The absence of statistics and the pre-Easter European session did not lead to market changes in the euro and the British pound. Although sellers of the pound sterling tried to influence the situation but they did not have enough strength. In the second half of the day, traders will expect the data that may affect decisions made by the Federal Reserve. If the unemployment rate in the United States is likely to remain unchanged, the number of employed in the non-farm sector may be lower than in February. This will lead to a slight increase in the euro and the pound sterling. Big traders will certainly use this moment to increase the number of their short positions on the trading instruments. The euro and the pound sterling will resume rising only in case of weak data from the US. Otherwise, the US dollar will rise even more. For this reason, I will act according to scenario №1, which I have analyzed in detail below.

EUR/USD

Signals to buy EUR

Scenario №1: today, you can buy the euro when the price reaches the area of 1.0931 (green line on the chart) with a target at the level of 1.0957. At the point of 1.0957, I recommend exiting the market and also selling the euro in the opposite direction, expecting a movement of 30-35 pips. Notably, before opening buy orders, make sure that the MACD indicator is above zero and is starting to climb from this level.

Scenario №2: you can also buy the euro today in case of two consecutive price tests of 1.0911 when the MACD indicator is in the oversold area. This will limit the downward potential of the pair and lead to a market reversal. You can expect growth to the opposite levels of 1.0931 and 1.0957.

Signals to sell EUR

Scenario №1: you can sell the euro after reaching the level of 1.0911 (red line on the chart). The target will be located at 1.0888, where I recommend exiting the market and buying the euro immediately in the opposite direction, expecting a decline of 20-25 pips Important! Before selling, make sure that the MACD indicator is below the zero level and only begins its fall from it.

Scenario №2: you can also sell the euro in case of two consecutive price tests of 1.0931 when the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a market reversal. You can expect a decrease to the opposite levels of 1.0911 and 1.0888.

GBP/USD

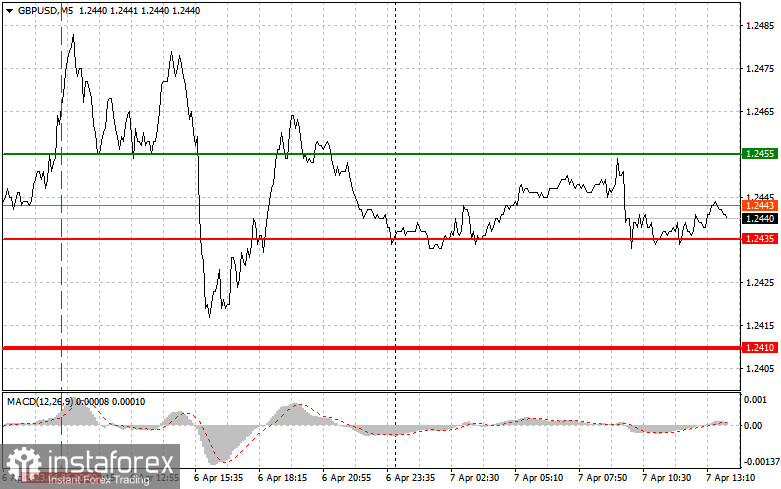

Signals to buy GBP

Scenario №1: you can buy the pound sterling today when the entry point reaches the area of 1.2455 (green line on the chart) with a target at the level of 1.2492 (thicker green line on the chart). Around 1.2492, I recommend closing buy orders and opening sell ones, expecting a change of 30-35 pips. Notably, before buying, make sure that the MACD indicator is above the zero level and only begins its growth from it.

Scenario №2: you can also buy the British pound in case of two consecutive price tests of 1.2435 when the MACD indicator is in the oversold area. This will cap the downward potential of the pair and lead to a market reversal. You can expect growth to the levels of 1.2455 and 1.2492.

Signals to sell GBP

Scenario №1: you can sell the pound sterling only if the price exceeds the level of 1.2435 (red line on the chart), which will lead to a rapid decline of the pair. The key target for sellers will be located at 1.2410, where I recommend closing sell orders and opening buy ones, expecting a change of 20-25 pips. Notably, before selling, make sure that the MACD indicator is below the zero level and only begins its fall from it.

Scenario №2: you can also sell the asset in case of two consecutive price tests of 1.2455 when the MACD indicator is in the overbought area. This will cap the upward potential of the pair and lead to a market reversal. You can expect a decrease to the levels of 1.2435 and 1.2410.