Though a little late, but the decision of OPEC+ to cut oil production by 1.6 million barrels per day still affected the dollar. This is not surprising since there is an inverse correlation between the dollar and almost all other instruments, which is most obvious during price surges. No matter whether the prices move up or down. Oil, in its turn, is a key resource. We can say that it is the lifeblood of the modern economy. So its rapid growth was bound to have an effect on the dollar. The only surprising thing is that the dollar did not weaken during the opening of the Asian session, but after the opening of the European session.

As a result, during the last couple of trading sessions the market was shifting from side to side, which obviously took it out of equilibrium. Moreover, it seems that some kind of range is being outlined, and the market is just rushing from one border to another. Consequently, it can be assumed that there will be some kind of pullback today, and the dollar will try to return to the values, where it was at the beginning of yesterday.

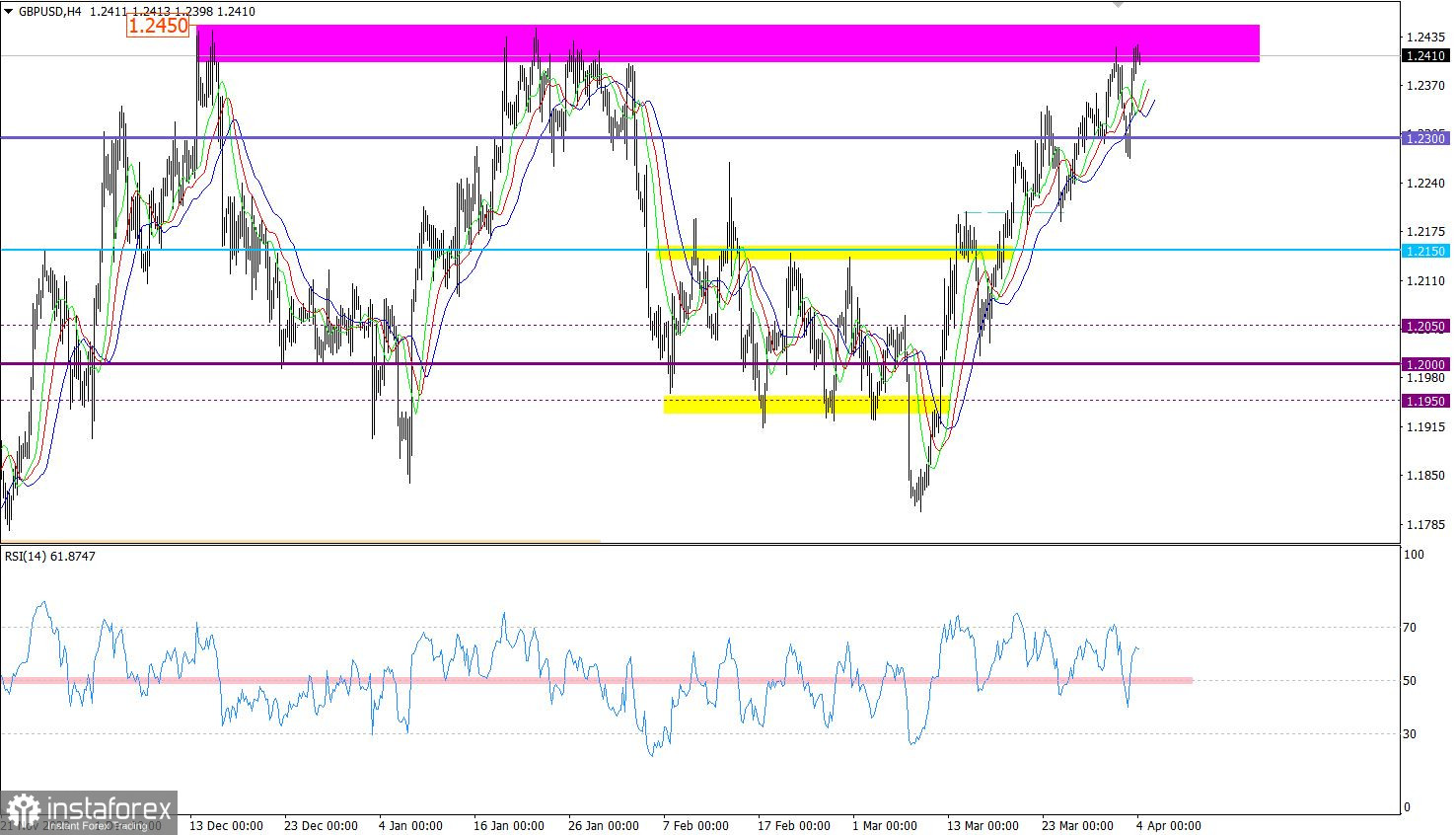

GBP/USD not only managed to restore the value relative to the recent decline, it renewed last week's local high. The area around 1.2300 became a support level, which is where growth in the volume of long positions was recorded.

On the four-hour chart, the RSI technical indicator is hovering in the upper area of 50/70, thus reflecting bullish sentiment among traders.

On the four-hour and daily charts, the Alligator's MAs are headed upwards, which reflects the quote's movement.

Outlook

Based on the bulls' current mood, we can expect the pair to stay above 1.2450, and this may result in maintaining the uptrend in the medium-term. However, it is better to be cautious, as the area of 1.2400/1.2450 has repeatedly played the role of resistance.

The complex indicator analysis points to an upward cycle in the short-term, intraday and medium-term periods.