the bearish sentiment. In this case, large sellers are sure to enter the market. It may provide new entry points into short positions with a likelihood of a fall to 1.1966. A more distant target level will be a monthly low of 1.1917. If the pair touches this level it will significantly affect the trajectory of the pound sterling for this month. At this level, I recommend locking in profits. If GBP/USD rises and bears show no energy at 1.2070, the bulls will assert strength. In this case, the bears will retreat and only a false breakout of the resistance level of 1.2119 will create an entry point into short positions. If bears fail to defend this level, you could sell GBP/USD at a bounce from 1.2177, keeping in mind a downward intraday correction of 30-35 pips.

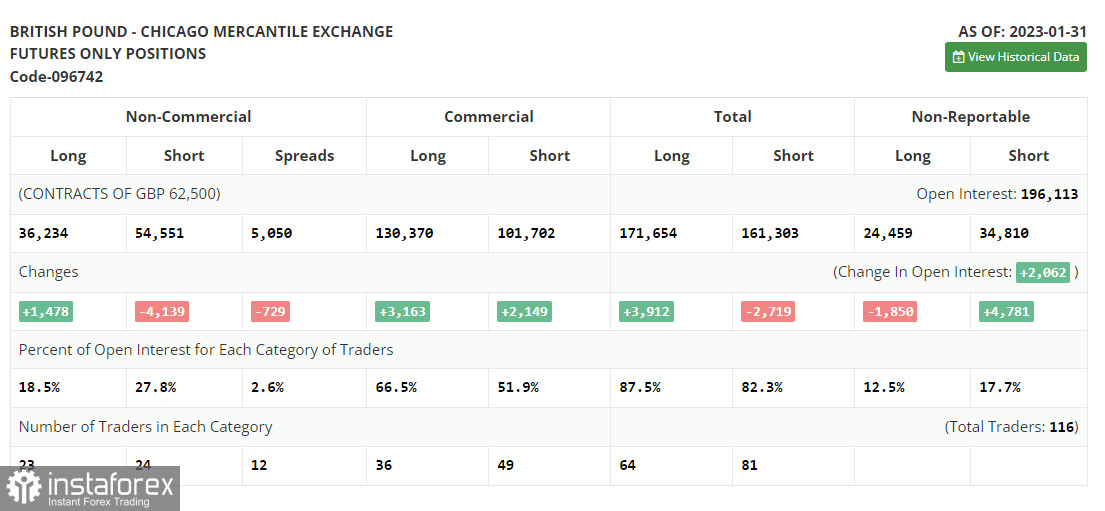

COT report

The COT report for January 31 logged an increase in long positions and a drop in short ones. Apparently, traders were betting on further interest rate hikes by the Bank of England. Therefore, they decided to exit the market before the meeting. However, this COT report is not relevant now. After the cyberattack on the CFTC, one should wait for fresh stats. There are no important economic data for the US economy this week, with the exception of a couple of reports. The pressure on risky assets may ease slightly, which could lead to an upward correction of the pound sterling. The latest COT report revealed that short non-commercial positions decreased by 4,139 to 54,551, while long non-commercial positions rose by 1,478 to 36,234. Thus, the negative delta of the non-commercial net position declined to -18,317 versus -23,934 a week earlier. The weekly closing price dips to 1.2333 against 1.2350.

Indicators' signals:

Trading is carried out above the 30 and 50 daily moving averages, which indicates bulls' attempt to regain control.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD climbs, the indicator's upper border at 1.2070 will serve as resistance. In case of a decline, the indicator's lower border at 1.1980 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.