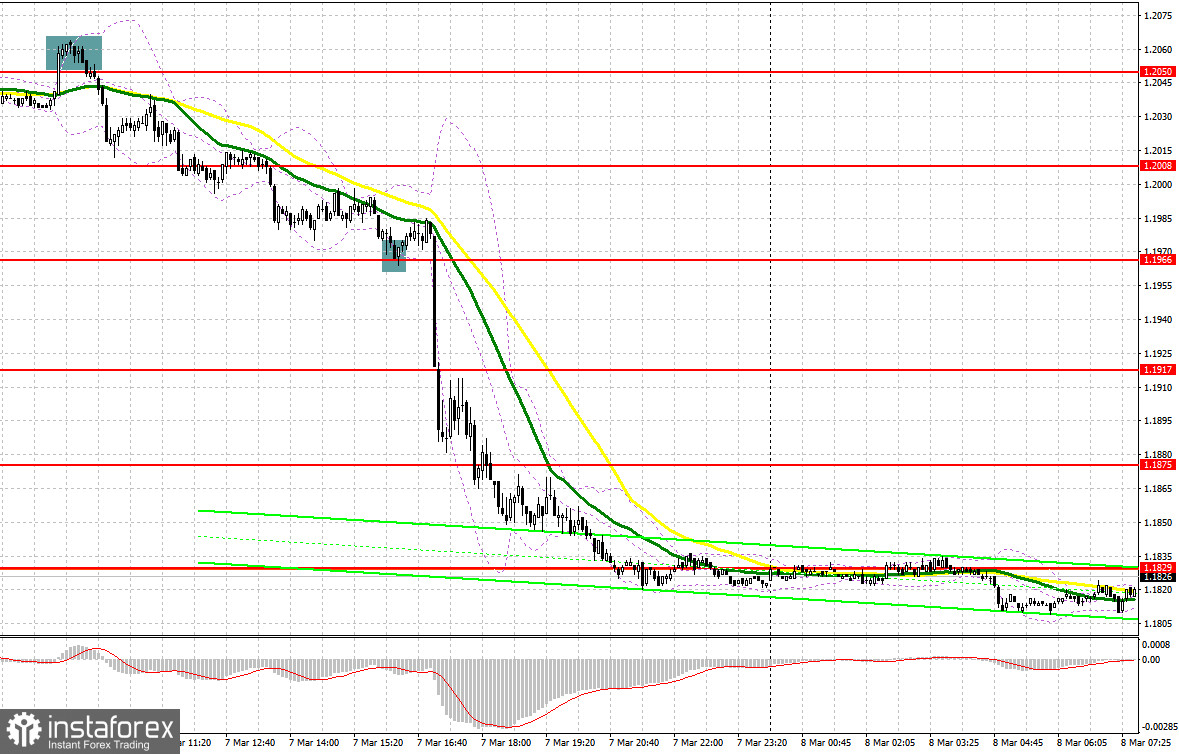

Yesterday, there were several entry points. Now, let's look at the 5-minute chart and figure out what actually happened. In my morning article, I turned your attention to 1.2050 and recommended making decisions with this level in focus. A rise and a false breakout of 1.2050 led to a sell signal, which resulted in a downward movement of more than 40 pips. In the afternoon, a false breakout of 1.1966 provided a buy signal. Yet, after moving up by 15 pips, the pressure on the pair increased again.

When to open long positions on GBP/USD:

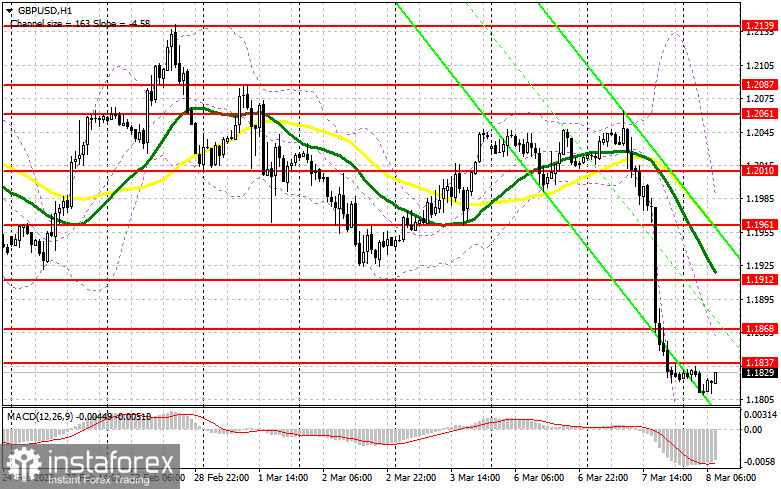

One could hardly expect an upward correction today, especially after Powell's hawkish speech yesterday. Even an empty economic calendar will not help the buyers of the pound sterling. So, I would advise you to consider long positions if the pair decreases. Only a false breakout of 1.1790 will give a buy signal despite the bear market. The pair may reach the support level of 1.1837 formed yesterday. After a downward test of this level, GBP/USD could climb to a high of 1.1868. It would be wise to go long after a breakout and increase to 1.1912. At this level, I recommend locking in profits. If the bulls fail to push the pair to 1.1790, the pressure on the pound sterling will escalate. In this case, I would advise you not to rush into purchases and open long positions only near the support level of 1.1747 after a false breakout. You could buy GBP/USD at a bounce from 1.1714, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

There is a slim chance that the bulls could return control over the market today, especially given the release of US economic reports in the afternoon. Therefore, it is better to open short positions after a false breakout of the resistance level of 1.1837. This will be an excellent sell signal, which will push GBP/USD to a new monthly low of 1.1790. A breakout and an upward retest of this level will increase pressure on the pair. It will also undermine ab upward correction. Large sellers will enter the market. It will generate new entry points into short positions with a fall to 1.1747. A more distant resistance level will be a low of 1.1714 where I recommend locking in profits. If GBP/USD rises and bears show no energy at 1.1837, a trend reversal will hardly occur. In this case, the bears will retreat and only a false breakout of the resistance level of 1.1868 will create an entry point into short positions. In the absence of activity there, you could sell GBP/USD at a bounce from 1.1912, keeping in mind a downward intraday correction of 30-35 pips.

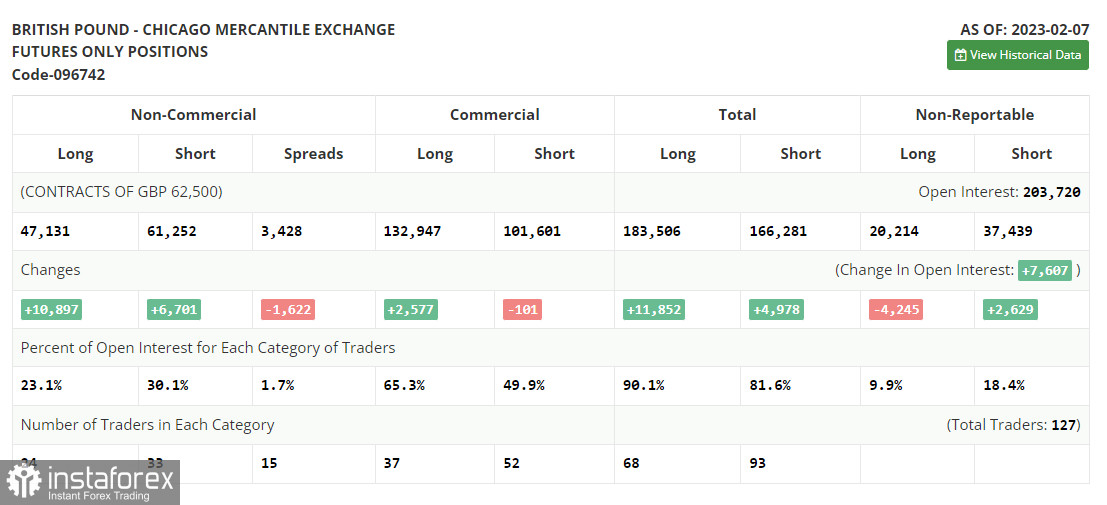

COT report

The COT report for February 7 logged a rise in both long and short positions. Apparently, traders cheered the BoE's further policy which is why they opened many long positions. Yet, some market participants decided to sell the pound sterling while it is still rising. They expect the Fed to maintain its aggressive monetary policy. This week, the economic calendar for the UK will be uneventful. It means that pressure on risk assets may finally ease. The pound sterling could take advantage of it and start an upside correction. Markets will definitely take notice of the statement by Fed Chair Jerome Powell as he is likely to provide hints about the regulator's key rate decision at the next meeting in late March. According to the latest COT report, short positions of the non-commercial group of traders went up by 6,701 to 61,252, while long positions rose by 10,897 to 47,131. This resulted in a decline in the negative value of the non-commercial net position. It dropped to -14,121 from -18,317 recorded a week ago. The weekly closing price fell to 1.2041 from 1.2333.

Indicators' signals:

Trading is carried out below the 30 and 50 daily moving averages, which indicates further downward movement.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD rises, the indicator's upper border at 1.1980 will serve as resistance. In case of a decline, the indicator's lower border at 1.1747 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.