Traders saw a striking rise in dollar during the pre-market despite the ongoing holidays in Europe and the complete emptiness of the macroeconomic calendar. However, the surge was short-lived as it gradually returned to the value at which it was before, showing that the rally was most likely a random spike, not a reaction to the recent US Department of Labor report.

Today, important macroeconomic data are being published, which will clearly affect investor sentiment. An example is the retail sales report in the Eurozone, which is expected to accelerate from -2.3% to -3.1%. This indicator shows consumer activity, and a decline in it indicates a looming recession in the economy. As such, it is recommended not to expect a rise in EUR/USD and GBP/USD as the upcoming data are prerequisites for their decline.

Retail sales (Europe):

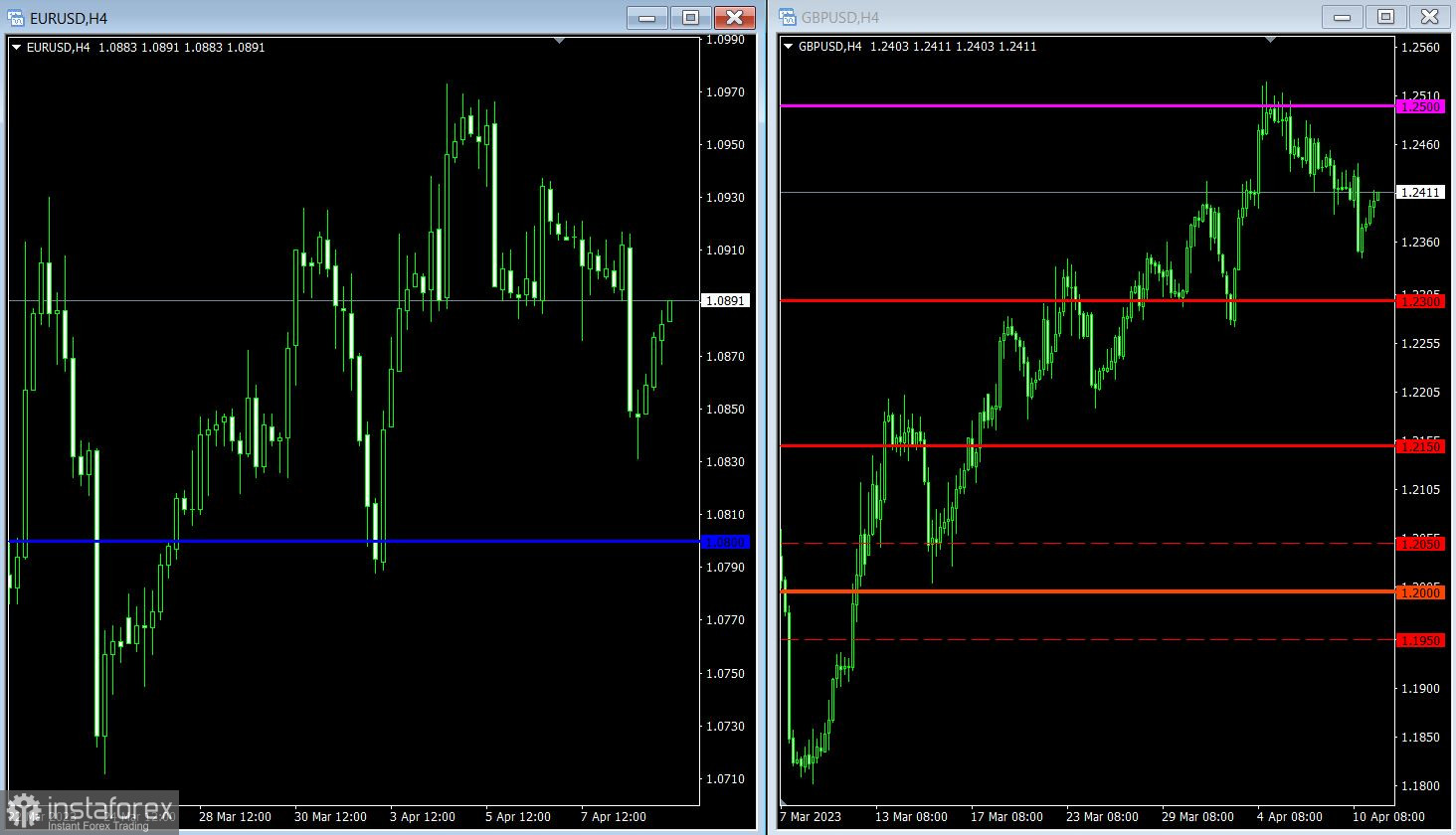

EUR/USD has recovered more than half of the recent decline. However, it is too early to talk about the end of the pullback unless the quote goes above 1.0950. The pullback will continue if the price returns below 1.0850.

The situation is similar in GBP/USD. The pullback will end if the quote rises above 1.2450. Meanwhile, it will resume when the price stays below 1.2350.