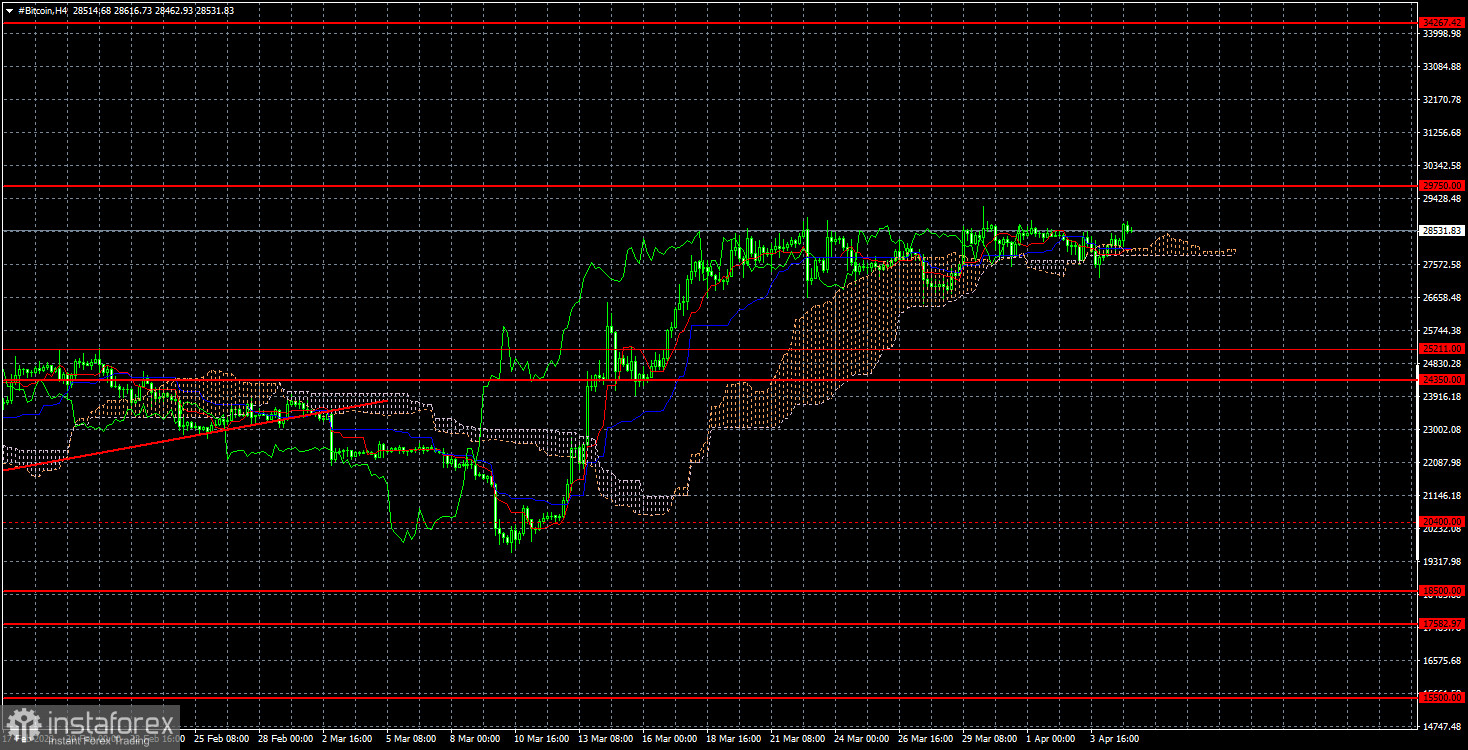

On the 4-hour time frame, the situation is particularly notable. Bitcoin has sharply risen and has easily overcome $25,211. However, after another upward surge, it has stalled and has been in a clear sideways trend for three weeks now. We have observed the same thing when Bitcoin was actively falling: a sharp drop followed by a flat trend for several weeks/months. Therefore, such uneven movement is not surprising. There is no sign of a correction at the moment, as the US dollar is declining across the board, providing additional support to cryptocurrency assets. Currently, it is reasonable to expect a breakthrough of either side of the horizontal channel ($26,676 - $28,789) followed by a move into that direction.

Last week, there were virtually no fundamental factors. This week, important data on the US labor market and unemployment will be published. Since the US dollar is falling across other currencies, it is vital for USD that Friday's statistics turn out to be strong. If the data is weak, it will simply provide another reason for market participants to sell the US currency. If demand for the US dollar falls further, Bitcoin and other assets may rise. However, if the statistics are strong, the US dollar may slightly increase in value, but it may not affect Bitcoin at all, as it would require crypto traders to start dumping it. And why sell Bitcoin now if almost everyone believes a new "bullish" trend has begun?

Therefore, we believe that Bitcoin will continue to grow in the medium term, following the pattern of a sharp upsurge followed by a flat for several weeks. The US statistics on Friday may only trigger further growth of the world's leading cryptocurrency. The next Federal Reserve meeting is still some time away, but even that is unlikely to dissuade traders from triggering a "bullish" trend. We would say that the fundamental background for BTC has subtly shifted to a more favorable one. And when the Federal Reserve starts to lower rates closer to the end of the year, the leading cryptocurrency may increase even higher. However, this favorable background is still perceived through existing expectations of traders and their belief in Bitcoin's upside potential. The asset itself still has no intrinsic value and does not provide any particular benefit to humanity. People continue to buy it only to profit from it, and not to use it for payments and settlements.

On the 4-hour timeframe, BTC has begun a new round of upward movement. Earlier, we advised buying Bitcoin if it climbs above $25,211. Thus, it is now possible to keep long positions open, targeting $29,750. Overcoming this level will allow opening new long positions with a target of $34,267. Selling during this bullish trend is not relevant, but upon a rebound from $29,750, small short positions can be opened with a target about $2,000-3,000 lower than the current level.