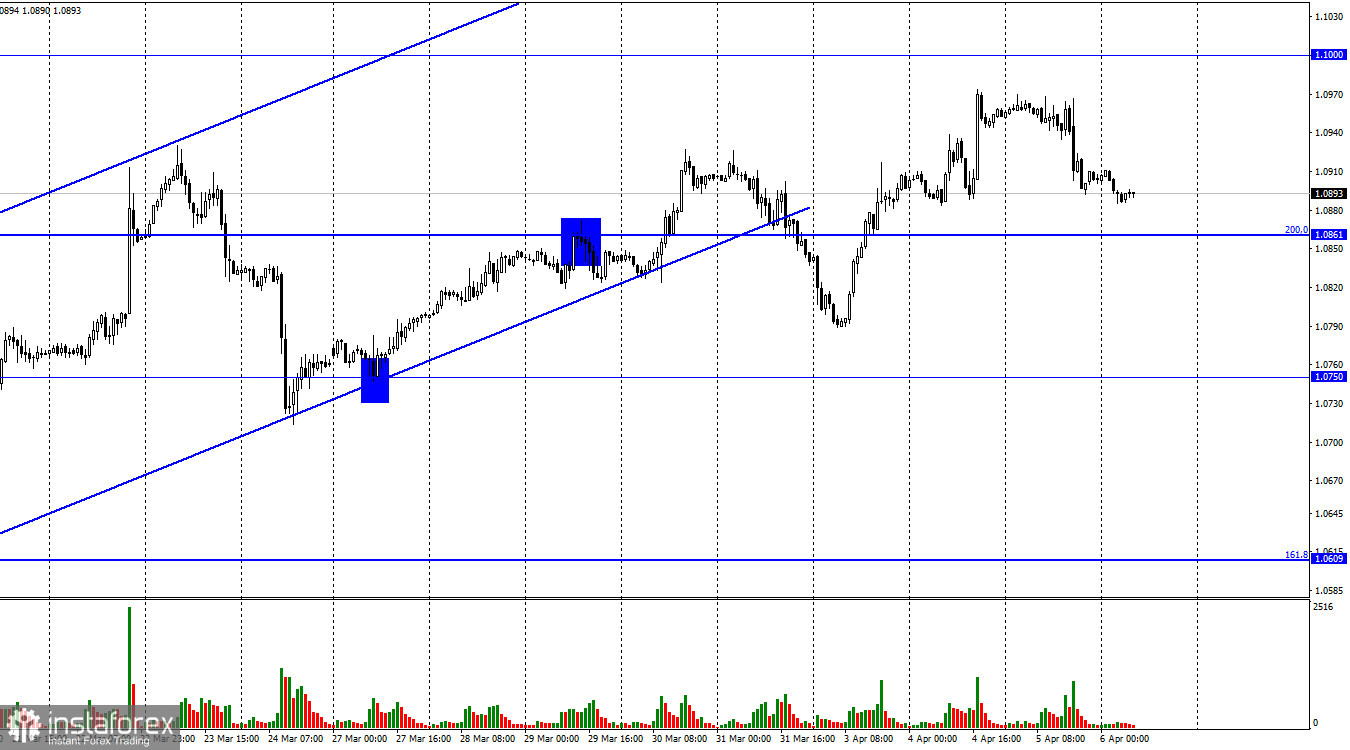

Hi, dear traders! On Wednesday, EUR/USD reversed downwards, sliding down towards the 200.0% retracement level at 1.0861. If the pair bounces off this level, it would rebound in the direction of 1.1000. If the pair closes below 1.0861, a continued decline towards 1.0750 will become more likely.

This week, traders are primarily focusing on US PMI and labor market data, with the labor market being particularly important. Remember that the US economy is currently in a relatively good state, as the Federal Reserve increased interest rates to 5%. GDP is growing steadily, unemployment remains near record lows, and the labor market continues to create new jobs. However, this week has already seen two warning signs indicating that the situation in the labor market is worsening. On Tuesday, the JOLTS report indicated significantly fewer job openings in the US. Yesterday, the ADP non-farm payrolls fell short of traders' expectations by around 25%. Traders didn't give much importance to the ADP report; however, the key ISM Services index also failed to meet optimistic predictions. The dollar struggled to recover yesterday. On Friday, the most critical labor market reports - the Nonfarm Payrolls and jobless claims - will be released. Based on the first two reports, their figures might be worse than currently anticipated. Therefore, the dollar may come under pressure for the rest of the week, unless bearish traders receive a pleasant surprise on Friday.

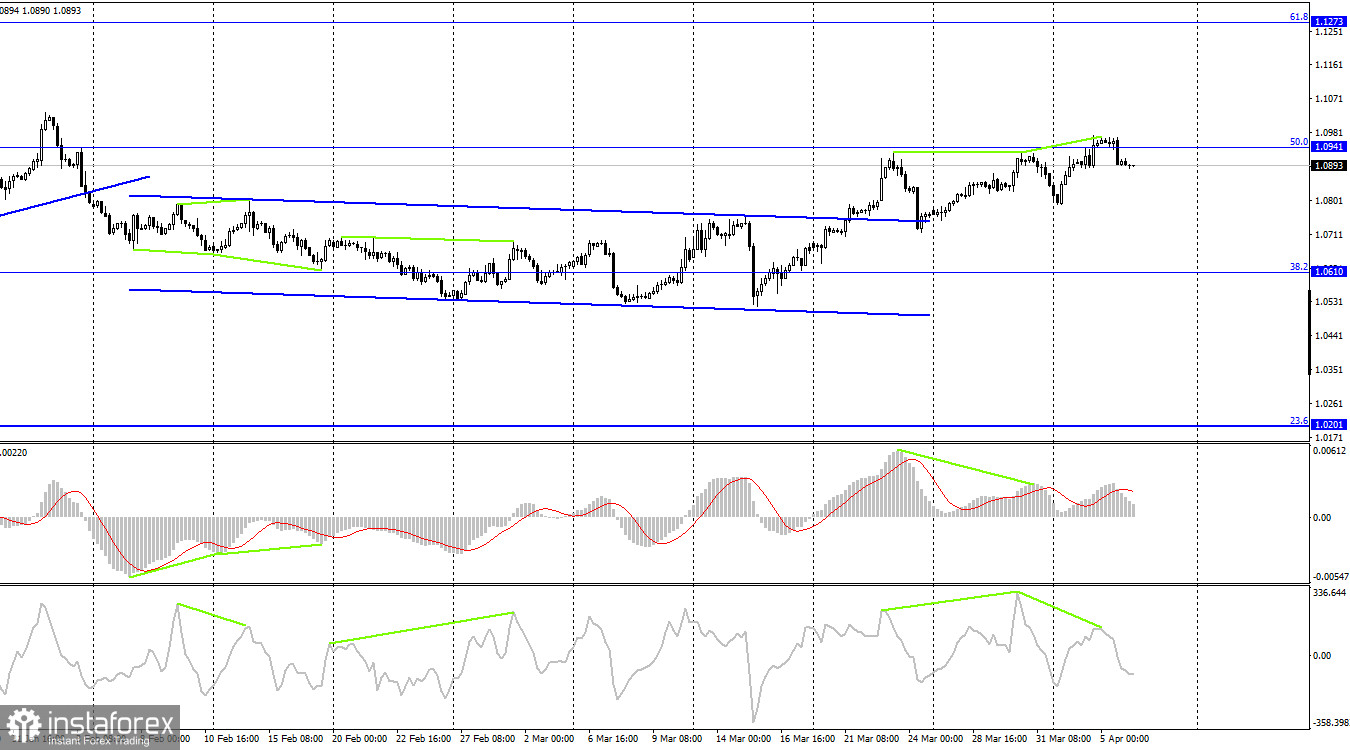

According to the 4-hour chart, the pair has stabilized above the sideways channel, suggesting that it has potential for further growth. However, it has not yet managed to settle above the 50.0% retracement level at 1.0941, and three "bearish" divergences have already formed. Consequently, on both charts, a decline in the pair seems increasingly likely. Nevertheless, if the pair closes above 1.0941, it will pave the way for continued growth towards the 61.8% retracement level at 1.1273.

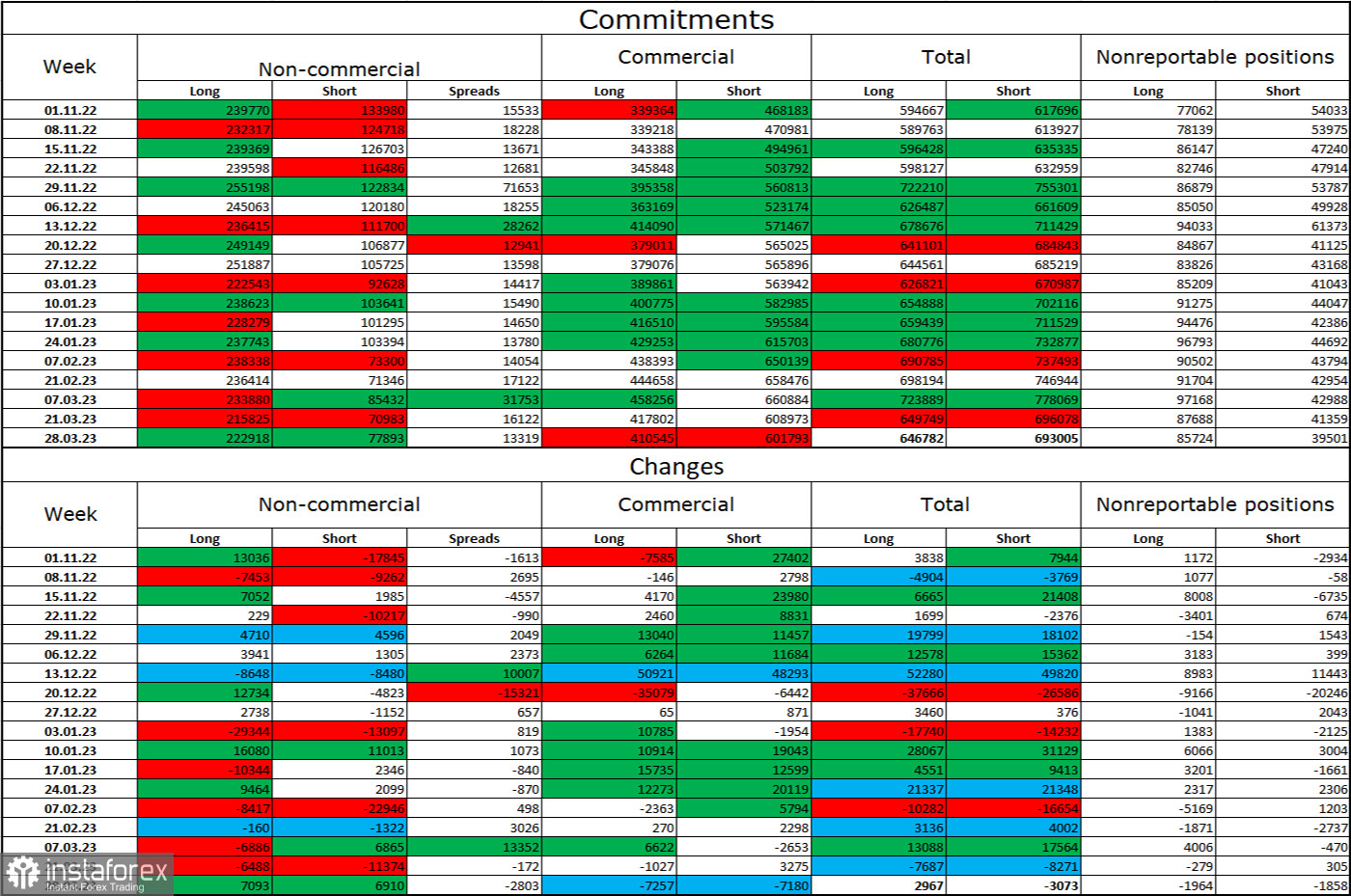

Commitments of Traders (COT) report:

During the reporting week, investors opened 7,093 Long positions and 6,910 Short positions. The sentiment among large-scale traders remains bullish and continues to gain momentum. Speculators currently hold a total of 223,000 Long contracts and 78,000 Short contracts. The European currency has advanced over the past six months; however, the number of Long contracts held by professional traders has plateaued in recent weeks. Despite emerging from a prolonged period of losses, the euro's outlook remains relatively positive, at least while the ECB incrementally raises interest rates by 0.50%. It is important to note that market sentiment may soon turn bearish, as the ECB cannot indefinitely keep hiking the rate by half a percent. Both charts exhibit sell signals.

US and EU economic calendar:

US - Initial jobless claims (12-30 UTC).

There is only one notable event on the economic calendar on April 6, which would have a minimal impact on traders.

Outlook for EUR/USD:

Traders may consider opening short positions if the pair rebounds from 1.0941 on the 4-hour chart, targeting 1.0861 and 1.0750. Long positions can be opened if the pair closes above 1.0941 on the 4-hour chart, targeting 1.1000 and 1.1100.