Two weeks of quiet Bitcoin consolidation ended in a rather unexpected way. The asset price exceeded $30k for the first time since June 2022 and triggered liquidation of short positions worth over $170 million.

At the moment, the price of BTC reached the $30.4k level, where the bears entered the fray and partially pushed the bulls to the $30k mark. A surge in volatility in the crypto market occurred ahead of the publication of U.S. inflation reports. It is likely that we can expect momentum in the downward direction in the near future.

Bitcoin has taken an important step towards the formation of a medium-term upward trend, but it is too early to speak with confidence about the further movement of BTC upward. The fundamental background around the crypto market looks tense, but if certain conditions are met, Bitcoin will continue to rise.

Clouds are gathering over the stock market

Despite the restoration of the correlation between BTC and stock indices, the cryptocurrency is in higher esteem among investors. The stock market is approaching the reporting season, and according to the WSJ, investors view this period as another test for the entire market.

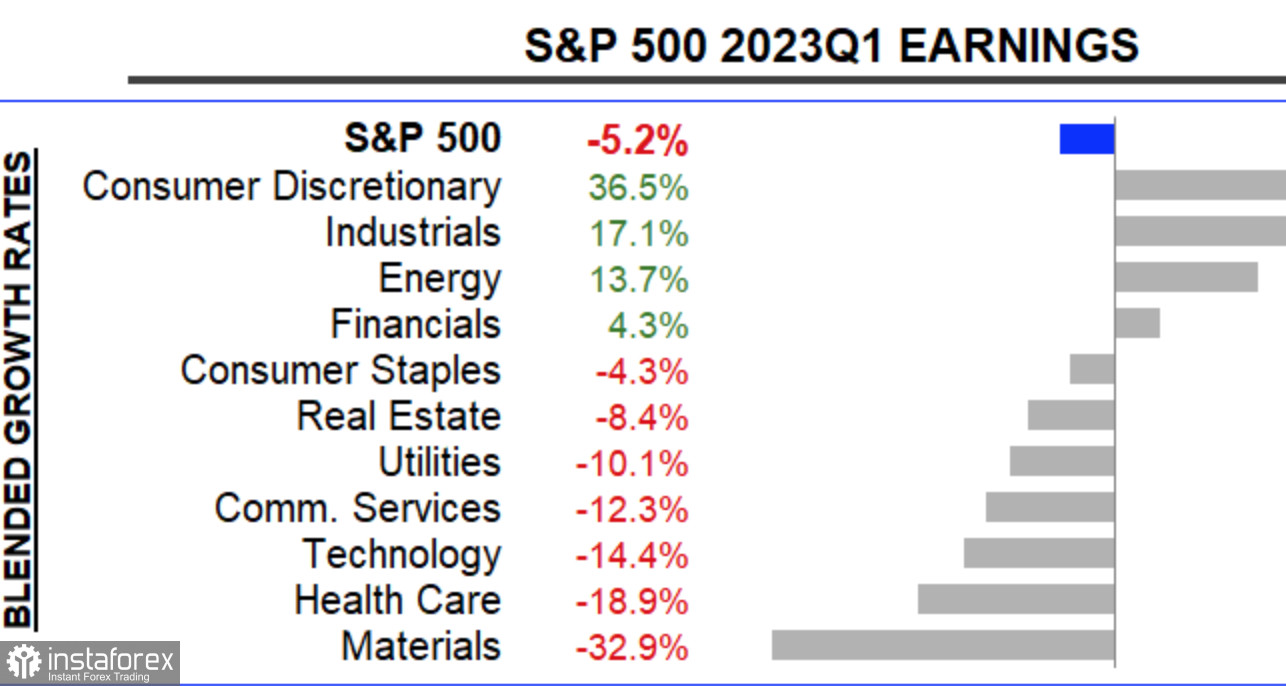

Factset lifted the veil of investor concern with information that companies in the S&P 500 will report an average drop in profits by 6.8%. This information is indirectly confirmed by the weekly summary from Lipper, which indicates that the financial flows into the U.S. stock market showed an outflow of $10.34 billion.

As of April 11, the S&P 500 index maintains positions near the $4,100 level. However, the indicator fails to continue the upward movement above this level. Given the approach of pessimistic reporting, the SPX has reached its peak and will begin to decline.

BTC/USD Analysis

At the end of yesterday's trading day, Bitcoin pulled ahead, leaving the SPX far behind. If the situation of the index does not change dramatically with the opening of the U.S. markets, the correlation of the asset and BTC will again raise questions.

As of April 11, Bitcoin is in the early stages of a bull market, attracting a wide range of investors. About 52% of long-term owners continue to hold their inventory steadily for more than two years.

However, it is too early to talk about the emergence of a new stage of the upward trend. The current price movement was the result of an impulsive breakdown of the wedge pattern, and the price will correct in the near future. To maintain the structure of the upward movement, Bitcoin needs to hold the $28.5k level.

The asset needs to make a local consolidation above this level to continue the upward movement. If this plan fails, the price will fall into the $28.5k–$26.6k corridor, where the bears will be ruthless and pull the price to $25k.

On the daily chart, we see the first signals for price stabilization. The upward movement of the stochastic was interrupted, and the metric acquired a flat direction. At the same time, the MACD is preparing to form a bullish crossover, which is an important bullish signal.

Results

Bitcoin took an important step to form an upward trend and move towards $32k. However, the key events of this week are just ahead, so anything can be expected from the volatile market. Therefore, consolidation above $28.5k over the next few days will be the main signal to the set of bullish positions.