Euro continued to rally this morning, thanks to the better-than-expected data from the eurozone. The weekly high was also updated, suggesting that euro and pound could grow further, especially if upcoming data from the US, as well as statements from central bank representatives, are very good. The NFIB small business optimism index, which is due out this afternoon, has little chance to change the situation in the market, but the statements of FOMC members Austan Goolsbee and Patrick Harker could prompt a spike in volatility today.

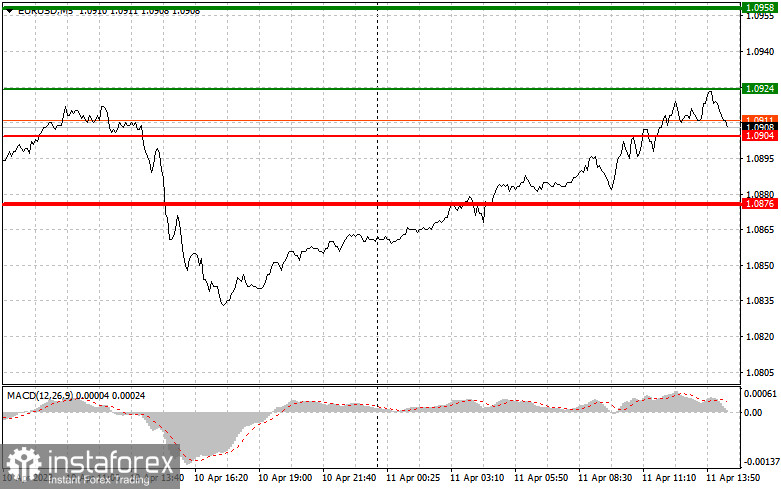

EUR/USD

For long positions:

Buy euro when the quote reaches 1.0924 (green line on the chart) and then take profit as soon as the price reaches 1.0958.

Euro can also be bought at 1.0904, but the MACD line should be in the oversold area as only by that will the market reverse to 1.0924 and 1.0958.

For short positions:

Sell euro when the quote reaches 1.0904 (red line on the chart) and then take profit as soon as the price reaches 1.0876.

Euro can also be sold at 1.0924, but the MACD line should be in the overbought area as only by that will the market reverse to 1.0904 and 1.0876.

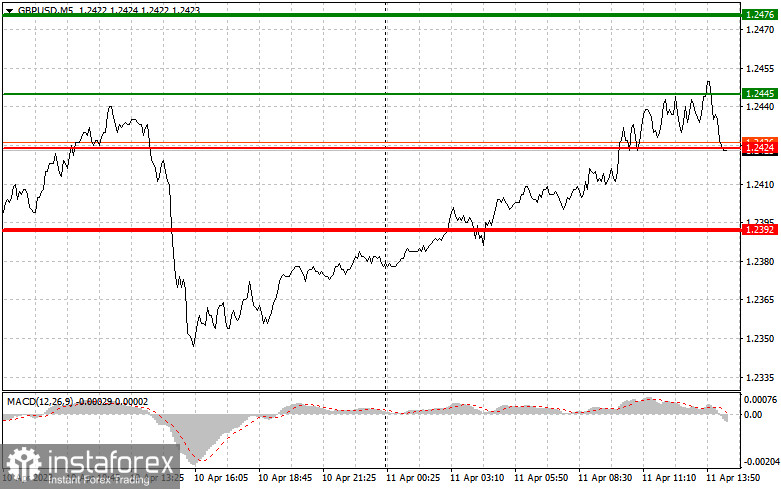

GBP/USD

For long positions:

Buy pound when the quote reaches 1.2445 (green line on the chart) and then take profit when the price hits 1.2476 (thicker green line on the chart).

Pound can also be bought at 1.2424, but the MACD line should be in the oversold area as only by that will the market reverse to 1.2445 and 1.2476.

For short positions:

Sell pound when the quote reaches 1.2424 (red line on the chart) and then take profit when the price hits 1.2392.

Pound can also be sold at 1.2445, but the MACD line should be in the overbought area as only by that will the market reverse to 1.2424 and 1.2392.