The cryptocurrency market has maintained a stable trend over the past few weeks, with Bitcoin trading near $29,000. Although there have been no significant price fluctuations, the flagship digital currency has managed to avoid any major corrections following its strong growth. The ascending trend line continues to signal a bullish sentiment and remains far enough from the actual price that any correction is unlikely to reverse this trend. As a result, Bitcoin is expected to rise to $29,750, even though it has only a short distance left to cover.

As for the fundamental backdrop, the situation has remained virtually unchanged over the last week, with no significant events impacting the market. There have been no major macroeconomic publications or important statements from Federal Reserve representatives. However, one notable development is the continuous depreciation of the US dollar against almost all of its competitors over the past few weeks. This seems that it is not the euro, pound sterling, or Bitcoin that are growing, but rather the US dollar that is losing value.

The potential reason for this depreciation is the banking crisis in the United States forcing the Federal Reserve to launch a new quantitative easing program amounting to approximately $300 billion. While it is unlikely that all of these funds were immediately injected into the market, the mere fact that the Federal Reserve is resorting to stimulus measures again has dampened demand for the US currency. Furthermore, the market's expectations for the Federal Reserve's interest rate have sharply decreased recently. While just a few weeks ago, the market anticipated 2-3 rate hikes in 2023 to around 5.75%, the decline in inflation and the banking crisis have now altered these expectations to only one increase in May.

While the Federal Reserve's interest rate continues to rise, there are still certain factors favoring Bitcoin's growth. This positive sentiment, combined with the weakening US dollar and a lack of major market-moving events, is contributing to Bitcoin's sustained bullish trend and potential for further gains.

By and large, Bitcoin has always grown based on market participants' expectations and beliefs. The market currently understands that there is no need to anticipate significant tightening of monetary policy from the Federal Reserve, and the ongoing banking crisis may provoke a faster reduction in key interest rates. If inflation continues to decline at its current pace, interest rates could begin to fall by the end of the year. As a result, crypto traders are simply working in advance on the future positive fundamental backdrop. We expected Bitcoin to start growing, but we believed it would happen later. However, Bitcoin is unlikely to surge significantly higher based solely on the refusal to raise interest rates. After all, it has already appreciated by nearly 100% from its last low.

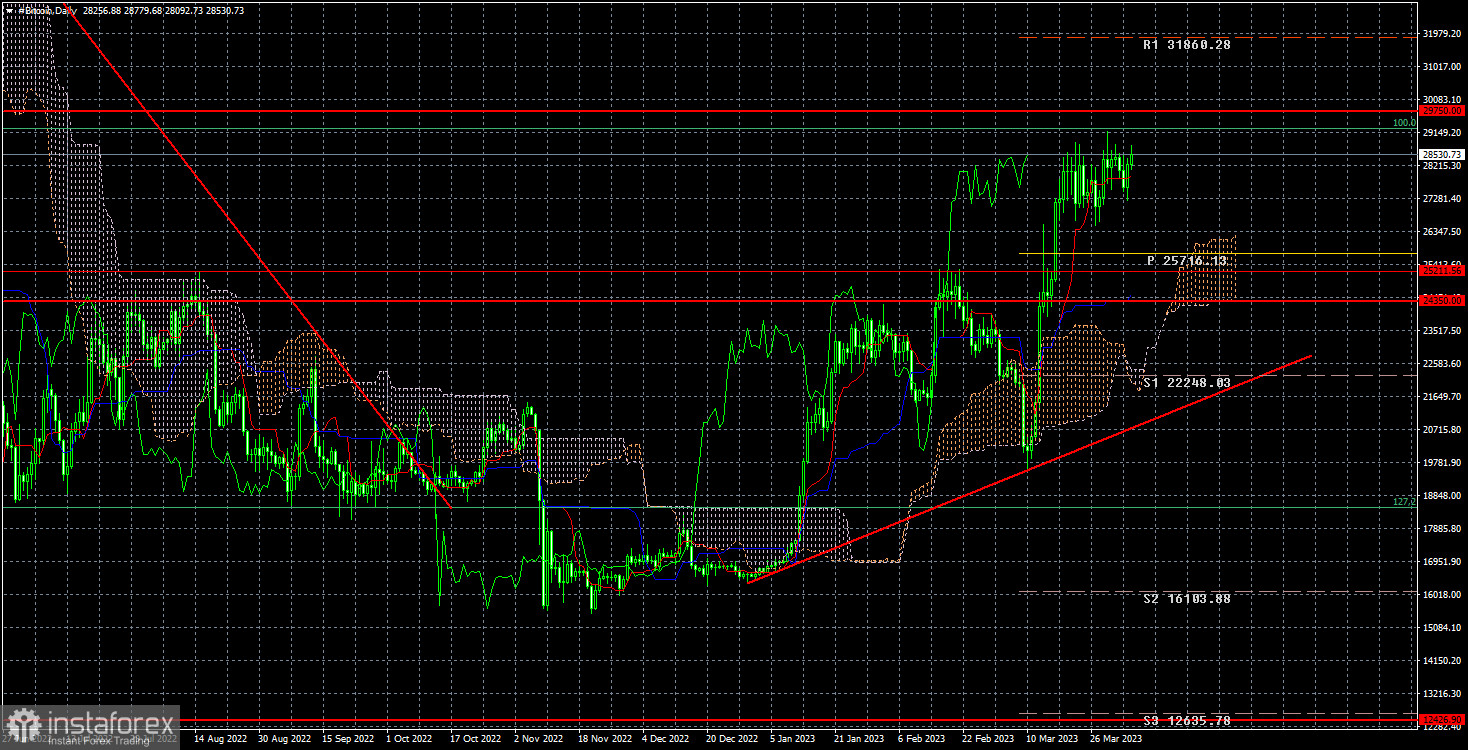

On the 24-hour time frame, Bitcoin has broken through the crucial level of $25,211, offering a good entry point for traders to open long positions with a target of $29,750. A bounce from this level may create selling opportunities, as the asset should at least slightly correct after a further 30% increase (or nearly 100% collectively from its recent lows). If the level of $29,750 is surpassed, traders can open long positions or hold onto existing ones with a target of $34,267.