Fears intensified in the market, after Wednesday's new ADP employment report and values of some other important indicators, that the US will enter recession this year with all ensuing consequences.

According to the ADP data, the US economy added 145,000 jobs in the non-farm payrolls sector in March, versus a forecast of 200,000 and an upward revision to 261,000 jobs in February. In addition, the ISM Services and Non-Manufacturing PMIs were weak, as was the ISM Non-Manufacturing Purchasing Managers' Index for the U.S. supply sector.

This news has raised fears that America may enter a recession as soon as summer, but still high inflation may continue to encourage the Federal Reserve to raise interest rates to moderate it, a very unpleasant surprise to markets that had previously hoped that a combination of the two would not happen.

Time will tell what it will really be like, but the situation may change, and drastically. What could happen?

I think that if tomorrow's employment report shows, as well as the ADP, a big drop in new jobs, then given last week's inflation numbers - the price index for personal consumption expenditures and the like - we can expect a hawkish rhetoric from Fed members regarding the need to continue to aggressively raise rates in the future to weaken. The central bank may decide to pause the rate hike cycle in May, assuming that the wave of declining new jobs, which points to increased layoffs of workers, will reduce demand from the population, which in turn will put pressure on inflation to continue its decline.

Under this scenario we can expect a sharp shift in sentiment in financial markets, which may lead to increased demand for stocks of companies, as investors will believe that if the Fed raises the rate again, it is highly likely to be the last one. But again, note that this should only be expected if updated inflation data coming out this month show a continued decline.

Forecast of the day:

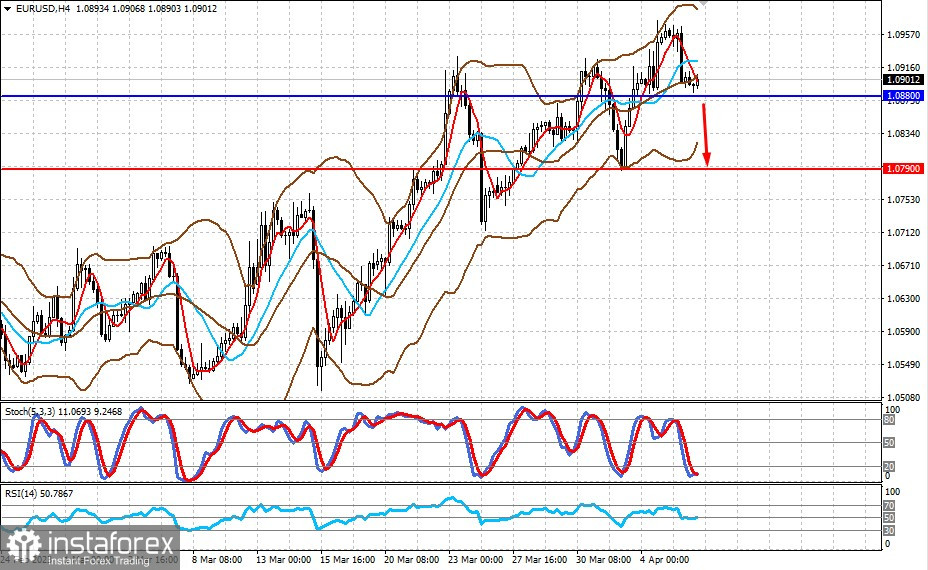

EURUSD

The pair is trading above 1.0880. If the negative sentiment persists on the market today, we can expect the pair to fall below this level and decline to 1.0790.

USDCAD

The pair is recovering amid the correction in crude oil prices and rising concerns related to the recession beginning in America. The persistence of these sentiments might push the pair to rise above 1.3500 to 1.3560.