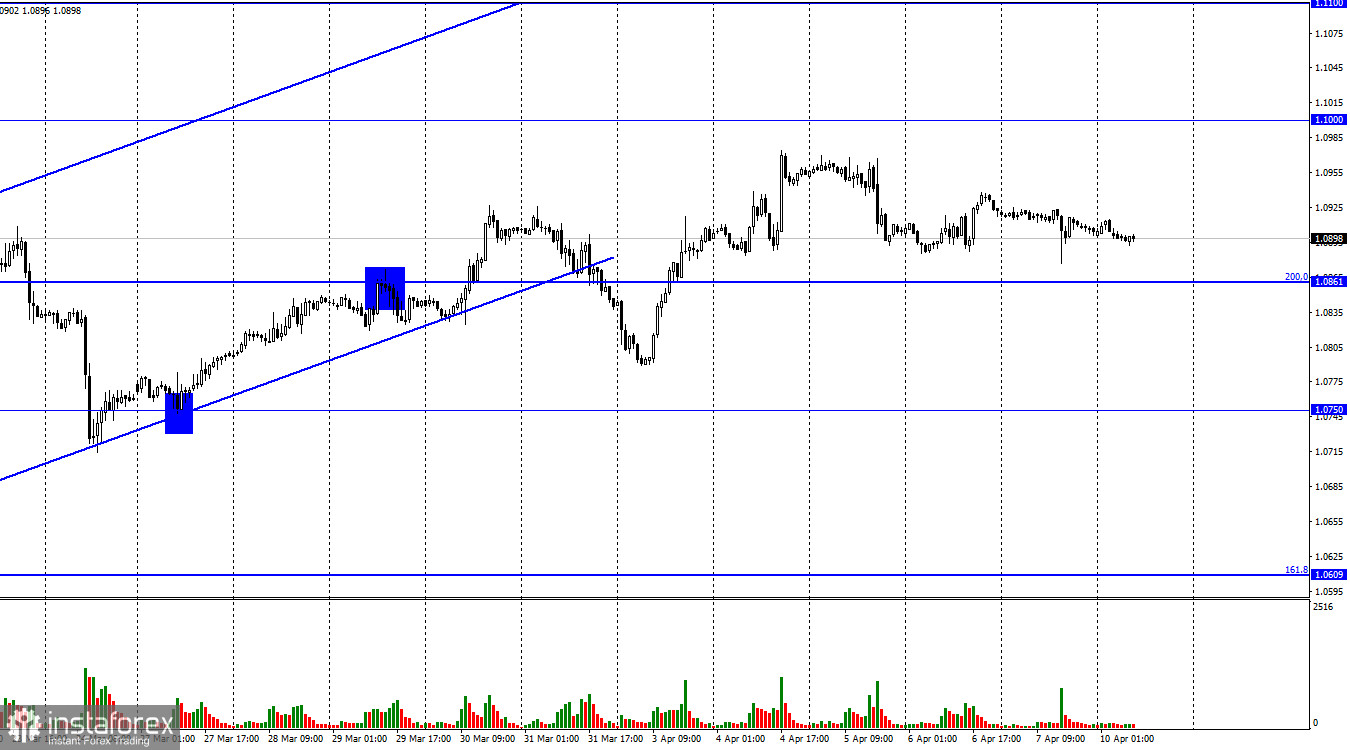

On Friday, the EUR/USD pair continued its virtually horizontal movement. I have not seen such days when important reports become available to traders for a long time, but there is practically no reaction. Of course, it's possible to justify this since Good Friday is a significant reason to take a day off. However, the market still needs to recognize data on unemployment and the labor market in the US, which still heavily influence the Fed's monetary policy. Thus, the reversal in favor of the dollar occurred three days ago, and during this time, the pair could not even fall to the nearest level of 1.0861. If bears gather their strength and push the pair down to this level, a rebound from it would allow for new growth towards 1.1000. Consolidation of the pair's rate below 1.0861 will increase the likelihood of a continued decline in the direction of the next level of 1.0750.

As I already mentioned, the economic statistics were very important and strong on Friday. Traders missed it, but I cannot do the same. Nonfarm payrolls reported creating 236,000 new jobs, and the unemployment rate fell to 3.5% after a 0.2% increase a month earlier. Thus, the negative trend was not confirmed by either the first or second indicator, and the bears had every opportunity to sell the pair but did not take advantage of it. And not just based on graphical analysis but on specific information background. But in the end, the almost non-working day helped the euro currency, which stayed strong in the face of strong US data.

The pair's decline should continue this week, at least to 1.0861. Further, the graphical analysis will come to the forefront, as the lack of closure below 1.0861 will not allow bears to build on their success. However, a 100-point drop in the pair can hardly be considered a success.

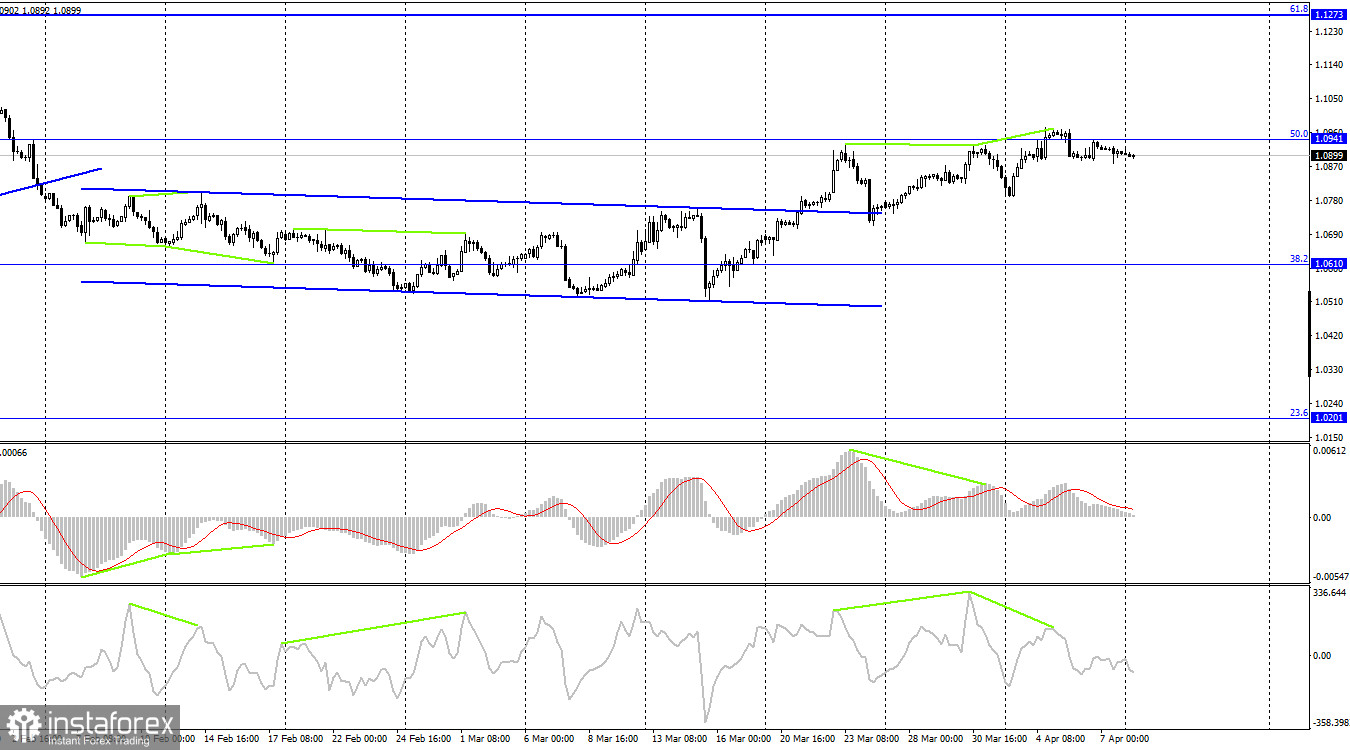

On the 4-hour chart, the pair has consolidated above the sideways channel, allowing traders to anticipate further growth. However, it has not yet consolidated above the corrective level of 50.0% (1.0941), and three "bearish" divergences have already formed. Thus, the decline of the pair continues to loom on both charts. Closing the quotes above the level of 1.0941 will allow for the expected continued growth in the direction of the corrective level of 61.8% (1.1273).

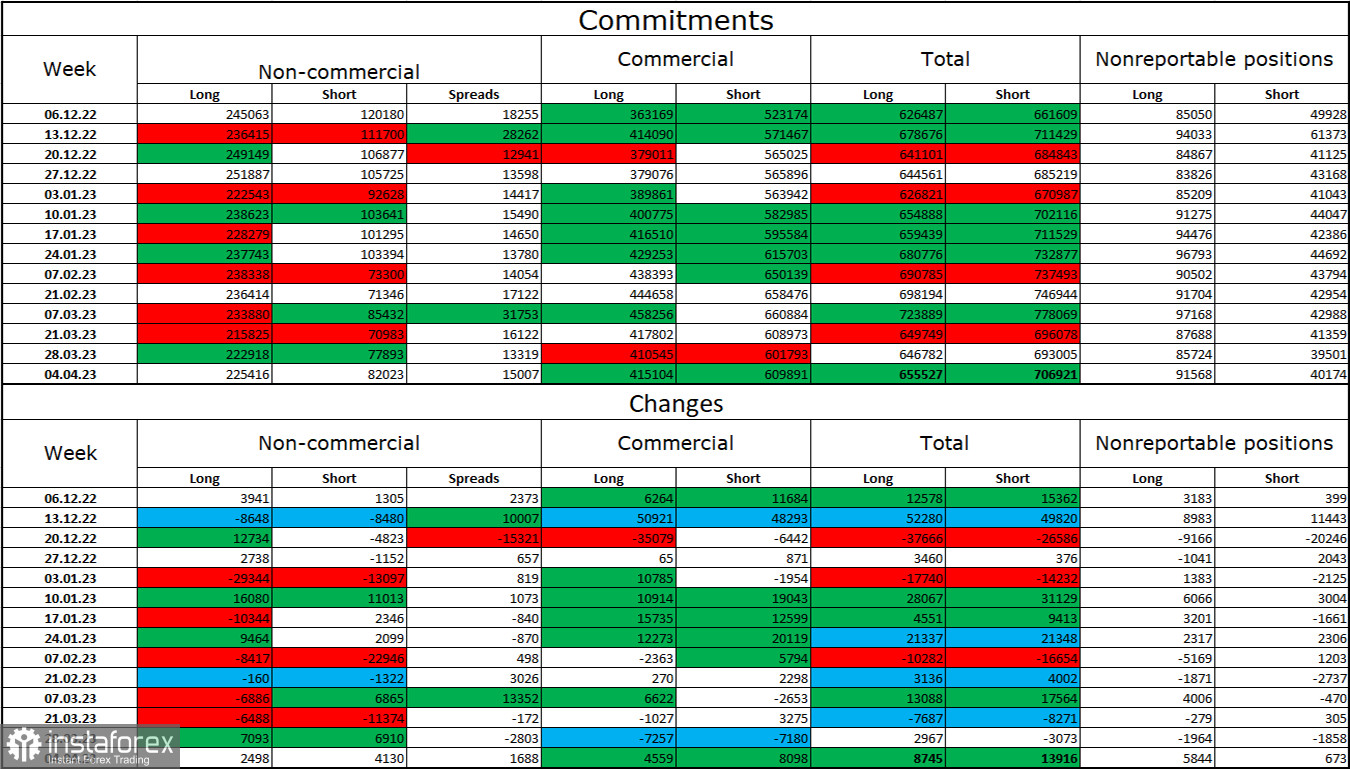

Commitments of Traders (COT) report:

During the last reporting week, speculators opened 2,498 long contracts and 4,130 short contracts. The sentiment of large traders remains "bullish" and continues to strengthen overall. The total number of long contracts concentrated in the hands of speculators is now 225,000, and short contracts – 82,000. The European currency has been growing for over half a year, but the number of long contracts among professional traders has not increased in the last few weeks. After a long "black period," the euro is still in a good position, so its future looks good. At least as long as the ECB raises the interest rate by 0.50%. However, I want to note that in the near future, market sentiment may change to "bearish," as the ECB cannot constantly raise the rate by half a percent and may drop to a 0.25% step in May. Sell signals are present on both charts.

News calendar for the US and the European Union:

On April 10th, the economic events calendar needs to be more interesting. The influence of the information background on traders' sentiment will be absent today.

EUR/USD forecast and trading tips:

Selling the pair is possible when it bounces from the 1.0941 level on the 4-hour chart with targets of 1.0861 and 1.0750. Purchasing the pair is possible upon closing above the 1.0941 level on the 4-hour chart with targets of 1.1000 and 1.1100.