In my morning forecast, I emphasized the level of 1.0921 and advised traders to base their market entry decisions on it. Let's analyze the 5-minute chart to see what happened. As a result of the market's minimal volatility, there was never a false breakout at this level. The technical situation and strategy have not changed for the second half of the day.

To initiate long positions on the EUR/USD, you must:

Given that nothing extraordinary is expected in the afternoon, market positioning will likely continue, and volatility will stay low. Since buyers could not move above 1.0921, bears will have the opportunity to update daily lows. Good data on the weekly number of initial claims for unemployment benefits in the United States and the speech of FOMC member James Bullard should help in this endeavor. Because the market situation has not changed, I recommend the following course of action: in the event of a pair decline, the 1.0870 area will serve as a good support level. I intend to wait there for the formation of a false collapse with a buy signal and the target of returning to the resistance of 1.0921, which we did not achieve today. A breakout and a top-down test of this range will restore the market to the buyer's side, providing an extra entry opportunity for establishing long positions with a rebound to 1.0970, the monthly high. The area around 1.1002 remains the farthest target, where I will fix the profit. Given the possibility of a EUR/USD decrease and a lack of buyers at 1.0870 in the afternoon, which cannot be ruled out, the pressure on the euro will intensify even more ahead of tomorrow's U.S. labor market data. In this circumstance, a decline to 1.0831 cannot be avoided. Only the formation of a false collapse will serve as an indication to purchase the euro. I will begin long positions immediately, anticipating a rebound from the day's low of 1.0792, targeting a 30-point-plus intraday correction.

To establish short positions on the EUR/USD, you must:

Nothing has changed for sellers: they must continue to defend the 1.0921 level of resistance created by yesterday's price action. Moving averages favor the bears just above this level. I expect significant participants to enter the market at 1.0921, so the ideal situation for starting new short positions will be the development of a false breakout. Positive statistics on the U.S. labor market will intensify the pressure on the euro, resulting in a drop to the area of 1.0870, the nearest support. A breakout and retest of this range will intensify the pressure, pushing the pair to 1.0831. A consolidation below this level will also allow entry to 1.0792, restoring the market's negative trend. I will fix the profit there. If the EUR/USD moves higher throughout the American session and there are no bears around 1.0921, which is a plausible scenario, I recommend delaying short positions to 1.0970. After a failed consolidation, you can sell. I will begin short positions immediately in anticipation of a rebound from the maximum of 1.1002 with the target of a 30-35 point decline.

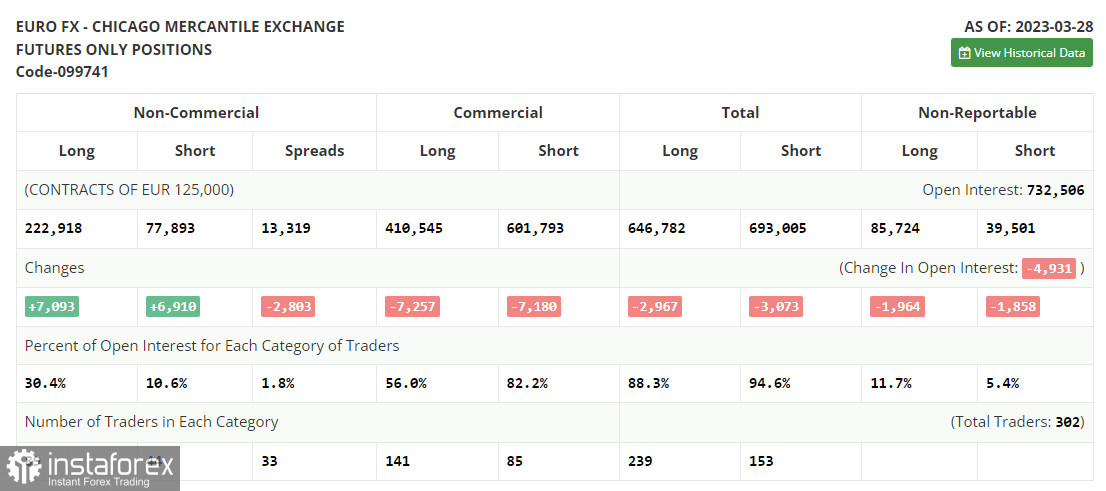

The Commitment of Traders (COT) report for March 28 revealed a rise in both long and short positions. Given that nothing noteworthy occurred last week and the figures on the price index of personal consumption expenditures in the United States were not as favorable as experts had anticipated, the Federal Reserve will likely raise interest rates at its next meeting. Yet, the aggressive European Central Bank, which will continue to raise interest rates aggressively, enables buyers of the European currency to act more aggressively with each significant loss of the euro versus the dollar. Aside from the U.S. unemployment data, there is nothing noteworthy this week. Therefore the euro has a good chance of surpassing the highs of March. According to the COT data, long non-commercial positions increased by 7,093 to 222,918, while short non-commercial positions increased by 6,910 to 77,893. The total non-commercial net position increased from 144,848 to 145,025 toward the week's conclusion. The weekly ending price increased from 1.0821 to 1.0896.

Signals from indicators

Moving Averages

Trade occurs just below the 30-day and 50-day moving averages, indicating an attempt by bears to continue the market drop.

The author considers the period and prices of moving averages on the hourly chart H1, which differs from the standard definition of daily moving averages on the daily chart D1.

Bollinger Bands

The indicator's upper limit near 1.0921 will act as resistance in an upward trend.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.