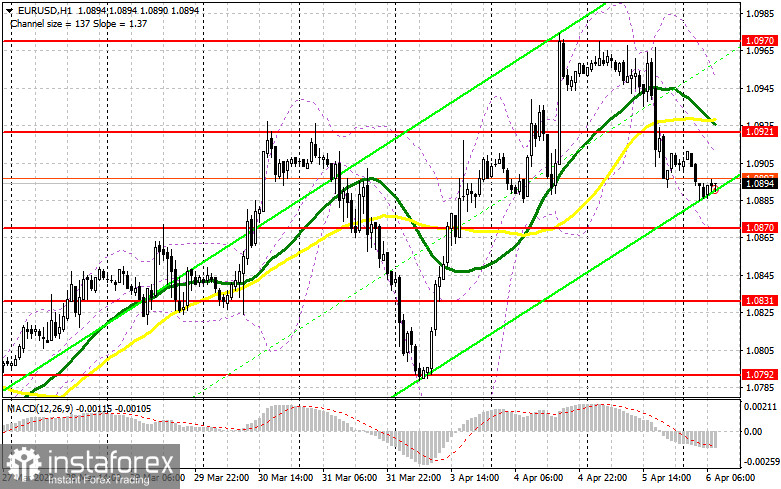

Yesterday, no market entry signals were formed. I suggest taking a look at the 5-minute chart and analyzing what happened there. In my morning forecast, I mentioned the 1.0927 level and recommended making market entry decisions from it. Due to a sharp drop in the market's volatility, the pair couldn't decline or form a false breakout. In the second half of the day, the break through the 1.0927 level remained without a reverse test, leaving us without a sell signal.

To open long positions on EURUSD:

Today's first half of the day promises to be just like yesterday. Forecasted data on changes in German industrial production volume and the PMI index for the construction sector are unlikely to cause a spike in volatility, so I expect trading to remain within a sideways channel. In case of a negative reaction to the data, the 1.0870 area will act as good support. That's where I plan to wait for a false breakout with a buy signal and a target of returning to the 1.0921 resistance, which bulls missed yesterday during the American session. A breakthrough and top-down test of this range will return the market to the buyers' side, forming an additional entry point for adding long positions with a return to the monthly high of 1.0970. The furthest target remains at the 1.1002 area, where I will lock in profits. In the case of a decline in EUR/USD and no buyers at 1.0870, which cannot be ruled out, pressure on the euro will increase even more ahead of tomorrow's US labor market data, and we will see a downward movement towards 1.0831. Only forming a false breakout there will give a signal to buy the euro. I will open long positions immediately on the rebound from the low of 1.0792, keeping in mind an intraday upward correction of 30-35 pips.

To open short positions on EURUSD:

Sellers took advantage of the pair's growth after weak US data and managed to push the market down quite well. Now, the important task for bears is to protect the nearest resistance at 1.0921 formed yesterday. Just above this level, the moving averages are playing on the bears' side. I expect to see major players entering the market at 1.0921. So the optimal scenario for opening new short positions will be a false breakout there. Weak data from Germany will increase pressure on the euro, leading to a decline in the pair towards the nearest support of 1.0870. A breakout and reverse test of this range will further increase pressure, pushing the pair down to 1.0831. Consolidation below this range will open the way to 1.0792, thus returning the market to a bearish trend. That's where I will lock in profits. In case of an upward movement in EUR/USD during the European session and no bears at 1.0921, which is also quite possible, I advise you to postpone short positions until the 1.0970 level. You can sell there only after unsuccessful consolidation. I will open short positions immediately on the rebound from the high of 1.1002, targeting a downward correction of 30-35 pips.

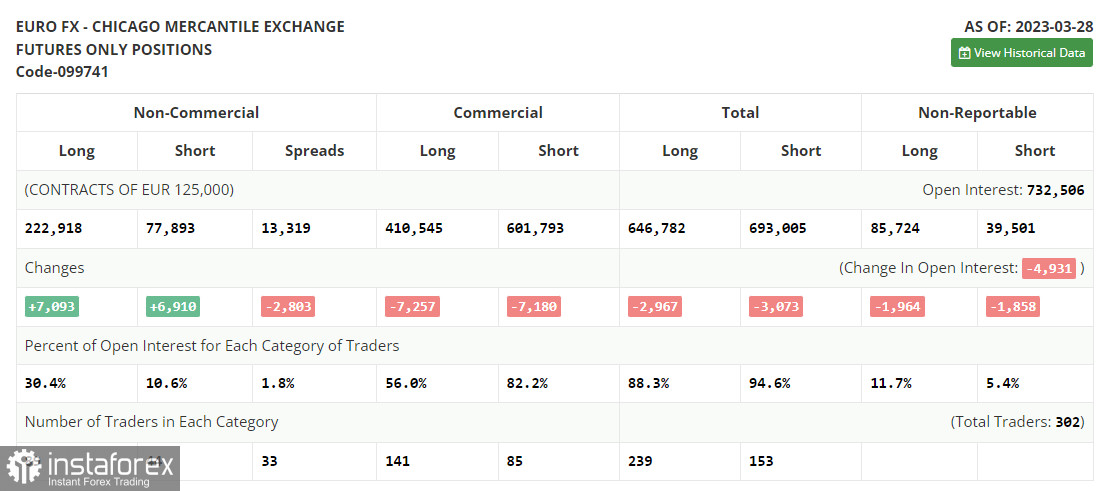

COT report:

In the Commitments of Traders report for March 28th, an increase in both long and short positions was recorded. Considering that nothing interesting happened last week, and the US personal consumption expenditure price index data turned out not as good as economists expected, the Federal Reserve System will likely raise rates again at the next meeting. However, an aggressively-minded European Central Bank, which will undoubtedly continue to actively raise interest rates further, allows the euro buyers to act more aggressively on every significant euro decline against the dollar. Apart from US unemployment data this week, there is nothing interesting, so the euro has every chance to update its March highs. The COT report indicates that non-commercial long positions increased by 7,093 to 222,918, while non-commercial short positions jumped by 6,910 to 77,893. As a result, the total non-commercial net position increased to 145,025 against 144,842. The weekly closing price went up to 1.0896 from 1.0821.

Indicator signals:

Moving Averages

Trading above the 30- and 50-day moving averages indicates a further possible rise in the euro

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair declines, the upper band of the indicator at 1.0900 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.