In my morning forecast, I focused on the 1.0907 level and suggested that you base your market entry decisions on it. Let's examine the 5-minute chart to determine what transpired there. As a result of the market's minimal volatility, there was never a false breakdown at the level of 1.0907, and there was no buy signal on the reverse test. As a result, I had to slightly revise the technical picture for the afternoon.

To initiate long positions on the EUR/USD, you must:

Given the lack of noteworthy news during the first half of the day, it was also pointless to anticipate significant volatility after the holidays. Even during the American session, no significant statistics are anticipated, so the second half of the day will likely be relatively calm, although the pressure on the pair could increase. The optimal scenario for opening long positions is a decline accompanied by the formation of a false breakout in the middle of the side channel at 1.0906. This will generate a buy signal with the target of returning to the 1.0934 resistance level established last week. A breakout and a top-down test of this range following the speech of Federal Reserve Representative Williams will return the market to the buyer's side, providing an additional entry point for forming long positions with a return to the monthly high of 1.0964. The area around 1.1002 remains the farthest target, where I will adjust the profit. With the possibility of a decline in EUR/USD and the absence of purchasers at 1.0906 in the afternoon, which could occur if markets once again anticipate an increase in U.S. interest rates, the pressure on the euro will intensify. In this scenario, the price will fall to 1.0879. Only the formation of a false breakout will serve as an indication to purchase the euro. I will open long positions promptly in anticipation of a rebound from the day's low of 1.0843, targeting a 30-point-plus daily correction.

To establish short positions on the EUR/USD, you must:

Sellers must regain control of 1.0906; otherwise, the pair will continue to rise. The protection of the nearest resistance level of 1.0934 is a vital mission. I expect to see major players at this level, so the ideal scenario for opening new short positions is the formation of a false breakout. Representatives of the Fed's "hawkish" position will put more pressure on the euro, which will cause the pair to fall to the 1.0906 support area. A breakout and retest of this range will already push the pair to 1.0843. A consolidation below this range will also allow entry to 1.0792, restoring the market's bearish trend. I will fix the profit there. If the EUR/USD moves higher during the American session and there are no bears at 1.0934, which is a plausible scenario, I recommend delaying short positions to 1.0964. Selling is permitted only after a failed consolidation. I will establish short positions immediately in anticipation of a rebound from the maximum of 1.1002 with the target of a 30-35 point decline.

Signals from indicators

Moving Averages

The fact that trading occurs between the 30- and 50-day moving averages indicate the market's lateral nature.

The author considers the period and values of moving averages on the hourly chart H1, which differ from the classic definition of daily moving averages on the daily chart D1.

Bollinger Bands

In the event of an upward trend, the indicator's upper limit in the area of 1.0910 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

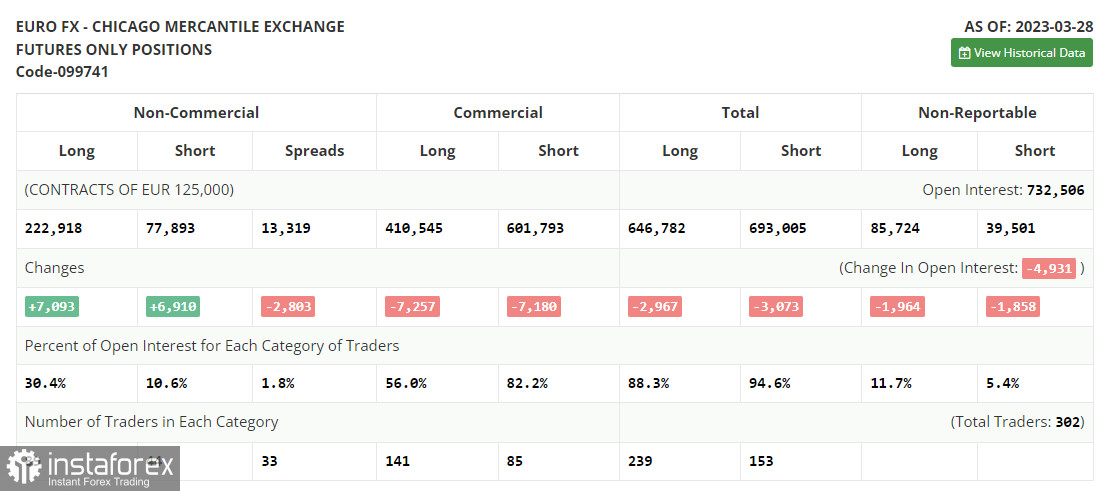

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.