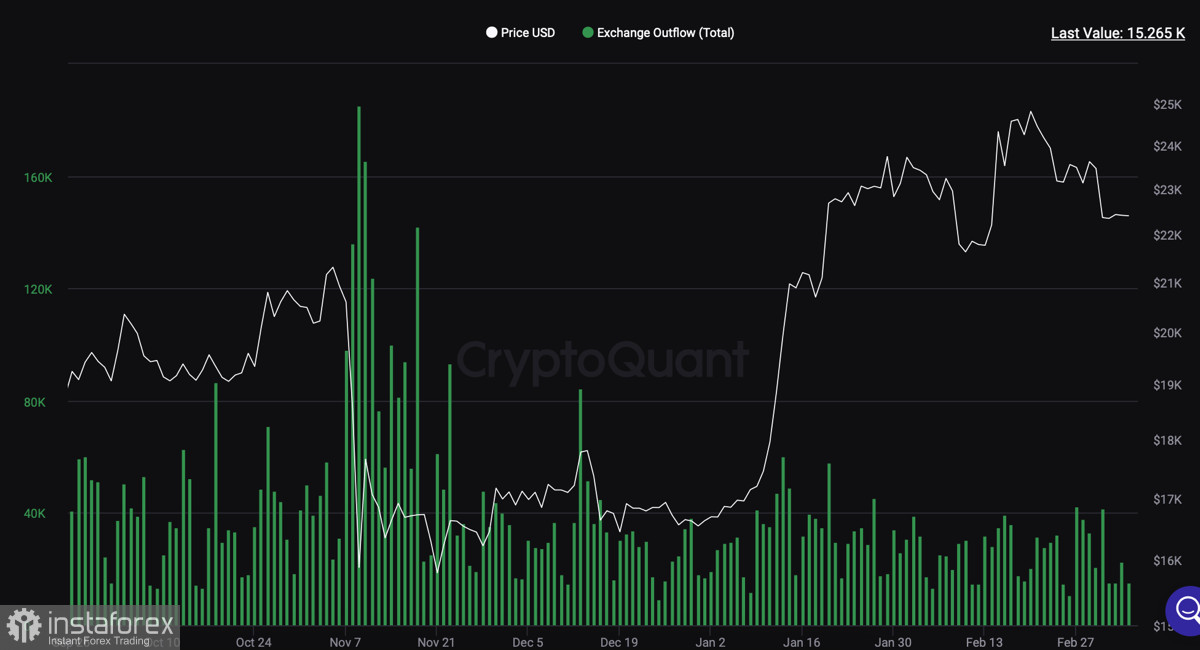

With the onset of a new trading week, the situation on the cryptocurrency market has not changed. The price continues its consolidation movement near the $22.5k level, while trading activity remains at a low level.

Market sentiment continues to worsen, which directly affects the price of Bitcoin. Over the past month, investors have transferred more than 22,000 BTC to crypto exchanges, which is equivalent to $505 million. Additional volumes of cryptocurrencies in the market complicate the strong price movement of cryptocurrencies.

At the same time, CryptoQuant experts note that, despite the difficult period, the fundamental value of the cryptocurrency is beyond doubt. Over 60% of the BTC supply is controlled by long-term investors, which is a bullish fundamental signal.

However, in the short term, the situation remains tense as Bitcoin continues to show dependence on other high-risk assets. This adds uncertainty to the forecasts for the price movement of the cryptocurrency, and as of writing, BTC can go both up and down.

Fundamental Factors

Bloomberg analysts believe that the bear market for cryptocurrencies is not over yet, and therefore it is necessary to allow the possibility of a second decline beyond the $20k level. It also became known that the majority of Fed members are in favor of further rate hikes.

It is worth recalling that, in addition to raising the rate, the regulator withdraws more than $80 billion from the economy every month. This is equivalent to a 0.5%–0.75% rate increase. The combination of actions within the framework of the Fed's aggressive monetary policy leads to a general decrease in investment activity.

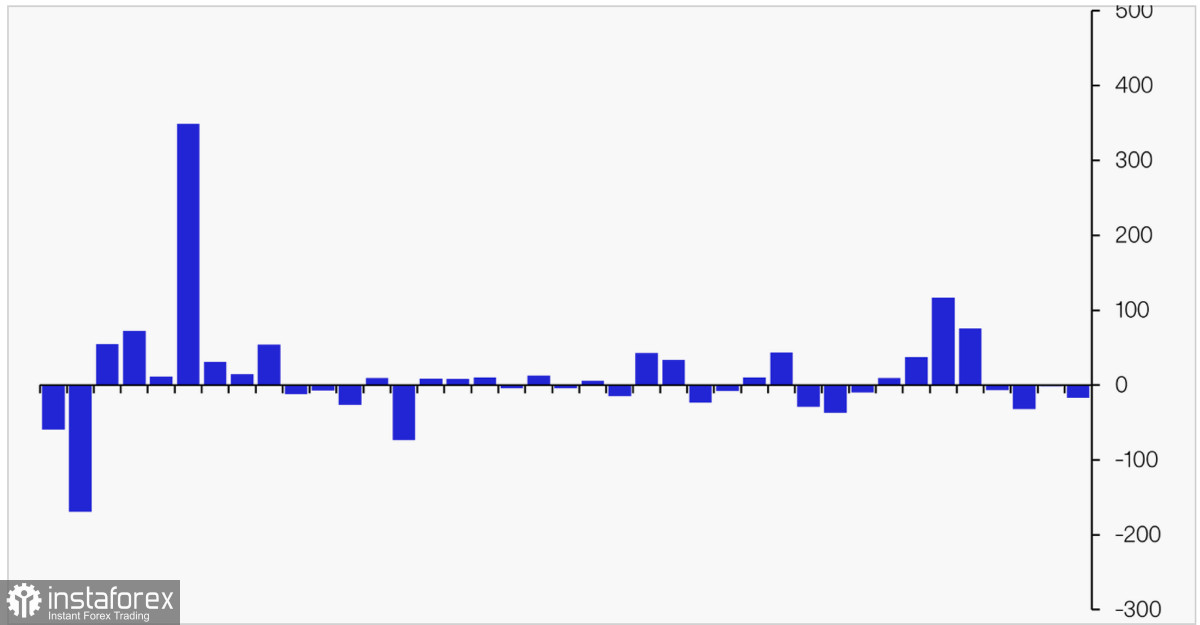

Increased liquidity withdrawals have led to continued momentum in crypto fund outflows. According to CoinShares, investors withdrew more than $17 million from crypto funds last week.

BTC/USD Analysis

At the end of March 6, Bitcoin's price movement was minimal. The asset continues to consolidate near the $24.4k level, but the process is slow due to low trading activity. However, as we have repeatedly seen, consolidation is followed by a strong price movement.

As of March 7, Bitcoin has a chance to go to $23k. However, for this, the cryptocurrency needs to make a full-fledged bullish breakout of the $22.8k–$23k area, which is a key resistance zone at the current stage of the price movement.

Also near the $22.8k–$23k area is the global 0.382 Fibo level, and now this line serves as a resistance zone. Therefore, the asset needs large volumes to break through the mark and gain a foothold above $23k.

At the same time, Bitcoin is at risk of continuing its downward movement and reaching the $21.2k–$21.6k support zone, where there was a massive buying of longs. Previously, the bears will also need to make a full breakdown of $22k, where we have already seen a local buyout.

Results

Bitcoin continues to consolidate near the $22.4k level. The asset can follow either direction, but when the minimum trading volume is reached, we should expect an impulsive price move. At the same time, the asset continues to move within the $22k–$24k area, and hence the probability of a move to the upper boundary is higher than a retest of the lower boundary of the fluctuation area.