Overview of yesterday's trade and trading tips on GBP/USD

The test of 1.2413 coincided with the moment when MACD was beginning its upward move from the zero mark. This confirmed that the market entry point for long positions was picked right. As a result, the pair grew by almost 40 pips. Other trading signals were not generated.

The empty economic calendar yesterday allowed the pound to continue its growth. Bank of England's Monetary Policy Committee members Silvana Tenreyro and Hugh Pill advocated for the need for further rate hikes. Such remarks reinforced the positions of buyers. Today, we should get acquainted with reports on the Services PMI and the Composite PMI for the UK. Upbeat data will encourage long positions on the British pound because traders will have reasons to anticipate a further bullish trend and the update of one-month highs. The speech by Bank of England's Monetary Policy Committee member Silvana Tenreyro will hardly spring surprises. In the second half of the day, the ADP employment report may further challenge the dollar's position as employment in the US private sector is expected sluggish in March. Data on the trade balance and the ISM non-manufacturing index are the factors which dollar buyers can count on today.

Buy signals

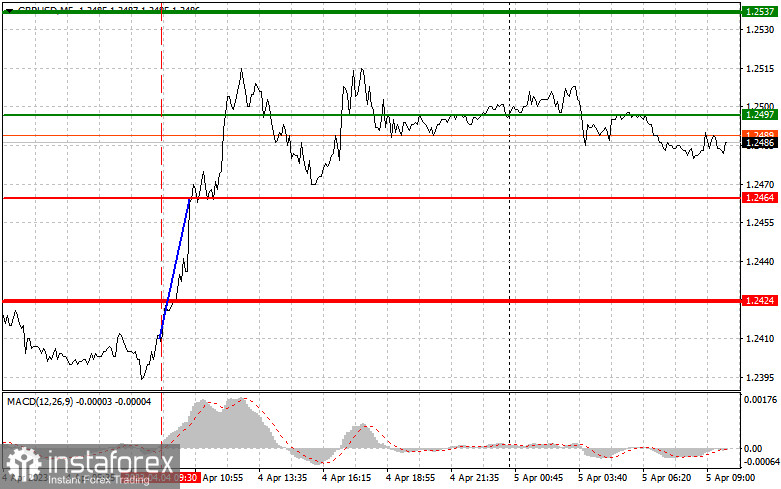

Scenario #1: Buying the pound today is possible when GBP/USD reaches the entry point at about 1.2497 (the green line on the chart). The upward target is seen at the level of 1.25376 (the thicker green line on the chart). In the area of 1.2537, it is recommended to exit long positions and open short ones in the opposite direction, reckoning a movement of 30-35 points in the opposite direction from that level. You can count on the pound's growth today and a further move along the trend, especially after the strong UK statistics. Important! Before buying, make sure that the MACD indicator is above the zero mark and only begins its growth from it.

Scenario #2: We can also buy the pound today in the case of two consecutive price tests at 1.2464, at the moment when the MACD indicator will be in the oversold area. This will limit the downside potential of the pair and lead to a market reversal upwards. You can expect growth to the opposite levels of 1.2497 and 1.2537.

Sell signals

Scenario #1: It's a good idea to sell the pound today after the level of 1.2464 (the red line on the chart) is updated. It will push GBP/USD sharply down. The key target for sellers will be 1.2424, where it is recommended to exit short positions and immediately open immediate long ones in the opposite direction, bearing in mind a movement of 20-25 points in the opposite direction from that level. GBP/UDS may come under selling pressure in case of unsuccessful consolidation at the monthly high. Important! Before selling, make sure that the MACD indicator is below the zero mark and only begins its decline from it.

Scenario #2: Another option to sell the pound today is when the price makes two consecutive tests at 1.2497, at the moment when the MACD indicator will be in the overbought area. This will limit the upward potential of the pair and encourage a downward reversal in the market. A decline is projected to the opposite levels of 1.2464 and 1.2424.

What's on the chart

The thin green line is the key level at which you can open long positions on the EUR/USD pair.

The thick green line is the target price, since the price is unlikely to move above this level.

The thin red line is the level at which you can open short positions on the EUR/USD pair.

The thick red line is the target price, since the price is unlikely to move below this level.

MACD line. When entering the market, it is important to adjust trading decisions to the overbought and oversold zones.

Importantly, novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid trading during sharp fluctuations in market quotes. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation will inevitably lead to losses for an intraday trader.