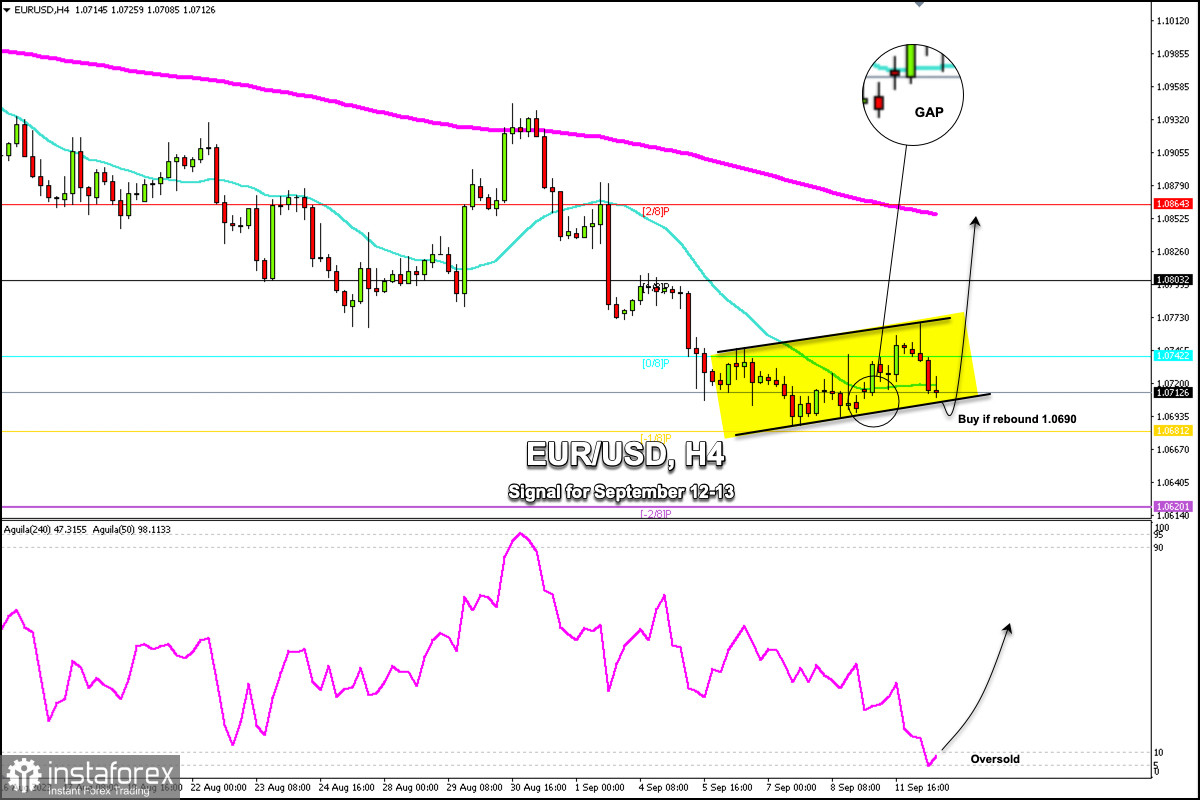

Early in the American session, EUR/USD is trading around 1.0712, below the 21 SMA, and within an uptrend channel formed since September 5.

According to the H-4 chart, we can see that the euro reached a high of 1.0768 in the European session. This level coincided with the top of the bullish trend channel and since then, we observed a strong technical correction.

At the opening of trading this week, the euro left a GAP at 1.0700 that still needs to be covered. In case the euro continues to decline, this GAP is expected to be covered. Then, we could expect a technical rebound and the instrument could reach the 200 EMA located at 1.0855.

Should EUR/USD consolidate above -1/8 Murray located at 1.0681, this could be seen as an opportunity to buy given that this area represents an extremely oversold level.

In case the downtrend remains underway and the euro trades below 1.0765, the bearish pressure is expected to persist until the next critical support level of -2/8 Murray located at 1.0620. Even if EUR/USD continues to decline below this level, the price could reach the psychological level of 1.05.

On the contrary, the euro is expected to recover as soon as it consolidates above the resistance of 1.0770. It could reach the 1/8 Murray level located at 1.0803 and then reach the 2/8 Murray zone, a level from the 200 EMA around 1.0864.

Tomorrow during the American session, the inflation data from the United States will be published. This data is expected to be key for the future of the euro. If the data comes out positive for the American dollar, we could expect a strong technical rebound in the euro and this could reach the 200 EMA around 1.0864.

If the data is negative for the United States, it could fuel the FED's tougher policy to increase its interest rate in the short term. Such prospects might force the euro to fall sharply and it could reach 1.0620 and 1.05.

Our trading plan for the next few hours is to buy in case EUR/USD bounces around 1.0690, with targets at 1.0742, 1.0803, and 1.0850. The eagle indicator is in the extremely oversold zone which supports our bullish strategy.