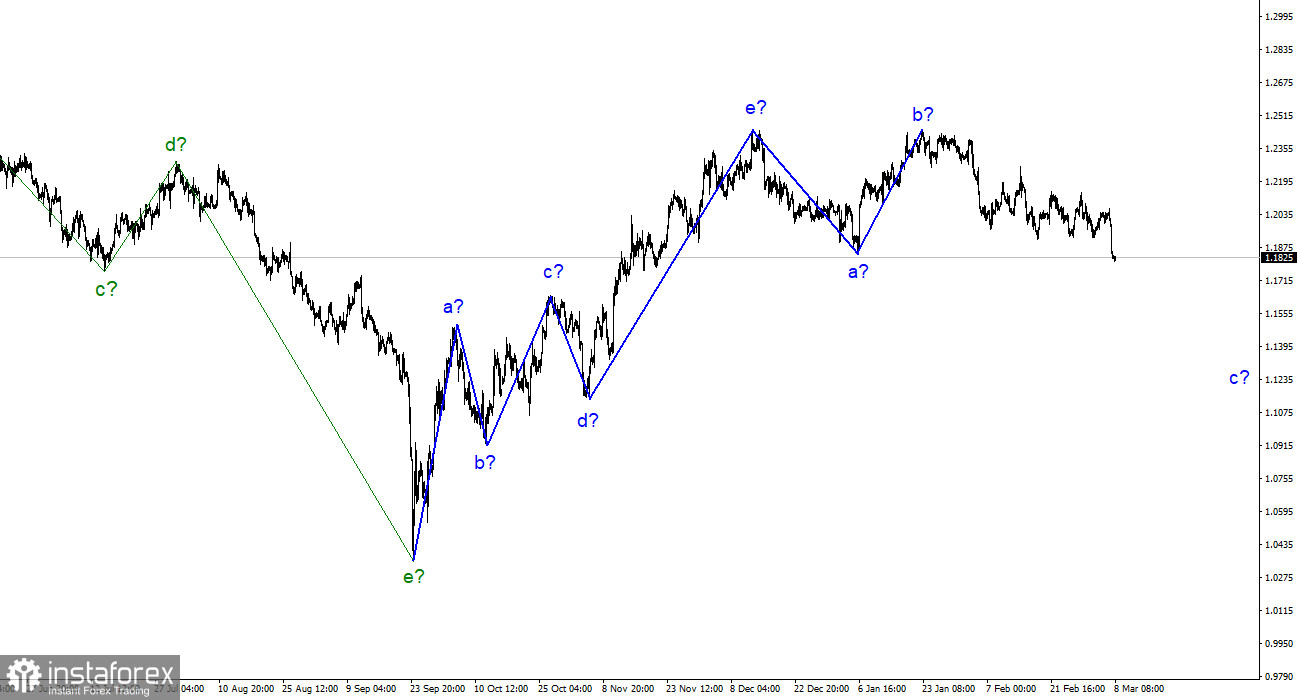

The wave analysis for the pound/dollar pair now appears to be challenging, but it does not call for any clarifications. The wave patterns for the euro and the pound differ somewhat, but both point to a decrease. Our five-wave upward trend section has the pattern a-b-c-d-e and is most likely already finished. I predict that the downward part of the trend has begun and will continue to develop, taking at least a three-wave form. Although Wave B appeared to be unnecessarily prolonged, it did not cancel. As a result, it is presumed that the construction of a wave with targets below wave a's low is currently continuing from the downward sector of the trend. The low of wave a has already been broken, allowing for the development of this wave to be finished right now. On the other hand, I think it will be considerably deeper—at least 200 points lower than the current price. It's still too early to speculate about whether the entire downward part of the trend will even take a five-wave pattern. I currently view the level of 1.1641 as the closest target, which according to Fibonacci equals 38.2%.

On Tuesday, the pound/dollar pair's exchange rate dropped by 200 basis points, enabling it to finally attempt and succeed in breaking through the 1.1944 level. Since wave c now has a much more approachable appearance, the decrease in quotes should continue. Of course, Powell's statement in the US House is "all to blame." In reality, he gave the markets reason to expect a rate increase of 50 basis points on March 21–22 as a result of his speech. Do you see why his speech yesterday had such an impact on the currency market? The Fed only lowered rate increases last month to 25 points, and in March it might speed them up once more. Because the market has come to rely on the consistency and smoothness of the regulator's actions, it has always reacted severely to such "swings." Yet, the Federal Reserve System has demonstrated once again that its major goal for it is 2% inflation, and it is willing to employ any technique to attain that goal, regardless of market reaction.

Analysts are now anticipating a further drop in demand for the pound, or perhaps it would be more accurate to say a greater rise in demand for the dollar. We'll have to familiarize ourselves with this week's Nonfarm Payrolls report on Friday, which might elicit an equally strong response as Powell's speech from yesterday. Based on this information, it is still challenging to make any predictions. It will be quite simple to achieve the market expectation of 200,000 new jobs outside the agricultural industry. There were 517 thousand payrolls made in the previous month. Based on this, the demand for the US dollar could increase through Friday and into the weekend. Do not forget that Jerome Powell's second speech in Congress will take place today, where he might further "inflame the situation" with his "hawkish" statements.

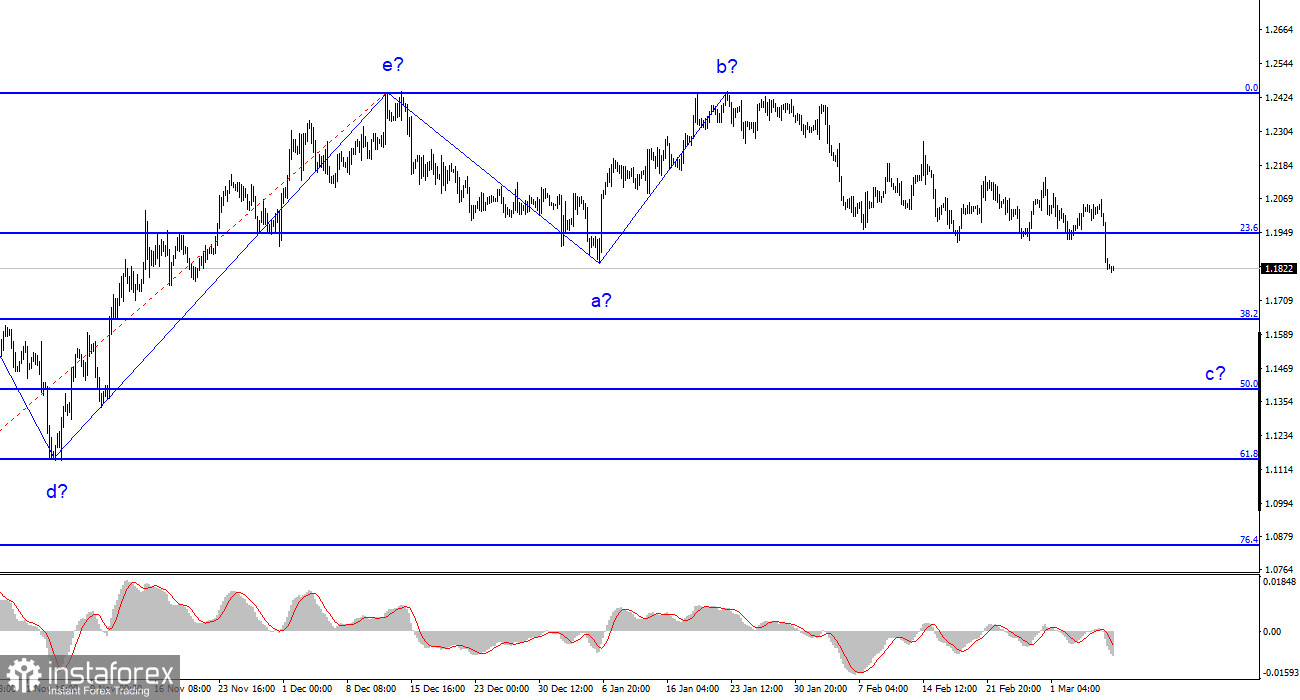

Conclusions in general.

The development of a downward trend section is implied by the wave pattern of the pound/dollar pair. Currently, sales with targets at the level of 1.1508, or 50.0% Fibonacci, might be taken into account. The peaks of waves e and b could be used to place a Stop Loss order. Wave c might be shorter, but for the time being, I anticipate a further 200-point drop (from current levels).

The picture resembles that of the euro/dollar pair at higher wave scales, but there are still minor differences. The upward correction part of the trend has now been finished. If this presumption is true, we must wait for the development of a downward section to continue for at least three waves with the possibility of a reduction in at least the area of figure 15.