Details of the economic calendar on March 3

The final index of business activity in the services sector of the Eurozone, the United Kingdom, and the United States was released.

Details of PMI statistics:

Eurozone Services PMI rose from 50.8 to 52.7 against the forecast of 53.0. Its Composite PMI rose from 50.3 to 52.0, with estimates of 52.3.

United Kingdom Services PMI rose from 48.7 to 53.5, compared to a forecast of 53.3. Its Composite PMI rose from 48.5 to 53.1.

United States Services PMI rose from 46.8 to 50.6. Its Composite PMI rose from 46.8 to 50.1.

The dollar reacted not quite typical to the positive statistics.

The European Union Producer Price Index (PPI) was also released, which fell by 2.8% in January from 1.1% in the previous month, according to Eurostat.

In annual terms, prices rose by 15% in the month before last, but there is a decline in the growth rate.

Analysis of trading charts from March 3

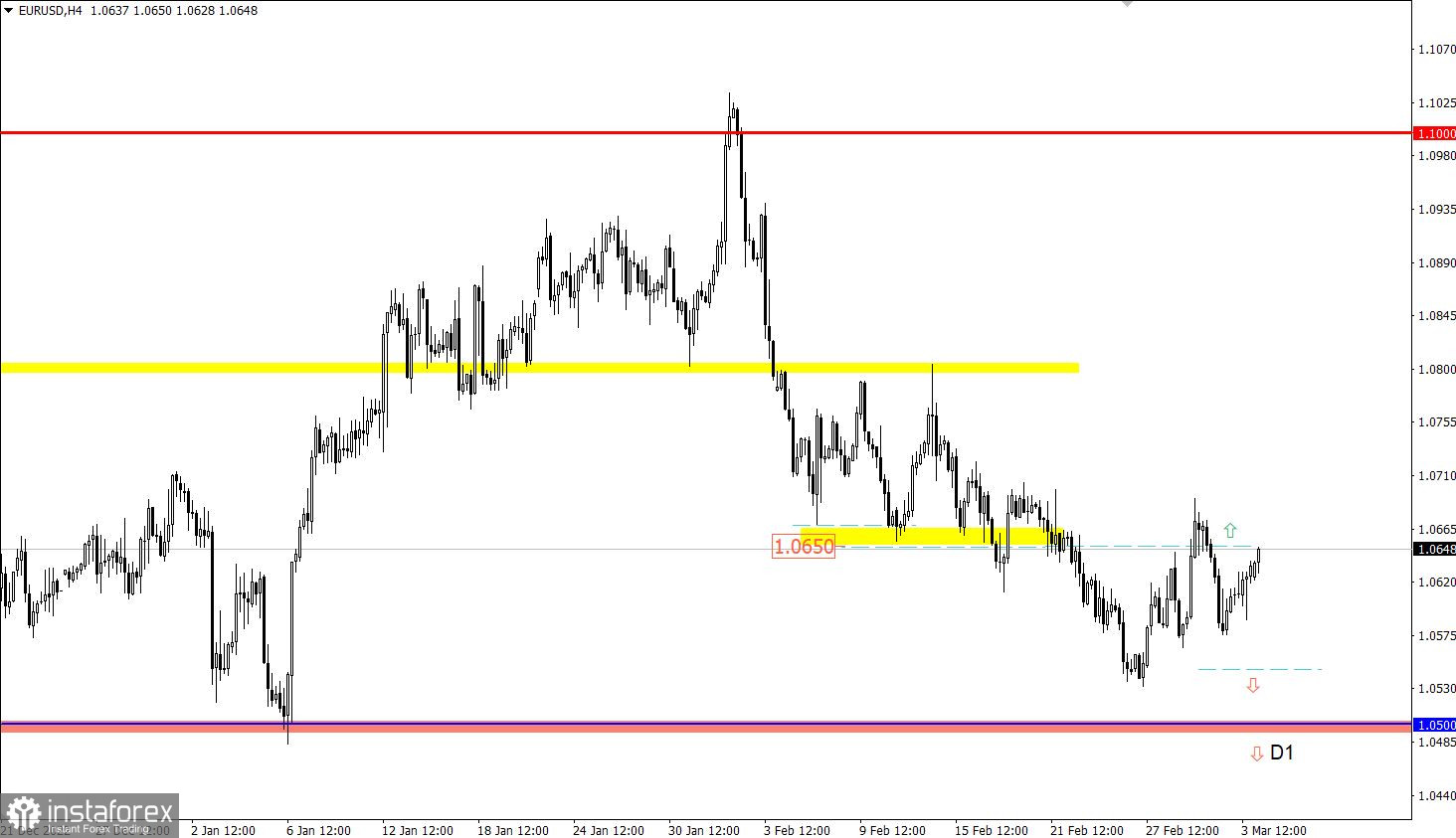

EUR/USD went up, which led to the return of the price to the value of 1.0650. This indicates that the market participants are maintaining an upward trend.

GBP/USD also traded upward after rebounding from the bottom of the sideways channel at 1.1920/1.2150. This increased the volume of long positions and returned the price above 1.2000.

Economic calendar for March 6

Although Monday usually has an empty macroeconomic calendar, this time there will be a number of important releases. First, the UK construction PMI for February, which may rise from 48.4 to 49.1. Then the data on EU retail sales, which may grow by 1% over January. This means we will see a slowdown in the rate of decline from -2.8% to -1.8% year-on-year.

During the U.S. trading session, data on industrial production will be published and based on forecasts, a decline is expected.

Time targeting:

UK Construction PMI – 09:30 UTC

EU Retail Sales – 10:00 UTC

US Industrial Production – 15:00 UTC

EUR/USD trading plan for March 6

If the euro price is stable above 1.0650, a further increase in the volume of long positions on the currency pair is possible. This, in turn, may lead to an update of the local high of last week and become a technical signal for the recovery of the euro after the February decline.

If the price returns below 1.0550, traders will consider a downward trend scenario, and there is a possibility of updating the local low of the current decline.

GBP/USD trading plan for March 6

Judging by the price fluctuations, a flat still persists in the market. If the price holds above the level of 1.2050, this may lead to strengthening of long positions and opening the way to the upper border at 1.2150.

However, if the growth rate slows down and the quote drops below 1.1950, then there is a risk of a breakdown of the lower flat line at 1.1920.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.