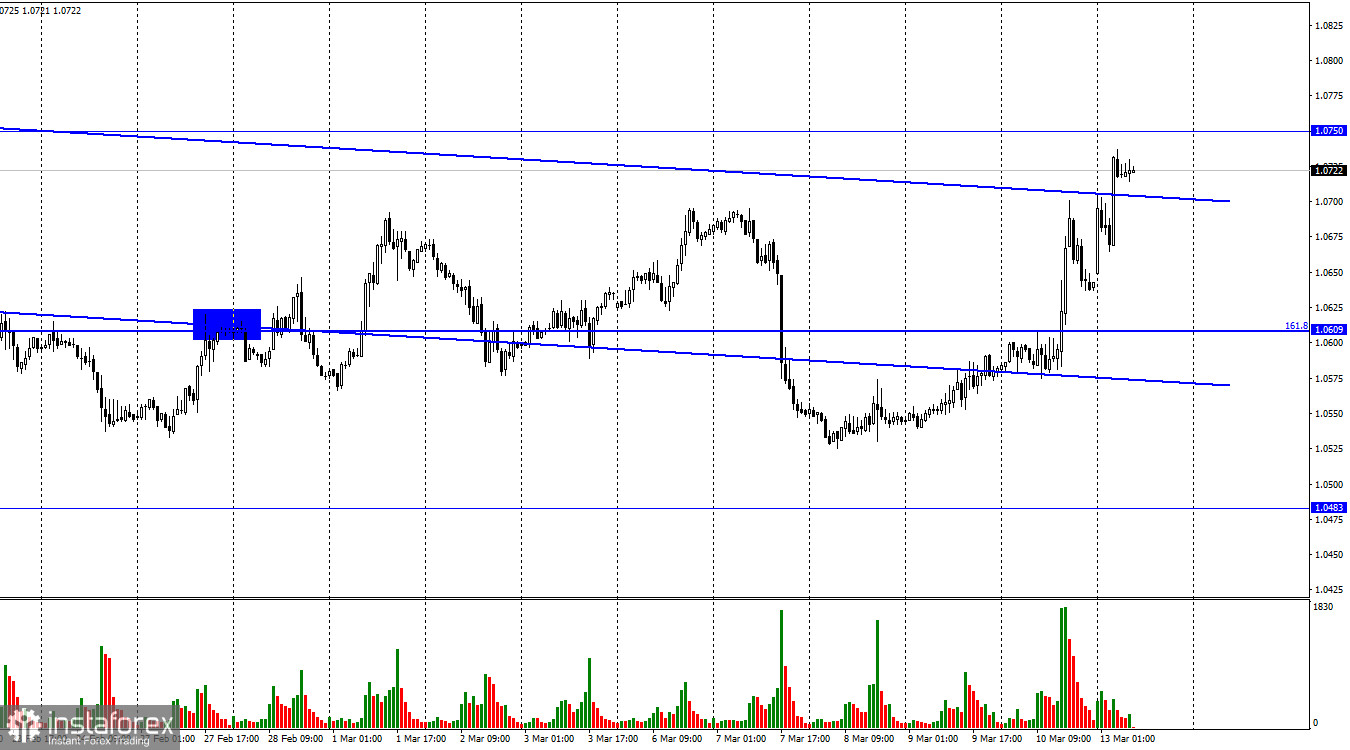

On Friday, the EUR/USD pair kept increasing, and on Monday, it managed to rise above the area of the bearish trend. As a result, at this point, the likelihood of an additional rise in the euro has greatly increased in terms of graphical analysis. On the one hand, the euro/dollar pair now needs to somewhat roll back down. On the other side, Monday is also working in favor of the euro, which managed to increase by a hefty 85 points in just 10 hours.

The information background was quite strong on Friday. Possibly the strongest day of the week. Economic statistics are now even more crucial because Powell's speech and the actions of the Fed are fully dependent on them. Of course, Jerome Powell's congressional remarks in Congress cannot be forgotten either. Yet in my view, despite the US currency's decline, Friday's strong movement was pretty reasonable. The number of payrolls for the second consecutive month substantially exceeds traders' forecasts, even if the unemployment rate increased to 3.6% (from 3.4% previously). Wages increased once more, but just a little more than projected. As a result, we have two reports that appear to be at odds with one another. First off, it is challenging to determine why unemployment has increased because there are a huge number of payrolls. Second, traders chose incorrectly to sell the dollar, given that there is now less probability of the FOMC raising its rate by 0.50% in March. That, in my opinion, is not the case. The unemployment rate cannot fluctuate consistently. Although unemployment is still at historically low levels and the trend is what matters in this case, traders viewed this report as if it had been growing for at least a few months in a row. The American unemployment rate doesn't simply keep going down; it keeps going down, reaching record lows. Although it's not great for inflation, it's great for the Fed and interest rates. I believe the dollar was unfairly devalued on Friday, and I'll work to make up the difference this week.

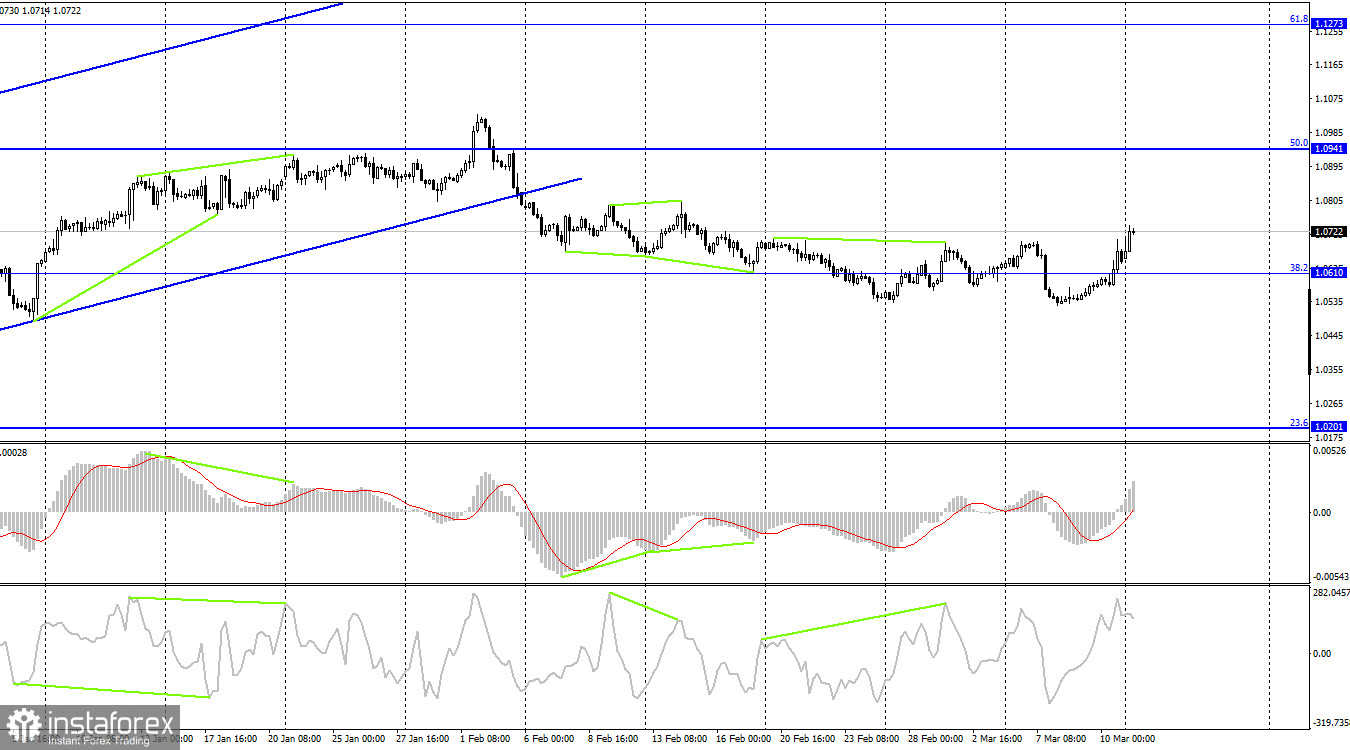

The pair has stabilized under the upward trend corridor on the 4-hour chart, allowing us to still anticipate a further decline even if the pair has left the corridor it has been in since October. Trader sentiment is described as "bearish," which creates strong growth opportunities for the US dollar with a target of 1.0201. But, we have recently seen increased horizontal movement.

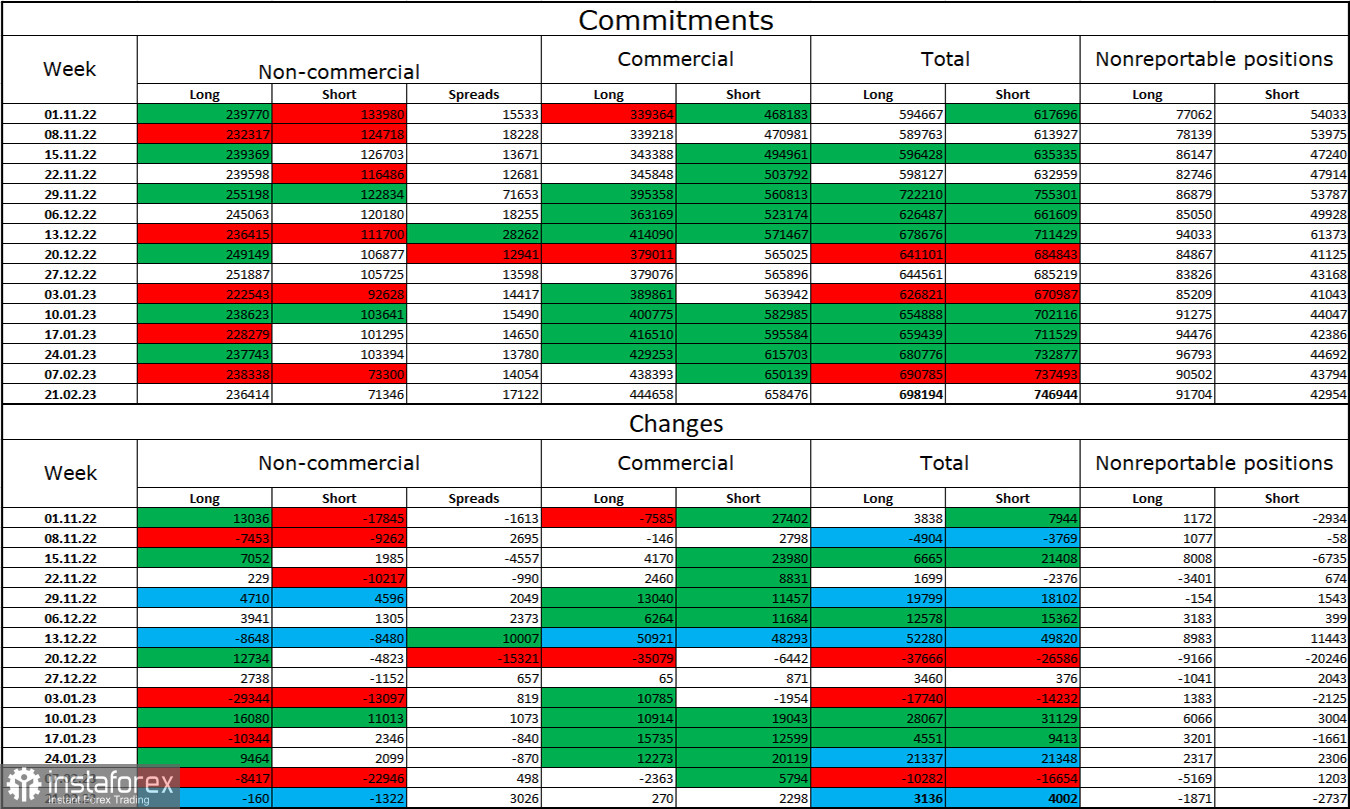

Report on Commitments of Traders (COT):

Speculators concluded 1,322 short contracts and 160 long contracts during the most recent reporting week. The positive sentiment among large traders is still present and getting stronger. I want to call your attention to the fact that the most recent report we have is from February 21. The "bullish" sentiment may have grown stronger in February, but how are things now? Speculators now have 236 thousand long contracts, while just 71 thousand short contracts are concentrated in their hands. While the value of the euro has been declining for some weeks, we are currently without new COT data. The likelihood of the euro currency's growth has been steadily increasing over the past few months, much like the euro itself, but the information background hasn't always backed it up. After a protracted "dark time," the situation is still in the euro's favor, and its prospects are strong. Until the ECB gradually raises the interest rate by increments of 0.50%, at least.

Calendar of events for the United States and the European Union:

There are no significant events scheduled for March 13 on either the economic calendars of the European Union or the United States. Today's traders won't be affected by the information background's sentiment.

Forecast for EUR/USD and trading advice:

On the hourly chart, new selling of the pair can be initiated when it recovers from the 1.0750 level with a target price of 1.0609. On the hourly chart, purchases of the euro currency are feasible if it closes above the level of 1.0750 with a target of 1.0861. But, I find it difficult to anticipate additional growth of the pair at this time.