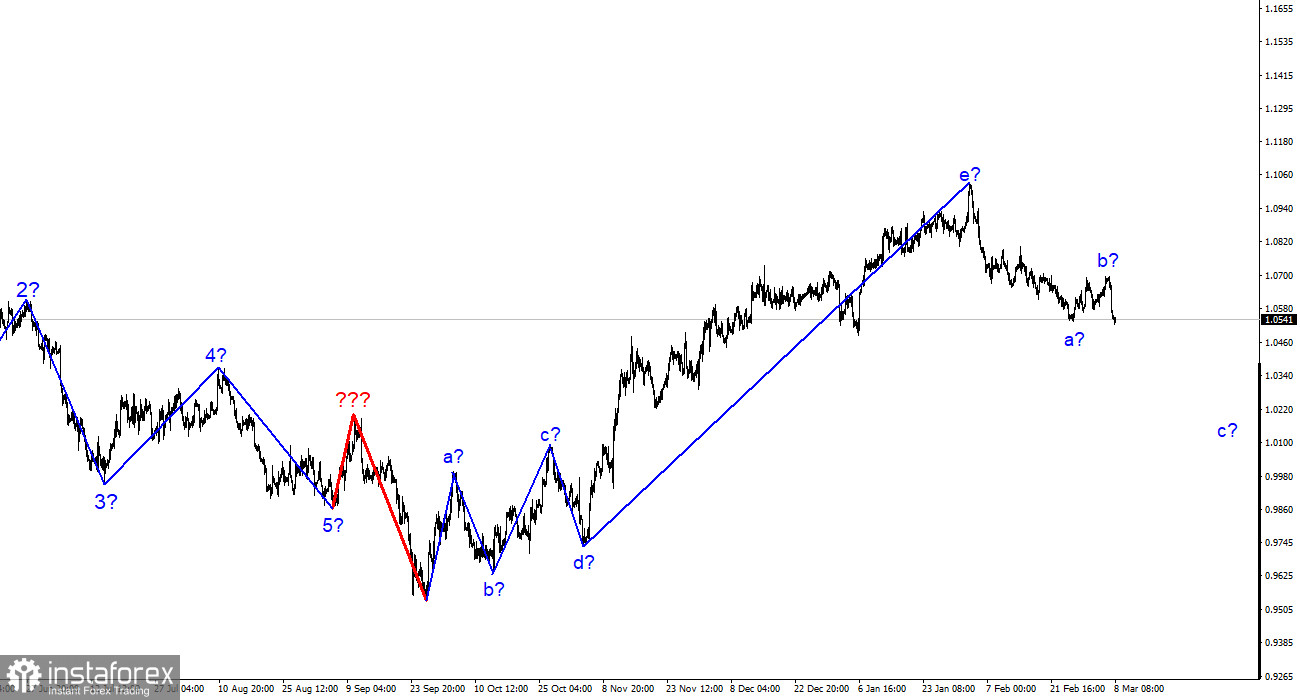

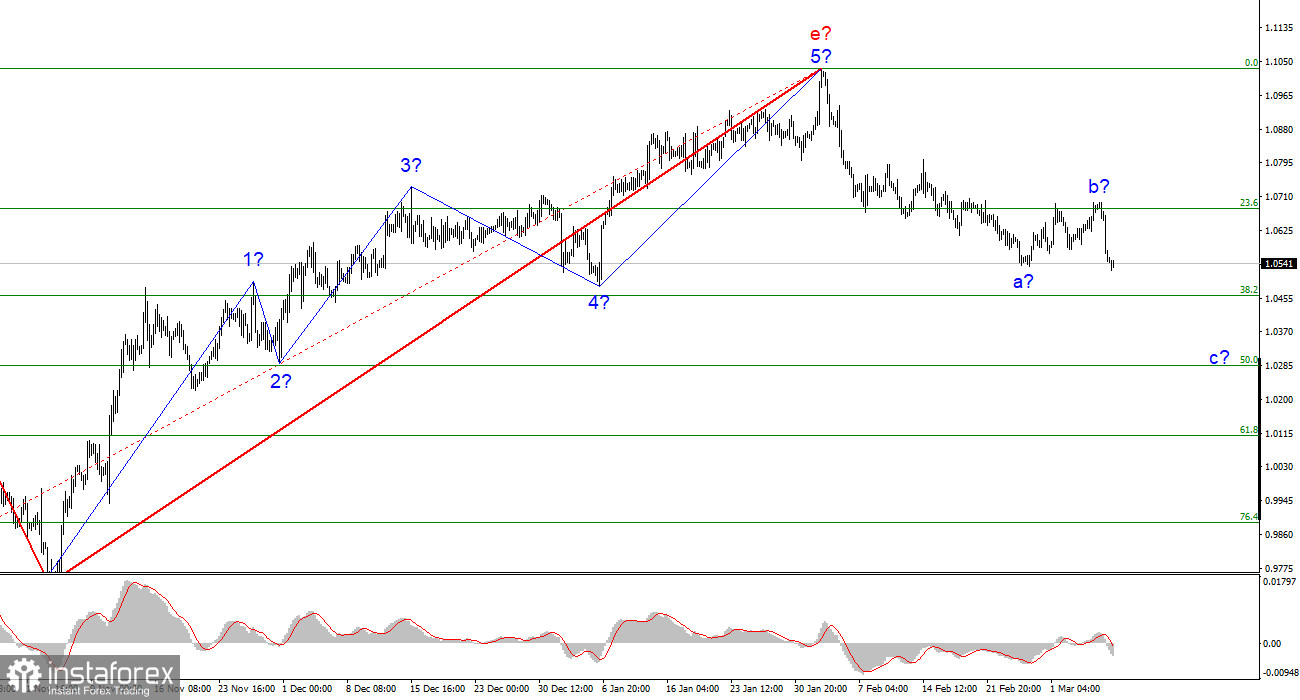

The 4-hour chart for the euro/dollar pair still shows the same wave pattern, which is excellent because it allows us to predict how the situation will develop. It's also encouraging that the movements are almost entirely in line with the wave pattern. The upward part of the trend, which has taken on the pattern a-b-c-d-e, is already finished. I continue to anticipate the pair to decline since, if the wave analysis for the current wave is accurate, we should build at least three waves down. Two of these three waves may already be finished. An update on the low wave a resulted from this week's fall in the pair's quotes. As a result, wave 3 or C is currently being developed. It should be noted that the entire current trend segment may end up being a pulse, just as the prior one was corrective, even though it was a five-wave section. As a result, I anticipate that the pair will continue to decrease, with targets close to the predicted mark of 1.0283, or 50.0% Fibonacci. To determine if the market may continue developing a downward trend section after working off this level, it will be required to assess the scenario and the wave picture.

On Tuesday, the euro/dollar pair lost 130 basis points. The movements had a relatively low amplitude just before the Fed President's speech. And it began almost at night. Yet even before he began speaking, the market was driving up demand for the dollar, indicating that it anticipated "hawkish" rhetoric from him. Let me quickly remind you that virtually all recent economic indicators from the United States indicated that the Fed rate would rise more quickly in 2023. When compared to expectations, the labor market value in January was twice as high, the unemployment rate dropped once more, and inflation started to decrease in the fall. Then Powell, who was supposed to comment on these reports, gave a speech that was so extraordinary that the market was forced to make a sharp rise in the demand for the dollar.

Yesterday's events were entirely positive in my opinion. The pair might have increased if Powell's words had been more forceful. The only bad thing that would happen is that wave b would become a little bit more challenging. It is still capable of taking a stronger three-wave form. Yet, the likelihood of developing a wave c increases with the strength and frequency of the euro currency declines rather than changing the entire trend section into something else, non-classical. The impact of Powell's speech, in my opinion, will last for a while. Currently, the market may gradually raise demand for the US dollar until the Fed meeting, which will take place on March 21–22, anticipating a larger rate hike of more than 25 basis points. For the present wave analysis, this is precisely what is required. This is the day of Powell's upcoming statement to Congress, where he will have another opportunity to make "hawkish" remarks that will help the dollar. We are getting ready for a new decline.

Conclusions in general.

I draw the conclusion that the upward trend section's development is finished based on the analysis. As a result, it is now allowed to take into account sales with targets close to the predicted mark of 1.0284, or 50.0% Fibonacci. A corrective wave 2 or b can still be developed at this point; however, it will now take a longer form. Opening sales now on the MACD "down" signals is advised.

In the older wave scale, the wave marking of the ascending trend section has taken an extended form but is probably completed. The a-b-c-d-e pattern is most likely represented by the five upward waves we observed. The downward part of the trend is already beginning to form.