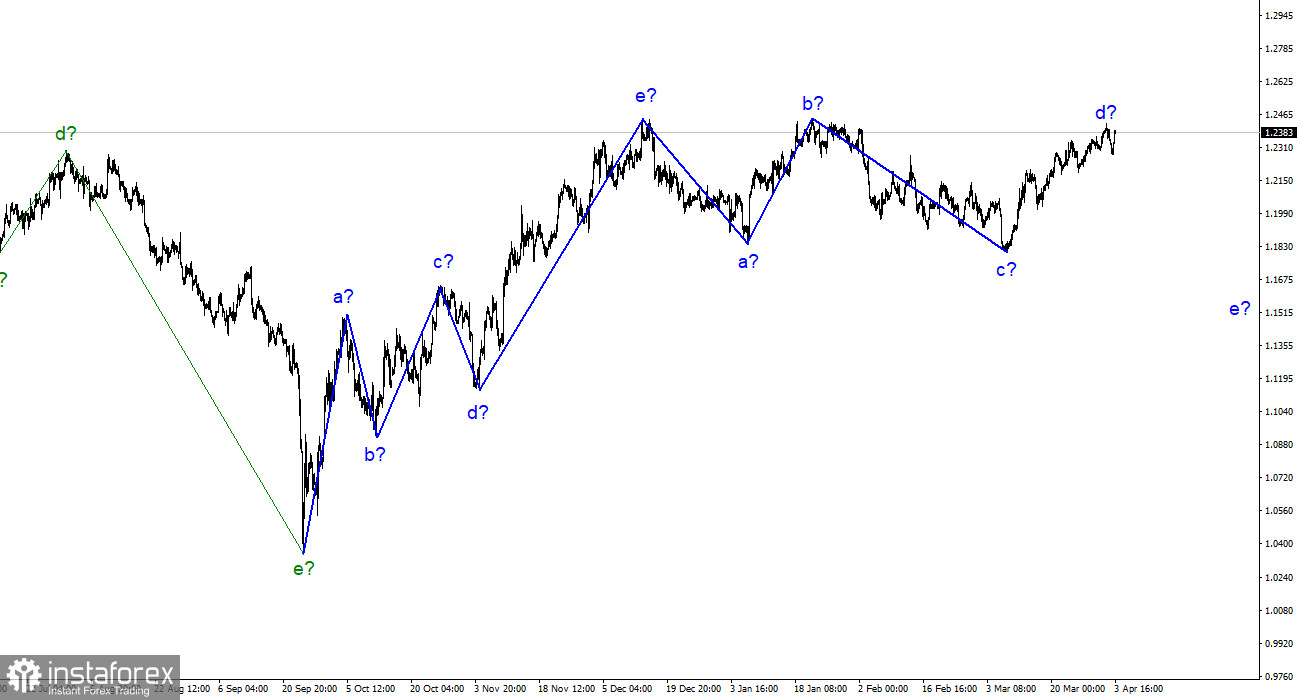

The wave analysis for the pound/dollar pair appears confusing but does not require clarification. The wave patterns of the euro and the pound differ in several ways. The downward part of the trend for the British pound is now increasing. Wave c assumed an extended form, but it has already concluded, as the pair fell below the low of wave a, albeit by a few points. I anticipate a stronger decline in the British pound, but it should be noted that expectations and reality do not always coincide. If the downward part of the trend has concluded for the euro, there is a greater than 50% chance that wave c has also concluded for the British pound. And the subsequent movements are not wave d, but rather the initial wave of a new upward trend segment. In the near future, the upward segment of the euro trend may also end. The pair can turn the downward section of the trend, which began on December 13, into a five-wave correction. In this case, the wave analysis would have appeared quite convincing, but I reiterate: there is an extremely low likelihood that the euro and the pound will develop distinct sections of the trend over time. Now, wave patterns could be clearer.

On Monday, the exchange rate of the pound/dollar pair initially decreased, then doubled. It is difficult to pinpoint the cause of the rise in demand for the pound. The British pound gained approximately 120 basis points from the day's low. From the news background in the first half of the day, only the UK manufacturing business activity index can be noted, which turned out to be worse than the February value and worse than market expectations. Therefore, it is highly unlikely that the British pound grew due to this report. The ISM manufacturing business activity index was released in the United States just a few minutes ago, with a value of 46.3 points despite market expectations of 49. After that, the dollar's decline accelerated. In general, however, today's news backdrop was not the primary reason for the dollar's decline. The market has again identified non-economic factors driving up demand for the euro and the pound. The wave analysis is ambiguous, so movement in any direction does not add clarity.

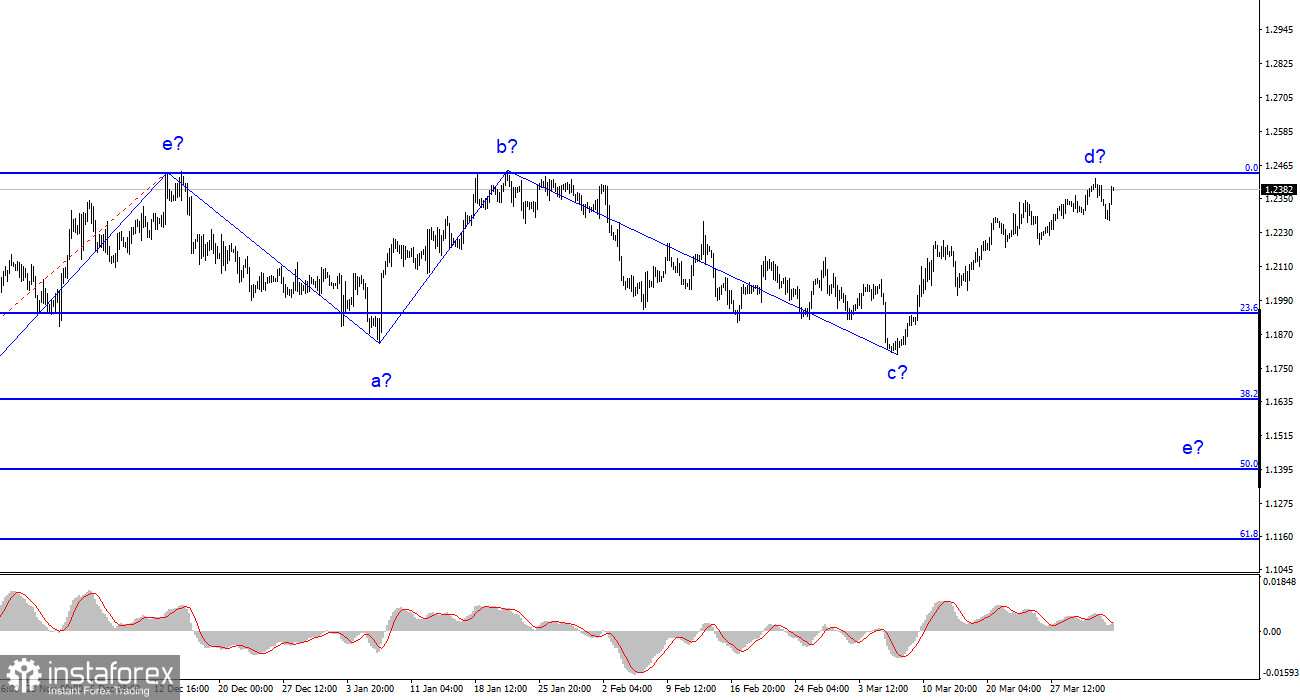

Positive news from the United Kingdom has been scarce for quite some time. The economy is on the verge of recession, a series of workers' strikes have occurred in the country demanding higher wages that lag far behind the rate of inflation, taxes have increased, and the Bank of England has raised the interest rate 11 times, resulting in almost no deceleration of inflation. What will occur next is uncertain. Despite this, the demand for the British pound remains high, which I find somewhat odd. Without today's increase in the pair, we could anticipate a 500-600 point decline within wave e. In contrast, a break of the 0.0% Fibonacci level is possible, which would invalidate the scenario and lead to another downward wave.

Conclusions in general.

The wave pattern of the pound/dollar pair assumes the conclusion of a segment of declining price momentum (solely due to the correlation of the euro and the pound). Currently, the wave markup is ambiguous, but you should consider purchases with targets exceeding 25 figures. However, I do not completely rule out the possibility of a wave e decline with targets 500 to 600 points below the current price. Consequently, it is currently difficult to make a recommendation. No news background would support the British pound. However, demand is increasing. And this is the issue.

The image resembles the euro/dollar pair on a higher wave scale, but there are still distinctions. Currently, the upward correction segment of the trend is complete. If this assumption is accurate, we are still awaiting the continuation of the development of a five-wave downward section with the possibility of a decline between 14 and 16 figures.