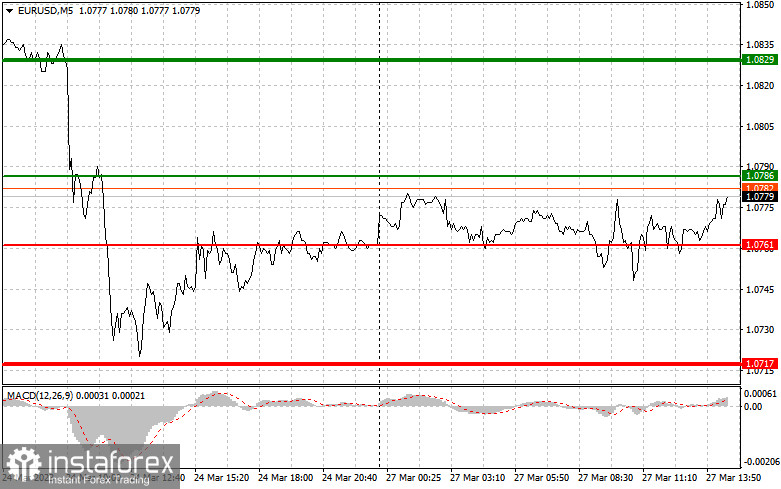

The euro instantly perked up following the upbeat Ifo survey on business sentiment, the assessment of current economic conditions, and economic expectations for Germany. Still, it was not enough for the euro to extend its upward correction. The economic calendar is empty in the second half of the day. The events worthy of note will be interviews of a few ECB policymakers. So, we will hardly see a clear-cut move of the instrument. For this reason, I'm going to trade according to scenario 2 presented below.

EURUSD

Buy signals

Scenario 1. Today we can buy EUR/USD after the price reached 1.0786 plotted by the green line on the chart with the target at 1.0829. I would recommend exiting the market at 1.0829 and also opening sell positions in the opposite direction, bearing in mind a 30-35 pips move from the market entry point. Importantly, before opening long positions on EUR/USD, make sure that the MACD indicator is above the zero level, beginning its growth from it.

Scenario 2. Another option to buy the euro today is to wait for two tests of 1.0761 at the time when the MACD indicator enters the oversold zone. This will cap the downward potential of the instrument and cause the opposite upward market reversal. We can expect the price growth to opposite levels of 1.0786 and 1.0829.

Sell signal

Scenario 1. We can sell the euro after the price reached the level of 1.0761 plotted by the red line on the chart. The target could be set at 1.0717 where I recommend leaving the market and buying the euro immediately in the opposite direction, bearing in mind a 20-25-pips move upwards. Importantly, before you go short, make sure the MACD indicator is below the zero level, starting its decline from it.

Scenario 2. The euro can be also sold today in case the level of 1.0786 is tested twice at the moment when MACD enters the overbought zone. This will put a lid on the price growth and push the market downward. We can expect a decline to the levels of 1.0761 and 1.0717.

GBPUSD

Buy signal

Scenario 1. We can go long on GBP/USD today after the price is detected at 1.2282 plotted by the green line on the chart with the target at 1.2324 plotted by the thick green line on the chart. It makes sense to exit the market at 1.2324 and open sell positions in the opposite direction, bearing in mind a 30-35-pips move downward from that level. Before buying the instrument, please check that MACD is above the zero level, beginning its growth from it.

Scenario 2. We could buy the sterling today in case we find out two tests of 1.2261 at the moment when MACD is in the oversold zone. This will cap the downward potential of the pair and enable the opposite market reversal upward. We could predict the growth to the opposite levels of 1.2283 and 1.2324.

Sell signal

Scenario 1. Short positions on GBP/USD could be opened today after the level of 1.2261 is updated (plotted by the red line on the chart). This will push the instrument sharply down. The sellers' key level is 1.2223 where I recommend closing short positions and opening long ones immediately in the opposite direction, reckoning a 20-25-pips move upward. Importantly, before selling GBP/USD, make sure that MACD is below the zero level, beginning its slide from it.

Scenario 2. Alternatively, we could sell the instrument today after two tests of 1.2283 at the time when MACD enters the overbought level. This will limit the upward potential of GBP/USD and will enable the opposite direction downward. We expect a decline to the opposite levels of 1.2261 and 1.2223.