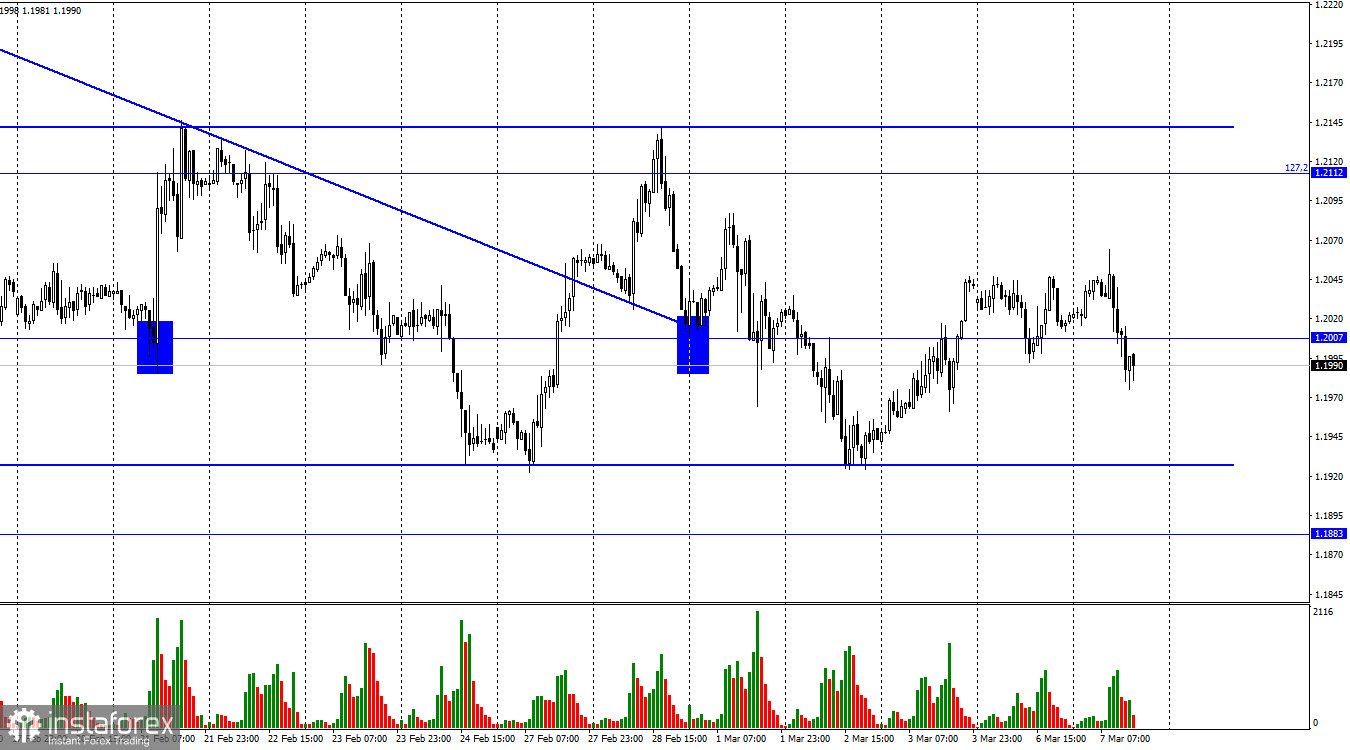

The hourly chart shows that the GBP/USD pair was unchanged throughout Monday. The pair was moving horizontally on Monday, and there is currently a horizontal corridor. Today, a reversal was made in the US dollar's favor, and a new process of falling in the direction of the corridor's bottom line started. The likelihood of the pair's rate falling further, towards the level of 1.1883 and below, will grow if it is fixed below that level. A rebound from the line will favor the British pound, allowing for some growth in the direction of the corrective level of 127.2% (1.2112).

Catherine Mann, one of the Bank of England's governors, has already delivered a speech today. As I've already stated, the time for the central banks to release the conclusions of their second meetings this year is slowly coming. In the case of the British regulator, it is currently uncertain even how much the rate will be raised this month. Considering that inflation is still at a very high level, most likely at 0.50 percent. Catherine Mann stated in her speech that "more should be done with the stakes." There was undoubtedly a greater increase in interest rates, but now everything rests on the Fed's actions as well as those of the Bank of England. If Jerome Powell makes it clear today that interest rates will continue to increase and that the Fed is not concerned about a future recession, the US currency will get a new trump card.

The persistence of core inflation concerns Catherine Mann as well, and the EU and US central banks have been fairly "tough" on PEPP. We can infer from this that the Bank of England won't slow down anytime soon. For the pound, though, none of this will matter unless it exits the horizontal corridor. It has complete freedom of movement inside the corridor. Today, a decline was observed that was not related to the information background (although it's possible that traders raised the dollar in response to Powell's evening statement). The growth could be the same tomorrow.

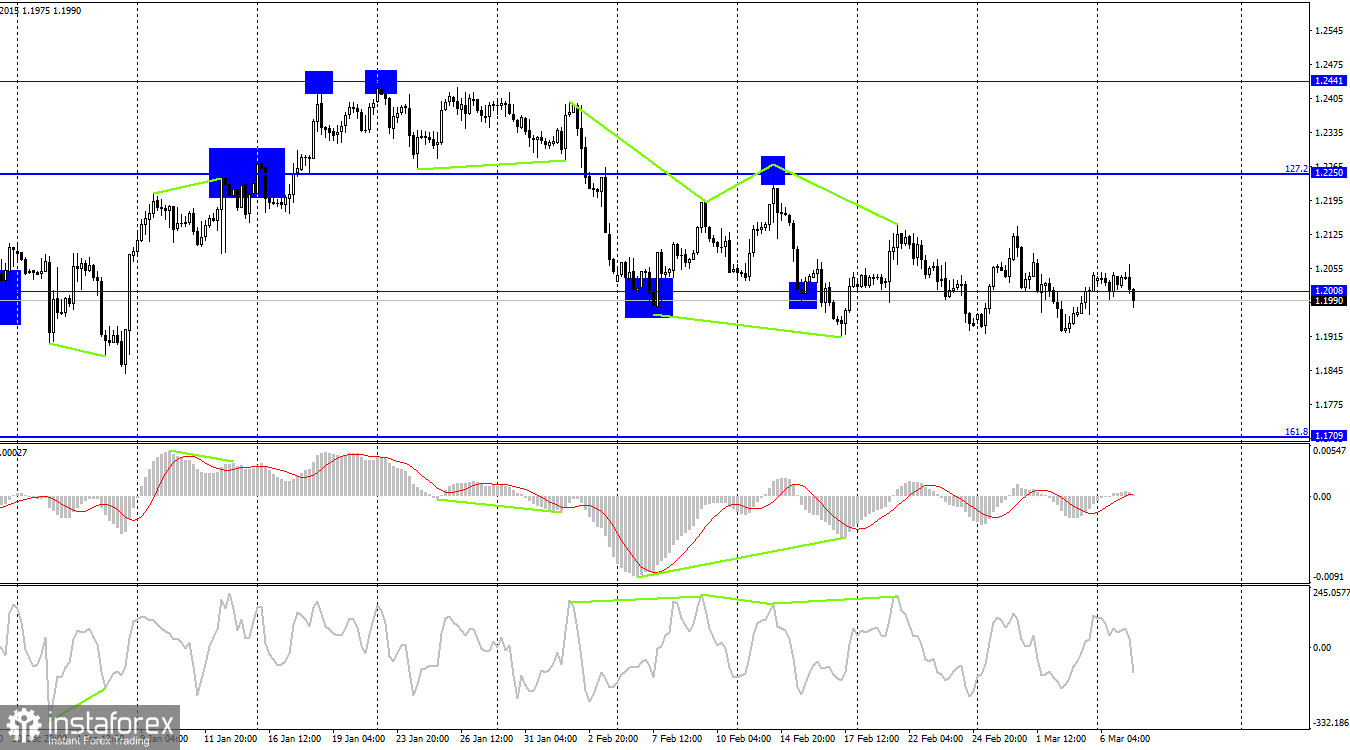

On the 4-hour chart, the pair made a new reversal in favor of the US dollar, but lately, market reversals have become a relatively common occurrence. The 1.2008 level is rarely noticed by traders. There are no new divergences in the making. No trend line or corridor exists. The scenario is rather intricate, so I encourage you to focus more on the hourly chart analysis even though not everything is yet evident.

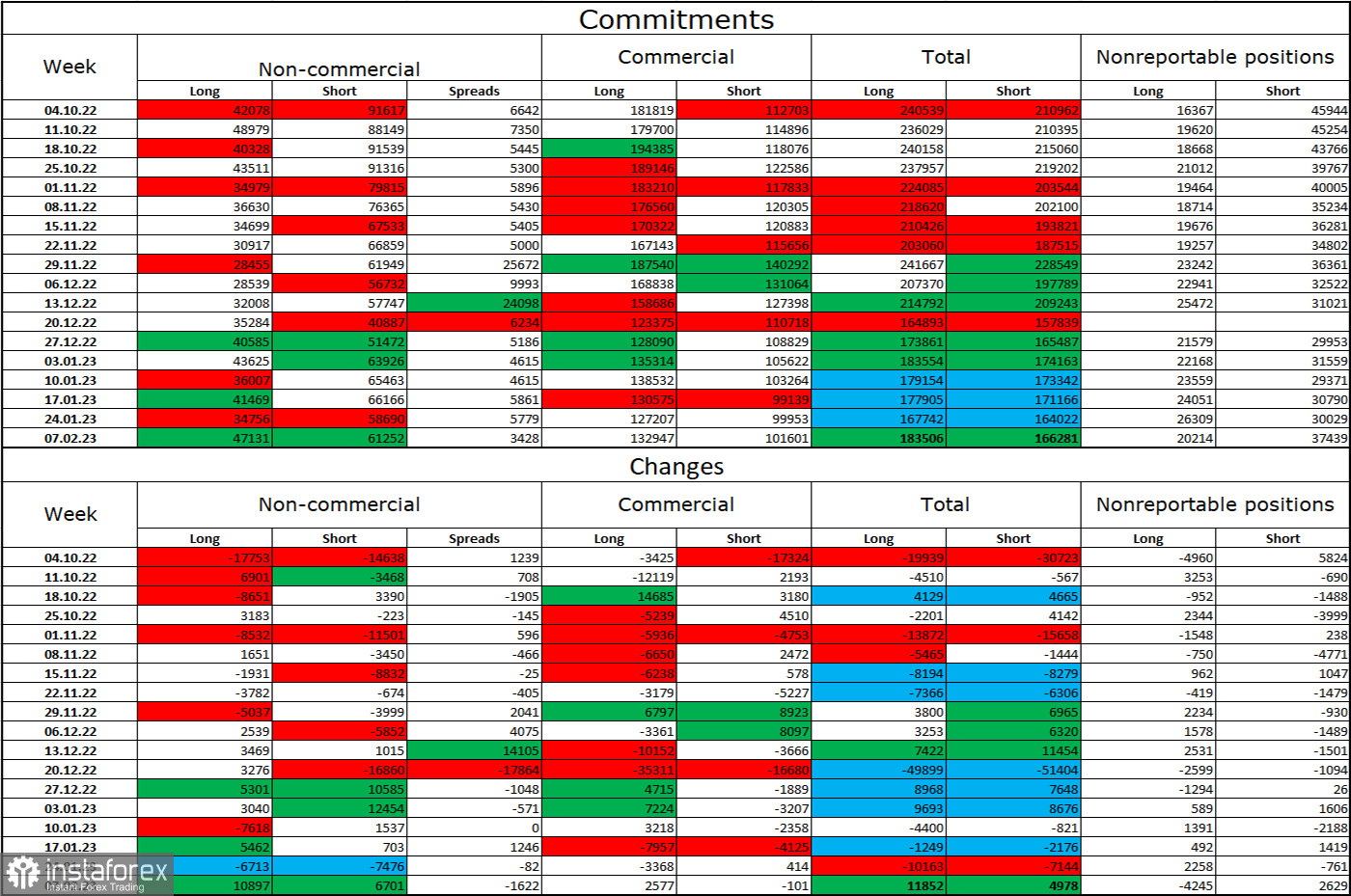

Report on Commitments of Traders (COT):

Over the most recent reporting week, the sentiment among traders in the "Non-commercial" category was less "bearish" than it had been the previous week. But, since the CFTC has not released any new reports, we are currently discussing reports from a month ago. Speculators now hold 10,897 more long contracts than short contracts, a difference of 6,701 units. The major players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. The situation has shifted in favor of the British during the last several months, although the difference between the number of long and short positions held by speculators still exists. And "now" is the start of February. Consequently, the pound's prospects remain dismal, but the British pound is not eager to decline and is instead concentrating on the euro. The three-month upward corridor on the 4-hour chart had an exit, and the dollar can now be supported at this time. On the hourly chart, though, you must still exit the side corridor to accomplish this.

The following is the UK and US news calendar:

US – Speech by the head of the Fed, Mr. Powell (15:00 UTC).

The only event on the economic calendars for Tuesday in the UK and the US is Powell's speech. The information background will have a significant impact on how traders think for the remainder of the day.

Forecast for GBP/USD and trading advice:

On the hourly chart, I suggest new sales of the pound when it closes below the level of 1.1920 (the lower line of the corridor), with targets of 1.1883 and 1.1737. With a target price of 1.2112, purchases of the pair were probable when the bulls recovered from the level of 1.1920. However, they were unable to do so.