To establish long positions on the GBP/USD, you must:

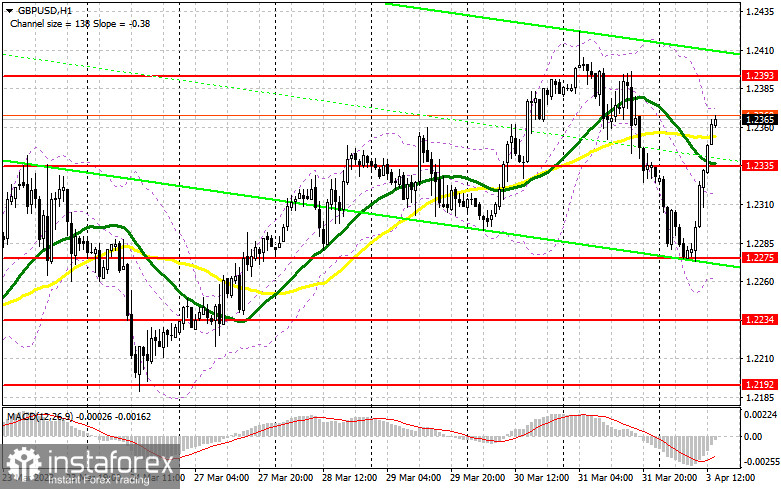

Given the current market conditions, predicting how the pair will react to ISM's index of business activity in the US manufacturing sector is difficult. I will not rush into long positions at the current highs; rather, it is best to wait for a decline to the nearest support at 1.2335, where the moving averages will already favor buyers. The formation of a false collapse will generate a buy signal, allowing the pair to reach 1.2393. A breakout and a top-down test of this range will constitute an additional buy signal, restoring the bullish trend and launching GBP/USD to 1.2443. In the event of an exit above this range, against the backdrop of very weak fundamental statistics for the United States, we can discuss a rise to 1.2505, where I will set my profit target. If GBP/USD falls and there are no buyers at 1.2335, which cannot be ruled out because it is not yet known what motivates traders to purchase risky assets with such enthusiasm, the pound may revert to sellers' control. If this occurs, I suggest delaying long positions until the 1.2275 test. I advise you to only purchase there on a false decline. Opening long positions on GBP/USD immediately for a rebound from 1.2234 to correct 30-35 points in a single trading day is possible.

To open short positions on GBP/USD, you must have the following:

The sellers are still trying to determine how to oppose such active purchases. Therefore, you should not rush into sales but rather wait for a test and a false collapse in the area of resistance at 1.2393, where the pound is currently headed. This will provide a favorable entry point for short positions, and the US data may help the bears dump the pound to the newly formed support level of 1.2335 by the end of the first half of the trading day. A breakout and a reversal test from the bottom to the top of this range will provide an entry point for selling with an update of the 1.2275 minimum, thereby restoring seller control over the market. I will set my profit target in the 1.2234 area, the farthest target. The formation of a new bearish trend is possible if this level is exceeded. With the possibility of GBP/USD growth and the absence of bears at 1.2393, which is more likely, the bull market will return, resulting in a move of GBP/USD to the nearby area of a new peak near 1.2443. A false breakout at this level provides an entry point into short positions based on the pound's downward movement. If there is a lack of activity, I recommend selling GBP/USD at 1.2505, anticipating a 30-35 point intraday decline.

Signals from indicators:

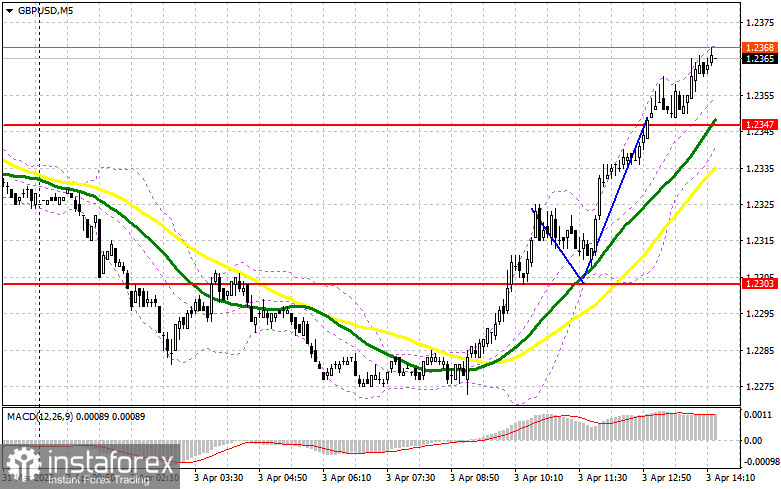

Moving Averages

Trading occurs around the 30-day and 50-day moving averages, indicating difficulties for sellers.

The author considers the period and prices of moving averages on the hourly chart H1, which differs from the classic definition of daily moving averages on the daily chart D1.

Bollinger Bands

In the event of a decline, the indicator's lower limit near 1.2275 will act as support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

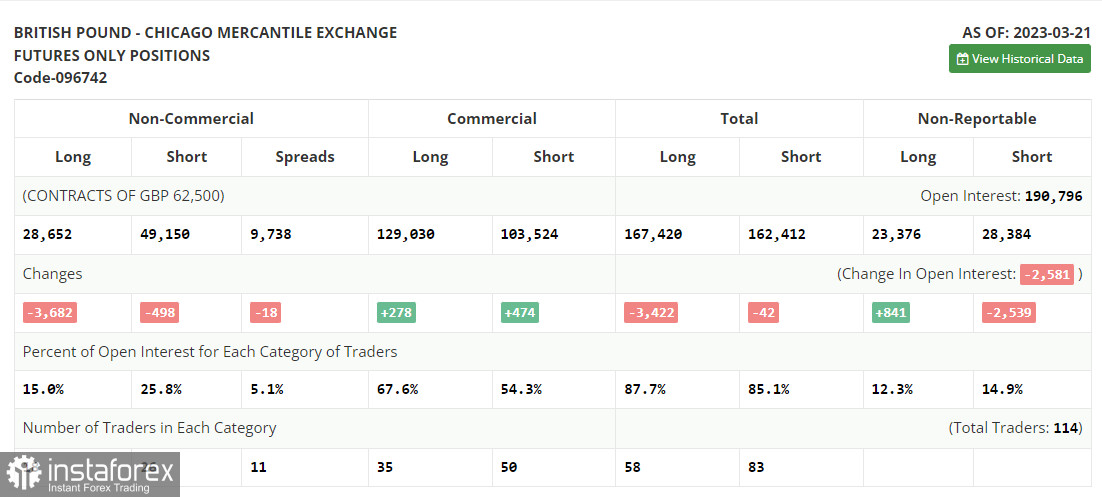

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.