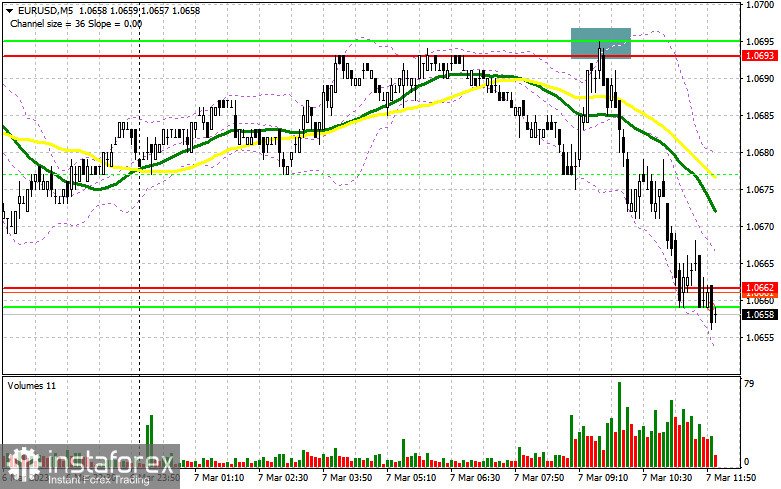

In my morning forecast, I focused on the level of 1.0690 and offered recommendations based on it for market entry decisions. Let's take a look at the 5-minute chart and see what happened. Growth and the emergence of a false breakout at this price point provided a great entry point for selling the pound, which brought about a rapid decline of more than 30 points. The technical picture partially changed in the afternoon.

If you want to trade long positions on EUR/USD, you will need:

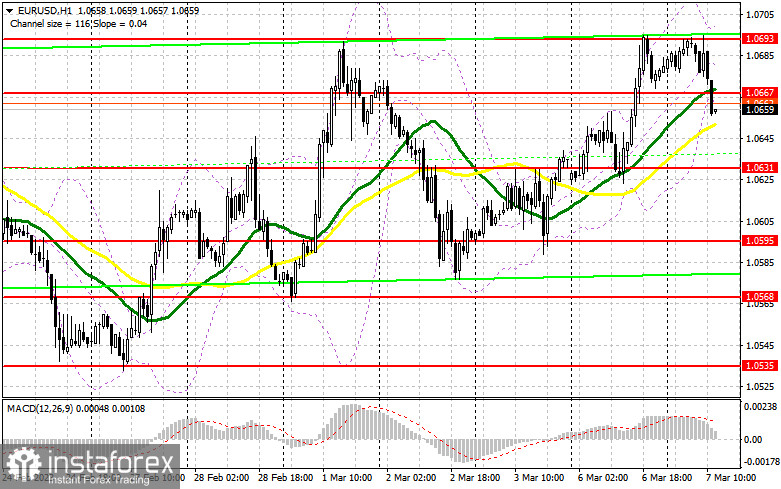

There will be a lot of focus on the statements made by Jerome Powell, chairman of the Federal Reserve System, who will adamantly support the need to continue fighting against the high level of inflation, the risk of which has greatly increased this spring. Any indications of a retreat from the path of a softer monetary policy and a return to the previous rate of interest rate hikes, namely 0.5% and 0.75%, will result in a strengthening of the US dollar against the euro. We will start with Powell's statements because there won't be any additional statistics in the afternoon. If the pair stays under pressure, the best scenario for the American session is to protect the nearest support of 1.0631, which was formed by yesterday's results. A new intermediate resistance level of 1.0667 will serve as the target for the recovery, and from this level, in my opinion, speculative sellers will start to enter the market. With a repeated movement to 1.0693, where bulls will once more have a difficult time, a breakout and top-down test of this area against the backdrop of dismal US data and Powell's dovish rhetoric create another entry point for building up long positions. The breakdown of 1.0693 will hit the bears' stop orders, causing the market to change and providing an extra signal with the probability of going to 1.0731, where I will fix profits. If this level is tested, it will signal the beginning of a new bull market. If the EUR/USD pair falls and there are no buyers at 1.0631, pressure will develop again, and a break of this level will cause a drop to the next support zone of 1.0595. Only the development of a false collapse will provide a signal to purchase the euro. I will immediately open long positions for a rebound from the low of 1.0568, or even lower - around 1.0535 - with the target of a 30-35 point upward reversal within the day.

If you want to trade short positions on EUR/USD, you'll need:

The sellers were very clear that anything beyond 1.0690 is pointless. All now depends on Jerome Powell, chairman of the Federal Reserve, speaking before the Senate. The euro fell in value in the first half of the day for the same reason. In the second half of the day, sales will be watched only after growth and the formation of a false breakdown in the area of a new resistance of 1.0667, where the moving averages are located, playing on the sellers' side. All of this will cause short positions to be opened to reduce to the area of 1.0631. The market will turn bearish again if this range is broken and reversed, forming a second sell signal with an exit at 1.0595. A more dramatic decrease to the level of 1.0568, where I will take profit, will result from fixing below this range. If the EUR/USD rises during the American session and there are no bears at 1.0667, which is possible given that this is an intermediate resistance level, I recommend postponing short positions until the level of 1.0693. By analogy with what I described earlier, you can only sell there after an unsuccessful consolidation. In anticipation of a rebound from the high of 1.0731, I will open short options right away with a 30- to 35-point corrective in mind.

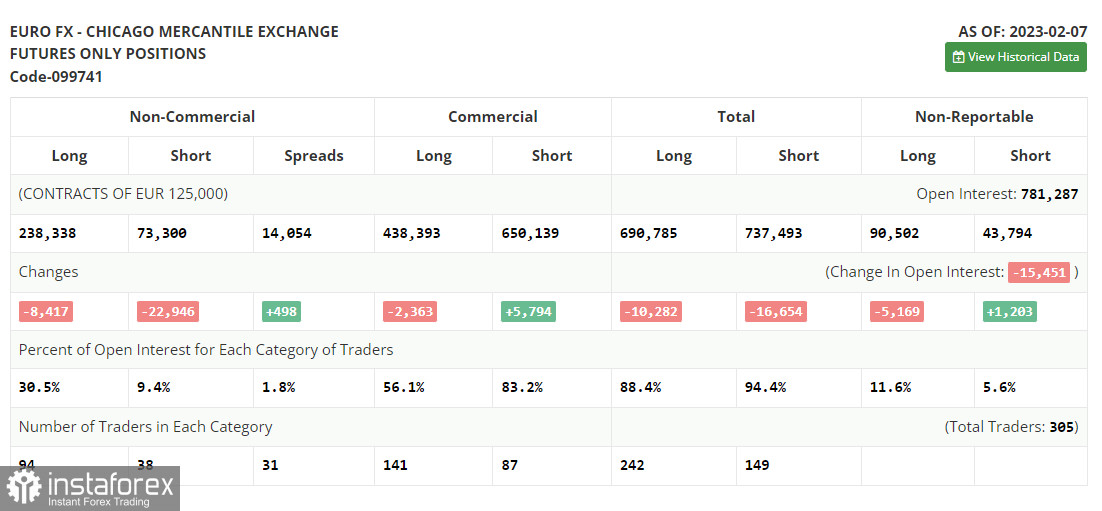

Long and short positions were down in the COT report (Commitment of Traders) for February 7. This undoubtedly took place after the Federal Reserve System and the European Central Bank decided on interest rates. However, it should be noted that these data are of no importance right now because statistics are only just starting to catch up following the cyberattack on the CFTC and the information from a month ago is not very pertinent right now. They will wait for new reports to be released before relying on more recent statistics. We are anticipating Fed Chairman Jerome Powell's significant speech in the near future, which could influence the direction of the dollar for the next month up until the Fed meeting at the end of March. Hawkish remarks on inflation and monetary policy will increase demand for the dollar and cause the euro to decline. The demand for the dollar will likely decline further if we don't hear anything new. According to the COT data, the number of long non-commercial positions fell by 8,417 to 238,338 while the number of short non-commercial positions fell by 22,946 to 73,300. The total non-commercial net position rose to 165,038 from 150,509 after the week. The weekly closing price fell from 1.0893 to 1.0742.

Signals from indicators

Moving Averages

Trade is taking place below the 30 and 50-day moving averages, which suggests that the bears are trying to retake the lead.

Notably, the author considers the time and prices of moving averages on the hourly chart H1 and departs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's upper bound, or approximately 1.0700, will serve as resistance in the event of an increase.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.