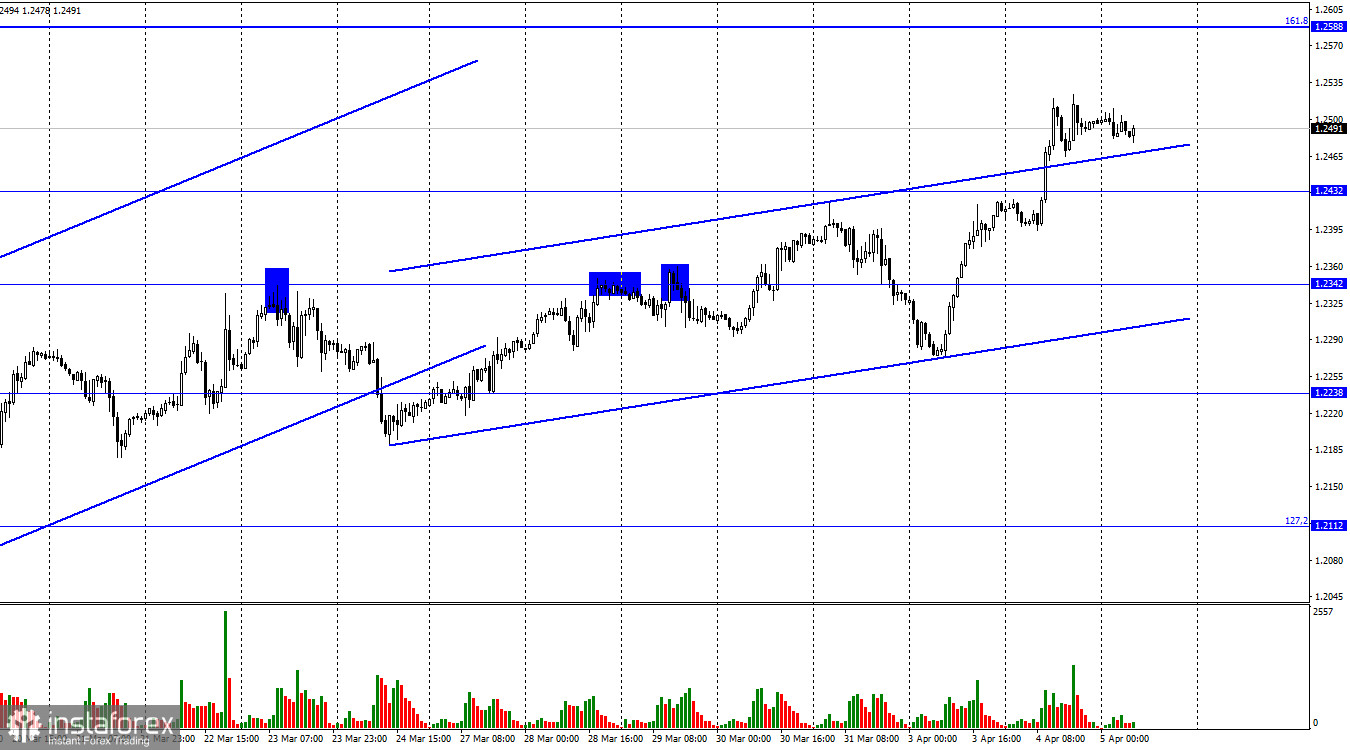

According to the hourly chart, the GBP/USD pair resumed its rise on Tuesday, closing above the 1.2432 level. Consequently, the British pound's growth can continue toward the corrective level of 161.8% (1.2588). The new upward trend corridor characterizes the "bullish" attitude of traders. The British pound has no real support for the information backdrop yet keeps growing, which appears odd.

Yesterday was nearly completely forgotten. Even the first report on the US labor market for the pound had no major consequences. Nonetheless, even in the first half of the day, traders actively purchased the pound, which resulted in a strong gain the next day. The current behavior of traders can be characterized as follows. The British pound is growing, and everyone who can is using it. Typically, such an information background, as it was today or last week, does not result in significant price fluctuations. The increase in the British dollar may be explained if there was a strong background, such as a high chance of a major tightening of the Bank of England's PPEP soon. At the most recent meeting, however, the British regulator announced a reduction in the rate of interest rate hikes. Market participants anticipate it will increase by a maximum of 0.25 percent, or two-to-three times its current value. In addition, the Fed's rate will certainly increase by 0.25 percentage points once more. As can be seen, the disparity between the rates is not significant. Thus, I do not believe that the British economy's growth is related to the PEPP of the Federal Reserve or the Bank of England. As stated previously, the pound's growth is, to put it mildly, unexpected. But, this week, there will be key US job market data, so the dollar will have a chance to recover some of its losses.

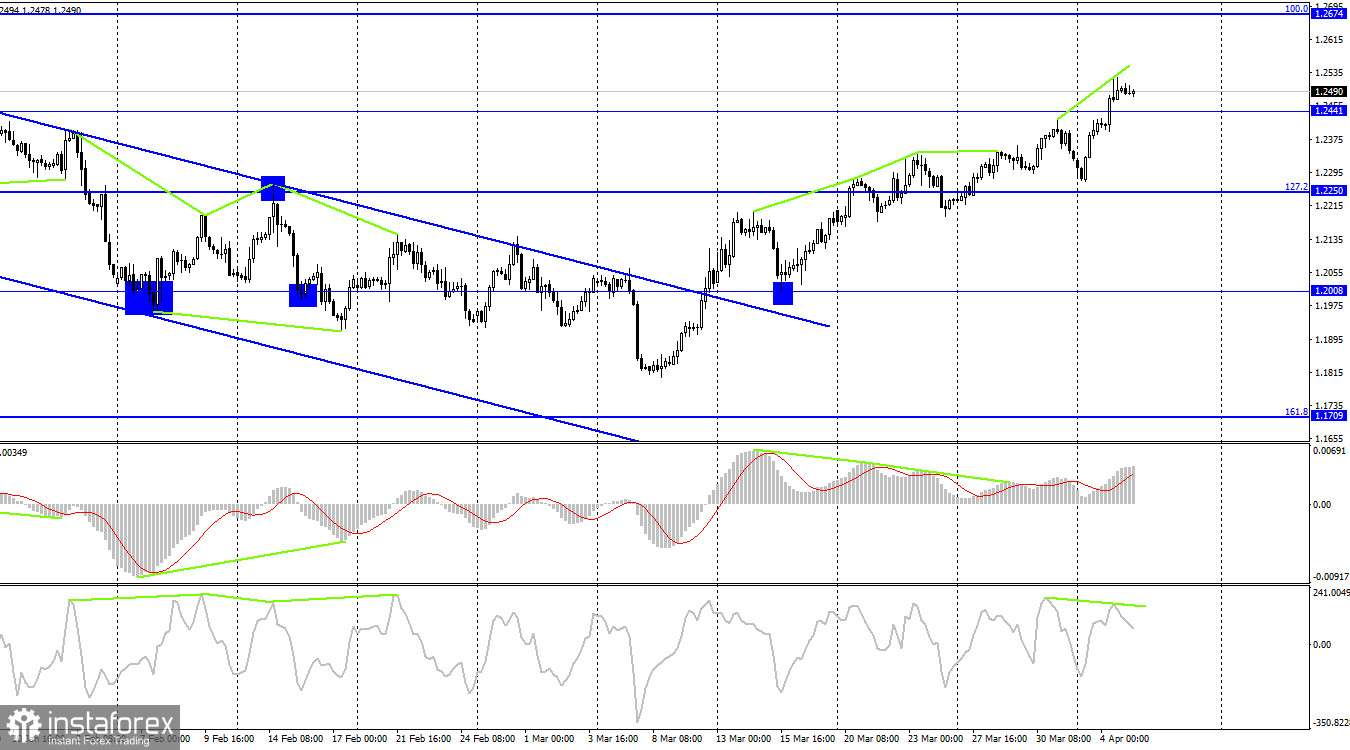

On the 4-hour chart, the pair reversed in favor of the British currency and maintained its ascent, closing above the 1.2441 level. The CSI indicator is forming a new "bearish" divergence, but the three previous "bearish" divergences did not significantly decline the British pound. Many sell signals have been issued recently, but the bears are on holiday. Currently, the pound can participate in a course at the Fibo level of 100.0% (1.2674).

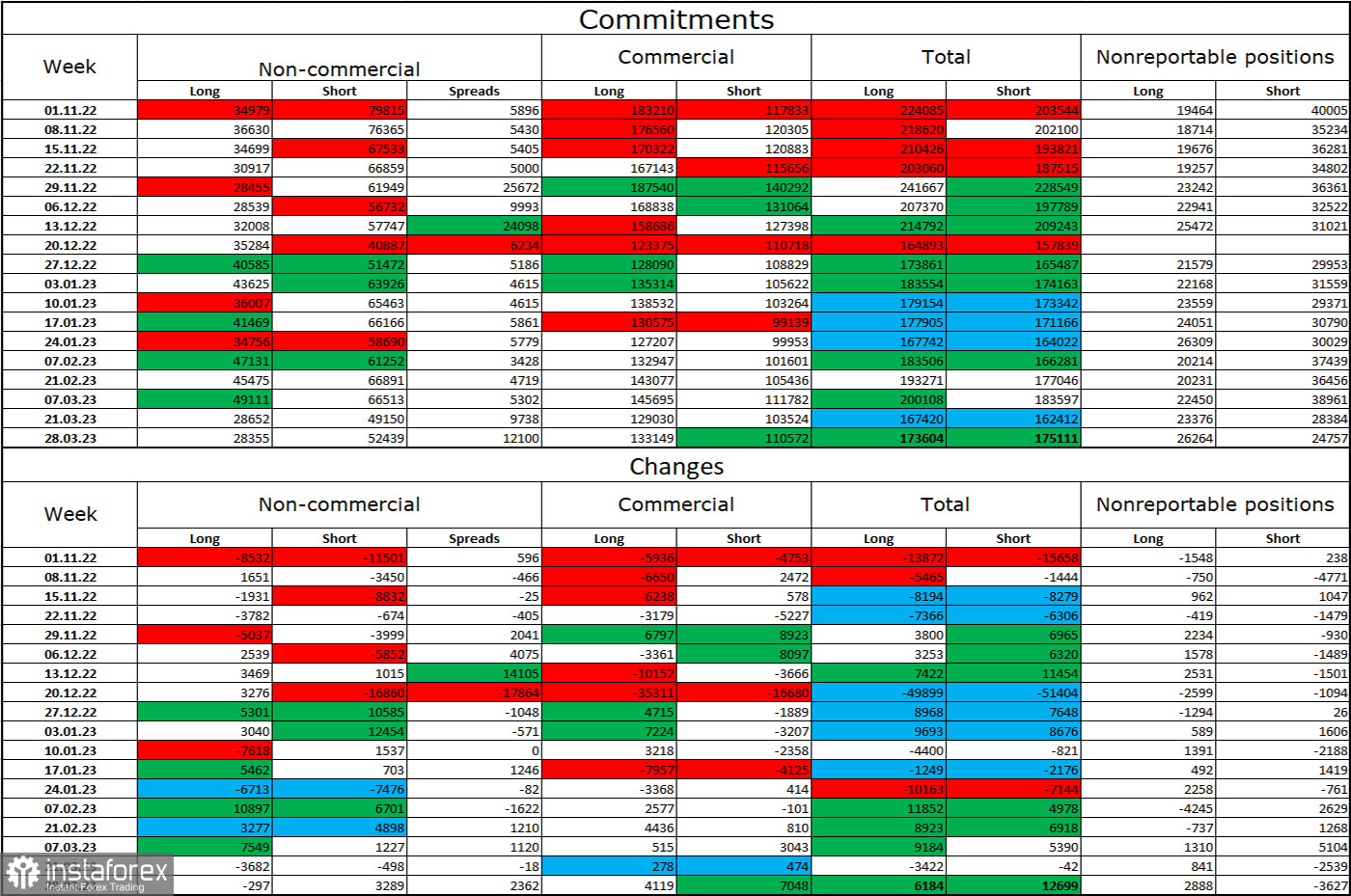

Report on Commitments of Traders (COT):

The sentiment of the "non-commercial" group of traders has moved little over the past week. The number of long contracts held by speculators declined by 297 units, while the number of short contracts grew by 3,289. The general sentiment of the key market participants remains "bearish," and the number of short contracts remains significantly greater than the number of long contracts. During the past few months, the situation has steadily shifted in favor of the pound. Still, the disparity between speculators' long and short positions remains substantial.

Consequently, the outlook for the pound is improved, yet the average British pound has not grown or decreased over the past few months. On the 4-hour chart, there was a breakout outside of the descending corridor; at this time, the pound can be supported. Yet, I observe that many factors contradict each other, and the information background does not offer much support to the pound.

News calendar for the United States and the United Kingdom:

UK – index of business activity in the service sector (08:30 UTC).

US – change in the number of people employed in the non-agricultural sector from ADP (12:15 UTC).

US – business activity index (PMI) in the services sector (13:45 UTC).

US – ISM purchasing managers index for the non-manufacturing sector of the US (14:00 UTC).

Wednesday's economic event calendars in the United Kingdom and the United States have numerous noteworthy entries. Today, the impact of the information context on the sentiment of traders may be of average strength.

GBP/USD forecast and trading suggestions:

Sales of the British pound are currently risky since the pound is growing nearly every day. Purchasing the British pound is risky because it has risen substantially, and we have recently received a vast amount of sell signals.