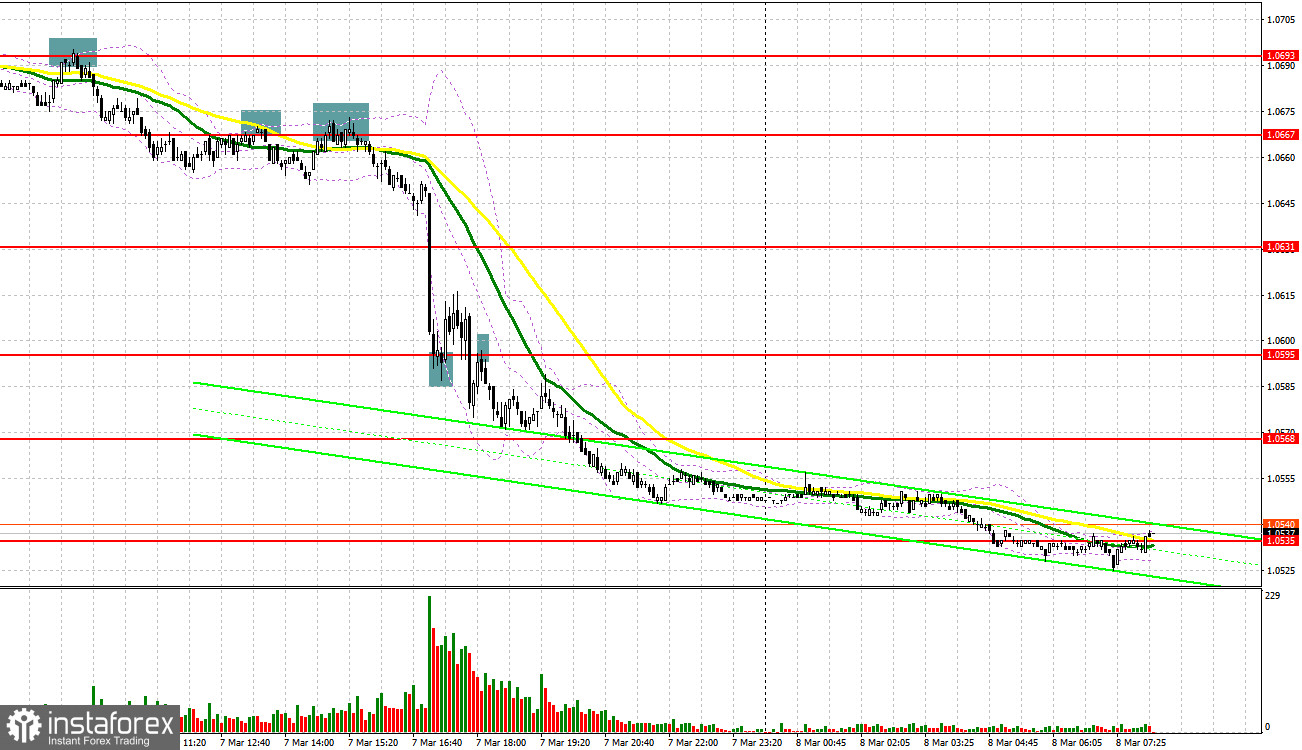

Yesterday, traders received several signals to enter the market. Let us take a look at the 5-minute chart to figure out what happened. Earlier, I asked you to pay attention to the level of 1.0690 to decide when to enter the market. A rise and a false breakout of this level led to a sell signal. As a result, the pair slumped by more than 30 pips. In the second part of the day, a breakout and settlement below 1.0667 formed one more sell signal. This caused a 60-pip decline. Bulls failed to protect 1.0595. A breakout and an upward test of this level led to another short signal, which spurred a drop of 50 pips.

Conditions for opening long positions on EUR/USD:

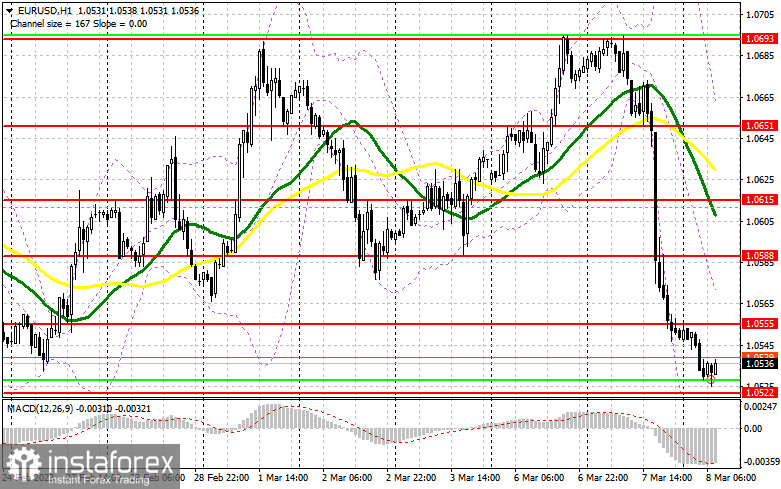

Today, buyers of the euro have little chance to regain control over the market. Yesterday's speech delivered by Jerome Powell gave traders clear information about the future direction of the US dollar. As a result, the euro was sold off. It is highly possible that the Fed will raise the benchmark rate by 0.5% later in March. This is encouraging traders to buy the greenback. Today, the macroeconomic calendar is rich in events. However, none of the reports is able to support the euro. Thus, Germany will disclose its industrial production figures, whereas data on retail sales will be issued in both Germany and Italy. What is more, a speech that will be delivered by Christine Lagarde may add pressure to the euro. The fact is that the ECB president is expected to talk about high inflation. In addition, the GDP data for the fourth quarter of 2022 was downwardly revised, which may encourage bears. That is why in the first part of the day, bulls should protect the nearest support level of 1.0522. A false breakout of this level will give a buy signal with the target at the resistance level of 1.0555. A breakout and a downward test will give an additional long signal amid the data from the eurozone. The target is located at 1.0588, where bulls may face obstacles. A breakout of 1.0588 will affect bears' stop orders, thus forming a long signal with the target at 1.0615, where it is better to lock in profits. A test of this level will point to the end of the bullish correction after yesterday's sell-off. If the euro/dollar pair slides and bulls fail to protect 1.0522, which is more likely, pressure on the pair will return. A breakout of this level may cause a decline to the next support level of 1.0487. Only a false breakout of this level will give a buy signal. Traders may also go long just after a bounce off the low of 1.0451 or even lower – at 1.0395, expecting a rise of 30-35 pips intraday.

Conditions for opening short positions on EUR/USD;

Yesterday, sellers were encouraged by Jerome Powell's comments and now, they are ready to continue the bearish trend. It will be wise to go short after a rise and a false breakout near the new resistance level of 1.0555. This may lead to a decline to 1.0522, an intermediate support level. A breakout and a reverse test of this level amid extremely weak data from the eurozone will give an additional sell signal with the target at 1.0487. A settlement below this area will cause a more significant drop to 1.0451, where it is better to lock in profits. If the euro/dollar pair increases during the European session and bears fail to protect 1.0555, traders should avoid selling the asset until the price touches 1.0588. There, it is possible to sell the asset only after an unsuccessful settlement. Traders may also go short just after a rebound from the high of 1.0615, expecting a decline of 30-35 pips.

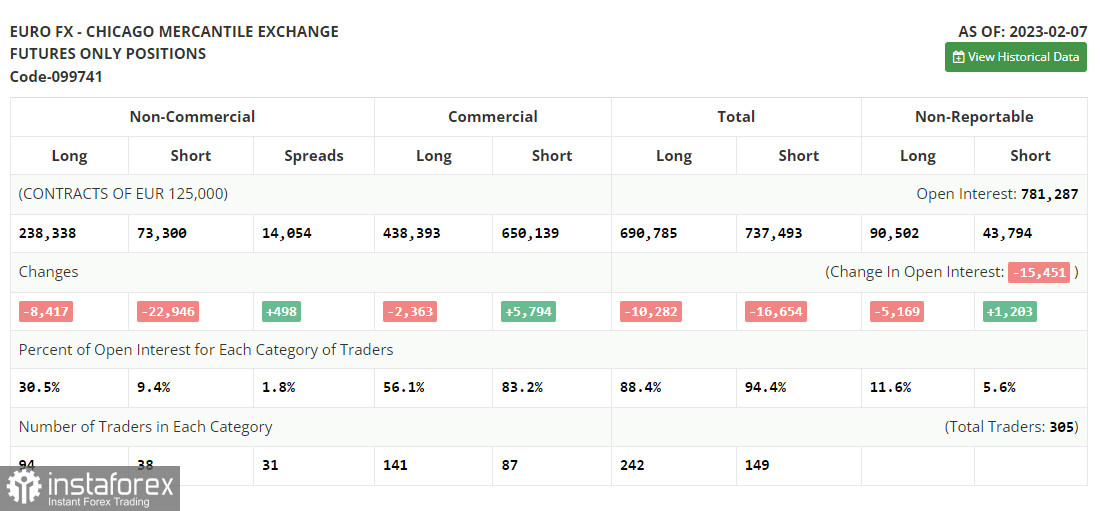

COT report

According to the COT report from February 7, the number of both long and short positions dropped. The COT report from February 7 logged a decrease in both long and short positions. This happened just after the Federal Reserve and the ECB announced their key rate decisions. In fact, the COT data from a month ago is of little interest at this point as it is not relevant due to the technical glitch the CFTC recently suffered. That is why we have to wait for fresh reports. In the near future, Fed Chair Jerome Powell will give testimony, which may determine the dollar's future trend for a month ahead. The FOMC meeting will take place at the end of March. Hawkish remarks about inflation and monetary policy will boost the US dollar against the euro. If Powell says nothing new on the matter, the greenback is likely to show weakness. According to the COT report, the number of long non-commercial positions decreased by 8,417 to 238,338. The number of short non-commercial positions slid by 22,946 to 73,300. Consequently, the non-commercial net position came in at 165,038 versus 150,509. The weekly closing price fell to 1.0742 from 1.0893.

Signals of indicators:

Moving Averages

Trading is performed below the 30- and 50-day moving averages, which points to a further decline in the euro.

Note: The author considers the period and prices of moving averages on the one-hour chart which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

In case of a decline, the lower limit of the indicator located at 1.0487 will act as support.

Description of indicators

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.