Prior to the publication of the British PMIs at the beginning of the month, many economists believed that the Bank of England could raise the interest rate to 5.50% or even 6.00% if inflation remained high. However, the August PMI data is expected to fuel speculation that interest rates may soon reach their peak, as noted by S&P Global Market Intelligence.

The fresh labor market data from the UK presented this morning became another proverbial fly in the ointment for market participants betting on further interest rate hikes by the Bank of England. The data from the Office for National Statistics indicated an increase in unemployment in the UK over the past three months (May–July) and a decrease in the employment rate.

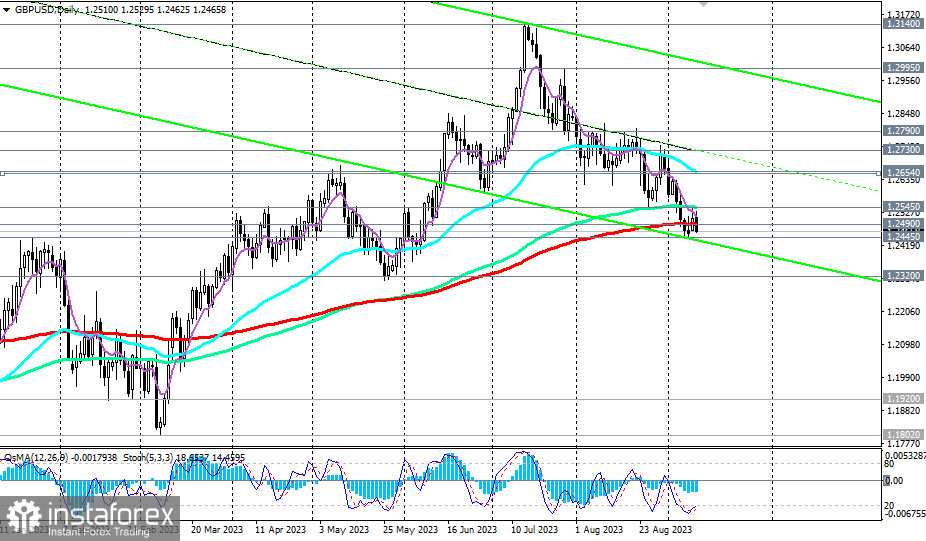

The pound sharply declined after today's publication of the UK labor market data, and the GBP/USD pair corrected lower. As of writing, the pair's decline continues, reaching the 1.2465 mark.

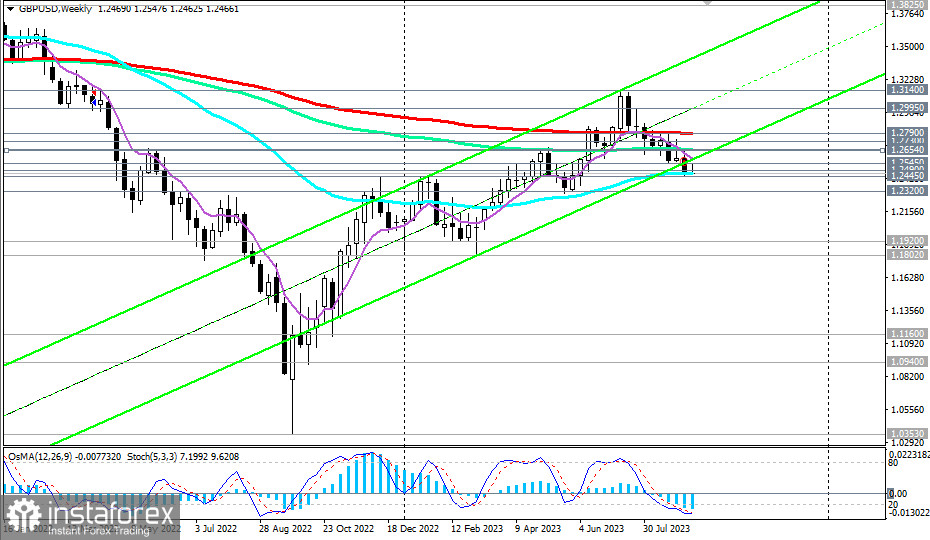

It is worth noting that the price has broken through the key medium-term support level at 1.2490 (200 EMA on the daily chart). A more successful retest of the important support level at 1.2450 (50 EMA on the weekly chart), its breakdown, and further decline will confirm the return of GBP/USD to the zone of the long-term bearish market, with the nearest target at the local support level of 1.2320.

In an alternative scenario, after breaking through the important resistance level at 1.2545 (144 EMA on the daily chart), the price will return to the medium-term bullish market of GBP/USD, and after breaking through the key resistance level at 1.2790 (200 EMA on the weekly chart), it will enter the long-term bullish market.

The first signal for resuming purchases here may be an increase above the levels of 1.2490 and 1.2500.

Support levels: 1.2450, 1.2445, 1.2400, 1.2320, 1.2300

Resistance levels: 1.2490, 1.2500, 1.2545, 1.2600, 1.2654, 1.2660, 1.2700, 1.2730, 1.2790, 1.2800, 1.2900, 1.3000, 1.3100, 1.3140, 1.3200