The biggest bank collapse since the 2008 great financial crisis has created a new bullish momentum in the gold market. Analysts say demand for the safe-haven asset will drive gold prices higher.

After California state regulators took control of Silicon Valley Bank on Friday and appointed the Federal Deposit Insurance Corporation as the receiver, the market was firmly bullish.

SVB also became the second bank to close last week after Silvergate Capital Corp announced it was voluntarily going out of business on Wednesday.

According to analysts, gold remains an attractive asset as investors protect themselves from inflation and potential financial shocks.

Analysts also noted that the collapse of the SVB could serve as the end of the Fed's tightening cycle.

In the current environment, the Fed is unlikely to be able to raise interest rates to 6%. And the sharp drop in both two-year and 10-year yields shows that interest rate expectations have peaked.

Two-year yields fell nearly 40 basis points on Friday from their mid-week highs. This is a positive factor for gold.

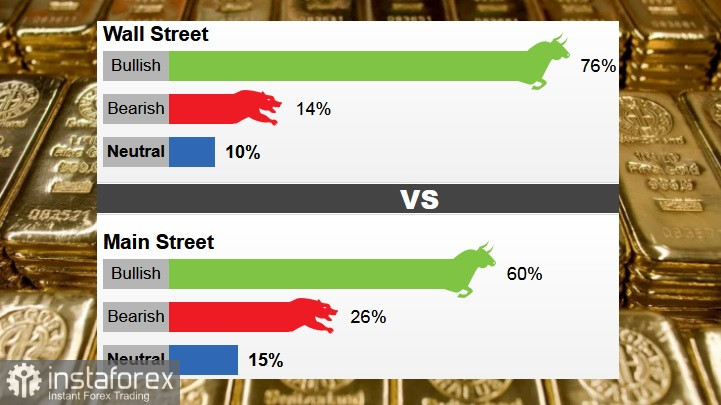

Last week, 21 Wall Street analysts took part in the gold survey. Among the participants, 16 analysts, or 76%, are optimistic. At the same time, three analysts, or 14%, are bearish for the current week, and two analysts, or 10%, believe that prices are trading in a sideways range.

There were 571 votes in the online polls. Of those, 340 respondents, or 60%, expect gold to rise this week. Another 146, or 26%, said the price would go down, while 85 voters, or 15%, were neutral.

Although Main Street investors are bullish on gold, their price forecasts are rather muted as the average forecasts suggest gold will be around $1,840 an ounce by the end of the week, similar to last week's forecast.

Although economic data continues to support further tightening by the Federal Reserve, gold rose due to the weakness of the U.S. dollar. The Fed will likely not be able to be as aggressive at the next meeting on the decision on interest rates as they would like. Therefore, gold is likely to hit $1,900 an ounce in the short term:

However, the data on inflation this week with the release of the consumer price index will create some risk for the precious metal.