On Thursday, EUR/USD completed a reversal in favor of the European currency and rose towards the 1.1000 level. However, the overall movement was very weak and almost horizontal. Today, the situation is even worse. The market is barely moving, which can be attributed to Good Friday. At the same time, important reports will be released in the United States later in the day. This means that today is both a holiday and a day with crucial macroeconomic data. How will traders react to the combination of these two events?

On the one hand, traders have already demonstrated during the European session that they have taken a break. On the other hand, how can one miss the Nonfarm Payrolls and unemployment reports, on which the Federal Reserve's monetary policy largely depends? In my opinion, anything can be expected in a couple of hours. Traders may wake up or they may show a postponed reaction on Monday. As for the reports, it is unclear whether there will be any reaction to them and what the reading will be. The European currency has been rising recently, so the US dollar needs strong reports to activate the bearish trend.

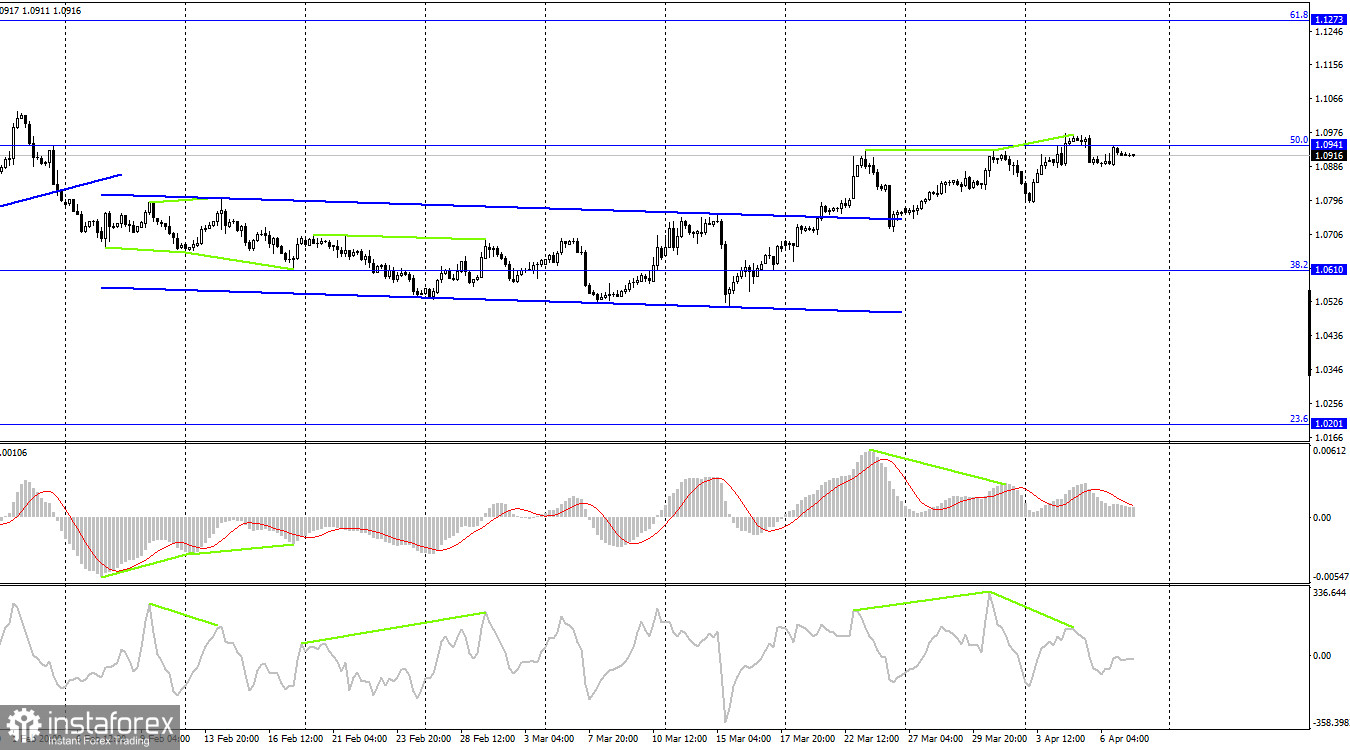

On the 4-hour chart, the pair has consolidated above the sideways channel, allowing traders to anticipate further growth. However, it has not yet managed to consolidate above the 50.0% Fibonacci retracement level at 1.0941, and currently, three bearish divergences have already formed. Thus, the decline of the pair continues to loom on both charts. However, closing above the 1.0941 level will suggest further growth towards the 61.8% correction level at 1.1273.

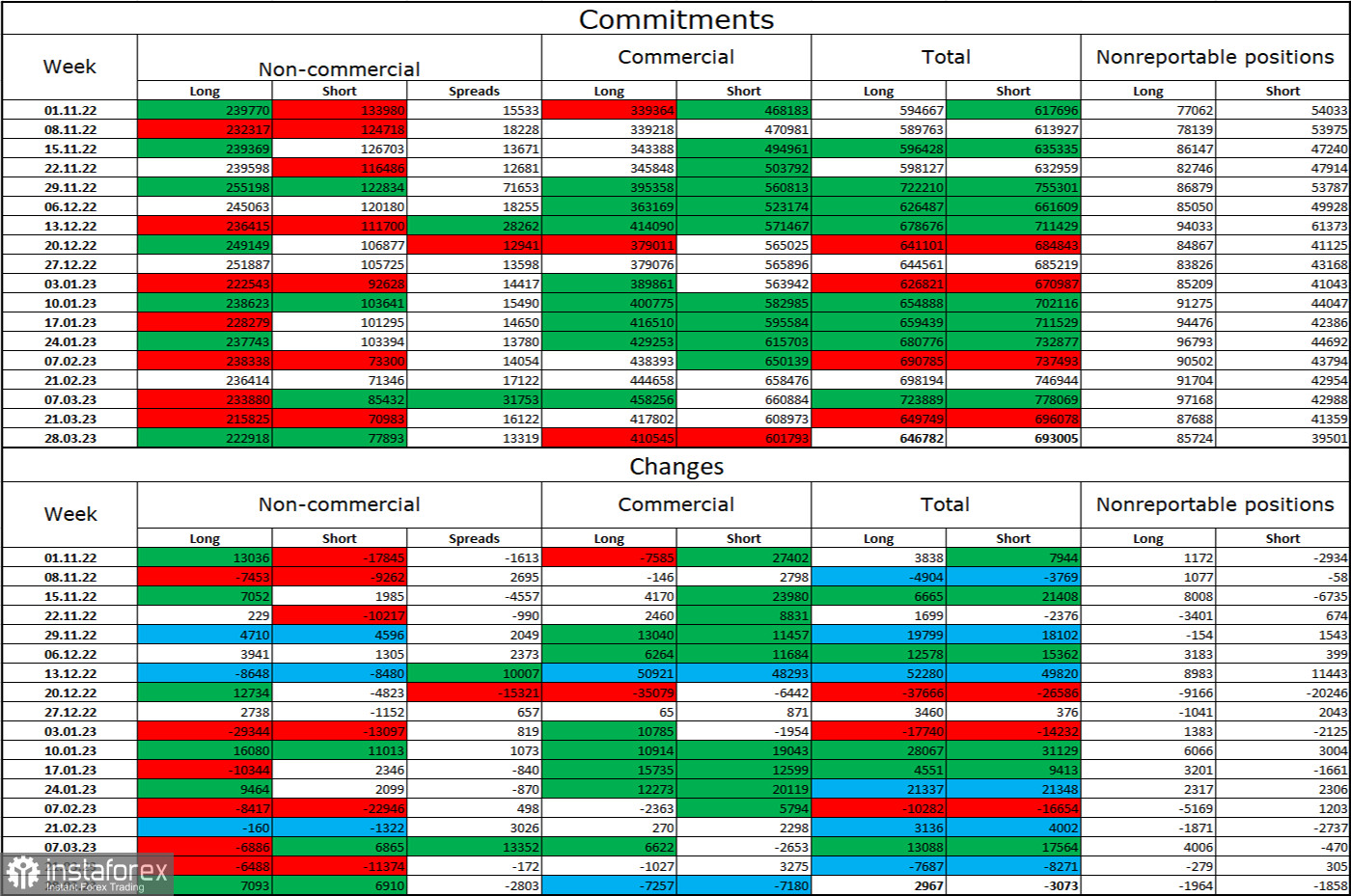

Commitments of Traders report:

During the last reporting week, traders opened 7,093 Long contracts and 6,910 Short contracts. The sentiment among large market players remains bullish and continues to strengthen overall. The total number of Long contracts held open by speculators now stands at 223,000, while Short contracts amount to 78,000. The European currency has been growing for more than half a year, but in recent weeks, the number of Long contracts among professional traders has not increased. The situation remains favorable for the euro after a prolonged "dark period." So its prospects remain quite good at least as long as the ECB raises interest rates at the pace of 0.50%. However, I would like to note that the market sentiment may soon turn bearish as the ECB will not be able to continuously increase the rate by half a percent. Sell signals are present on both charts.

Economic calendar for US and EU:

US – Average Hourly Earnings (12-30 UTC).

US – Nonfarm Payrolls (12-30 UTC).

US – Unemployment rate (12-30 UTC).

On April 7, the economic calendar for the US contains three important events. However, today is also Good Friday, so trading activity may be low. The influence of the news background on traders' sentiment today will be strong, but traders themselves may not be present today.

EUR/USD forecast and trading tips:

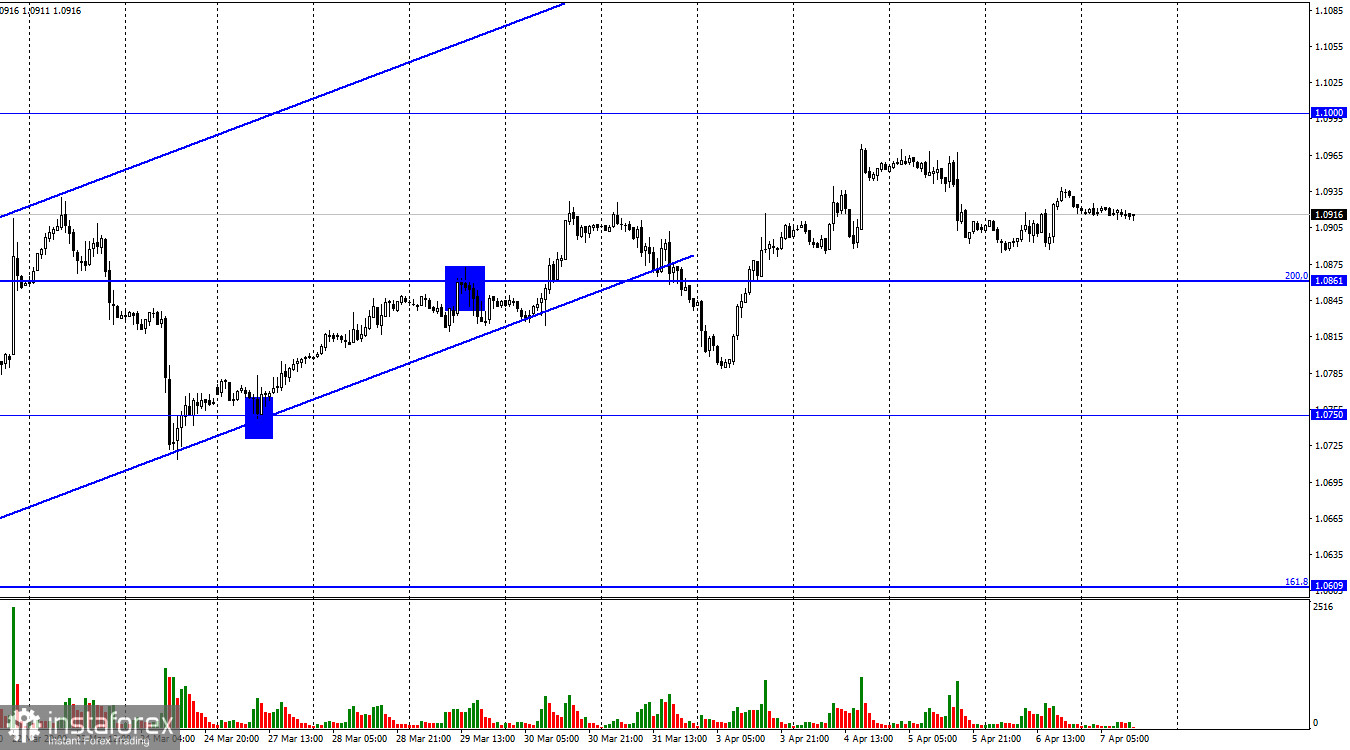

You can sell the pair after a rebound from the 1.0941 level on the 4-hour chart with the targets at 1.0861 and 1.0750. Buying the pair is possible upon closing above the 1.0941 level on the 4-hour chart with the targets at 1.1000 and 1.1100.